US Inflation Maintains FED’s Rate Path

The US PCE inflation reading for August came in at 2.7%, matching expectations. So did core PCE. The data gave markets some breathing room that inflation is under control, but also take away the expectations that the FED may cut aggressively.

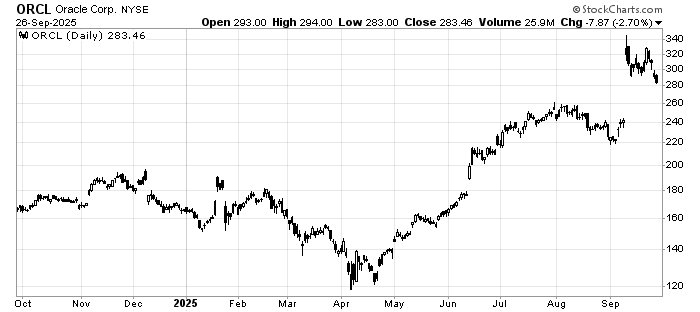

US GDP Revision Complicates The Inflation Outlook

Q2 GDP was revised upwards to 3.8%, the strongest since Q3 of 2023. With stronger growth, the odds of aggressive rate cuts are likely to fall. Highly valued stocks may come under pressure. Already, Oracle lost 8% on Friday.

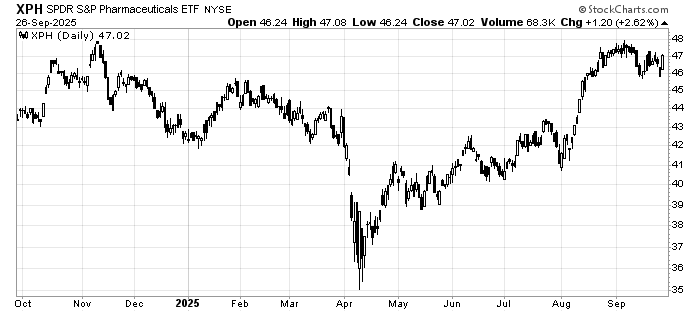

Trump’s Latest Tariffs

The U.S. administration unveiled sharp new tariffs: 100% on branded pharmaceuticals, 25% on heavy trucks, and additional levies on other goods. These moves have unnerved markets because they could stoke inflation (via import cost pass-through) and complicate global supply chains and trade flows. Markets appear to be taking it in its stride. The Pharmaceutical ETF traded higher on Friday.

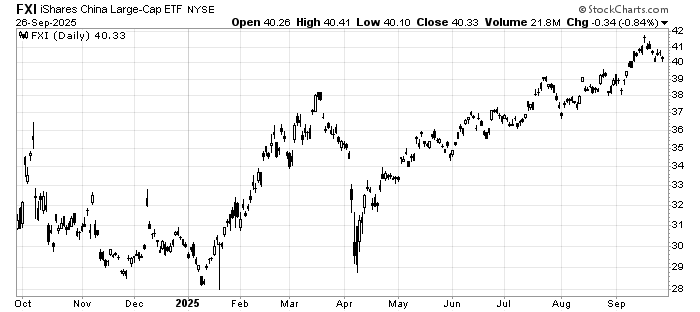

China’s Industrial Profits Rebound

Chinese industrial profits grew 20.4% year-on-year for August, reversing recent declines, and year-to-date profits rose 0.9%. The rebound suggests that some corporate margin pressures are easing, which could alleviate concerns about cascading defaults or severe weakness in the industrial sector. The key is always sustainability, so we need to watch for Sep and Oct numbers. That said, the strength of the Chinese stock market cannot be ignored.

Leave a Reply