US Stocks At New High But USD Is Weak

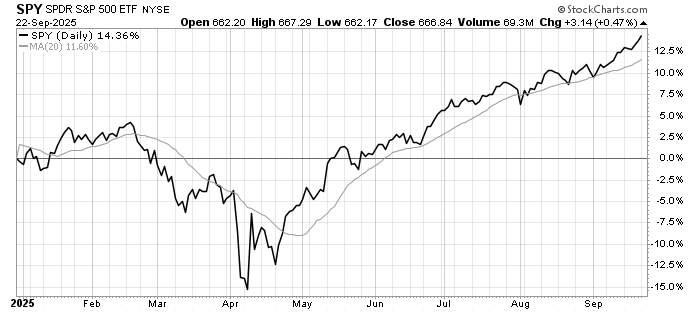

The US stock market remains technically healthy and strongly bullish. The major indices, the S&P 500, Nasdaq, and DJIA, are at or near record highs, confirming strong underlying momentum.

However, the market is also overbought in the short term, and the possibility of a pullback or sideways consolidation in the coming weeks will not be surprising.

Over the next six months, the bias remains upward, supported by improving breadth, robust risk appetite, and the prospect of easier monetary policy.

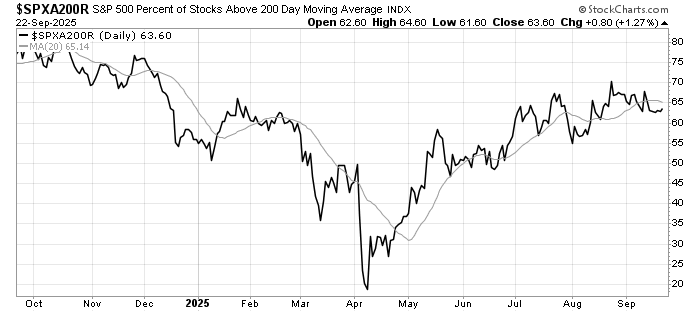

Market Breadth and Sector Rotation

-

Participation is broadening. More than half of S&P 500 stocks trade above both 50- and 200-day averages. Although the trend is starting to slow, confirming the expectations that a period of consolidation is in store.

-

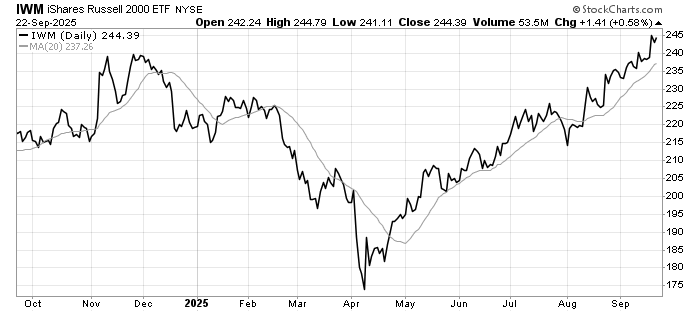

Rotation improving: Small-cap and value stocks have rallied recently, while leadership in technology remains intact.

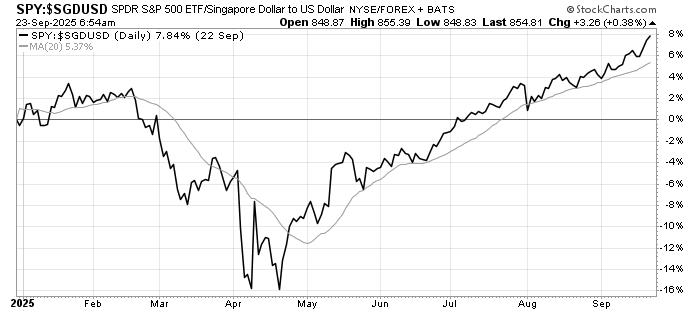

The weakness of USD continues to haunt foreign investors. For S$ based investors, an unhedged position in the S&P 500 underperformed by 50%.

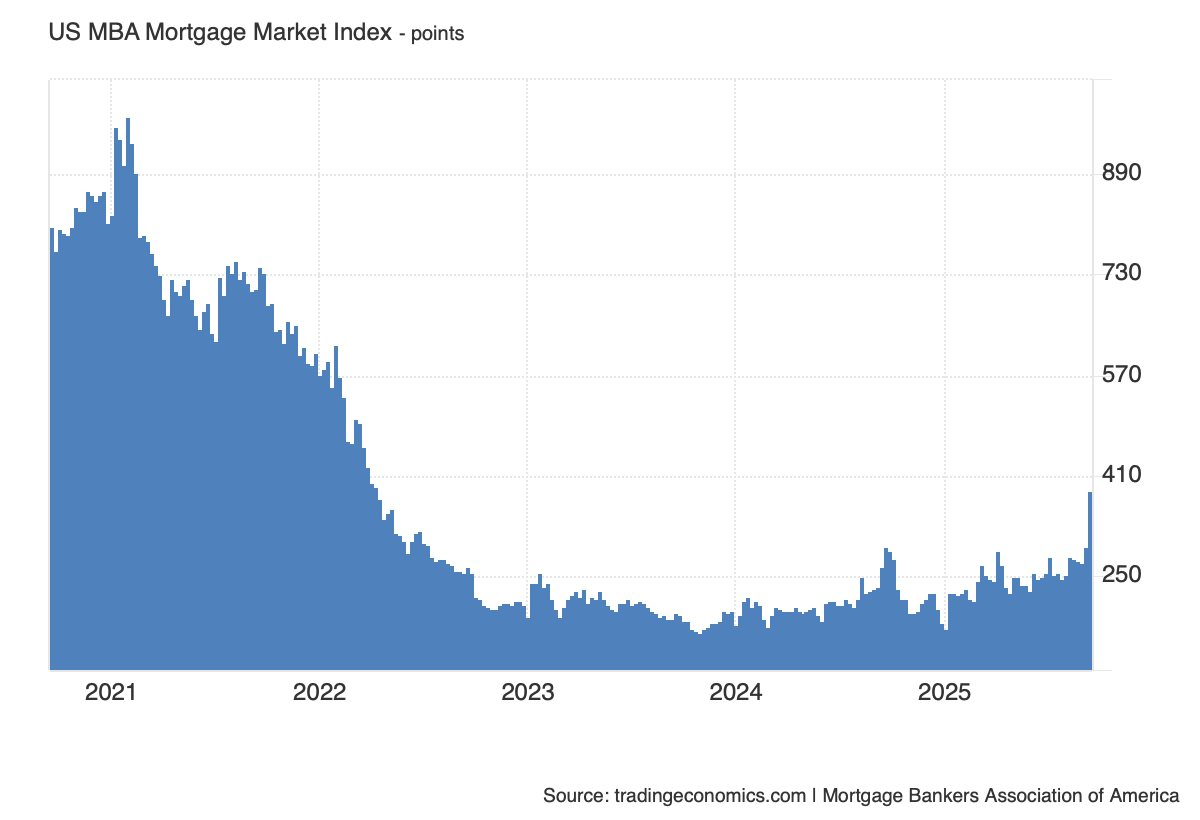

US Housing On Verge Of Recovery

With mortgage rates at a 11-month low, mortgage application and refinancing activity is surging. Continued easing of monetary policy increases the odds of an over-heated economy, stock market melt-up and return of high inflation. The risk of a bear market in mid-2026 is increasing.

Leave a Reply