Key Takeaways

Amazon and Alphabet beat revenue expectations but stocks fell on AI capex concernsSoftware stocks remain structurally weak despite oversold conditionsInvestors continue rotating out of US growth into value, small caps and ex-US marketsBitcoin rebounded sharply, but gold remains the preferred hedge

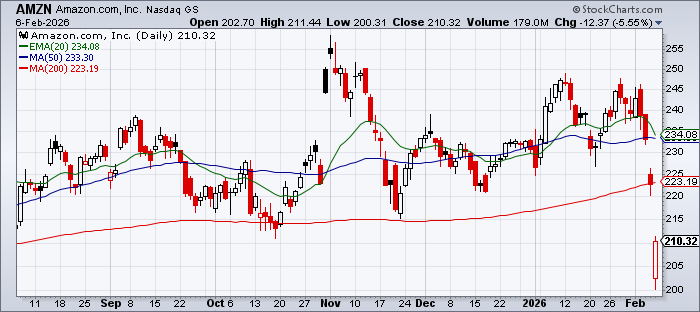

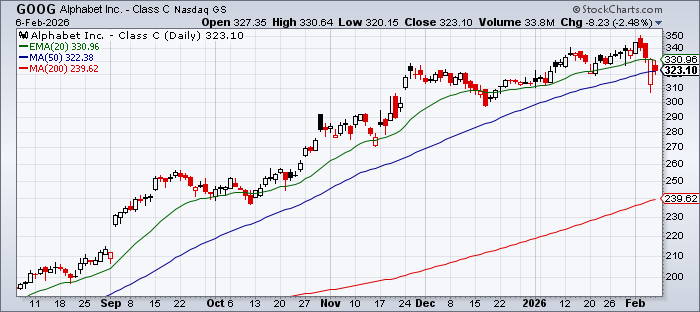

Amazon and Google Earnings Highlight AI Capex Risks

Two AI hyperscalers reported earnings and gave guidance on CapEx spending. Amazon beat on revenues but miss earnings expectations, while Alphabet exceeded analysts’ estimates on both count. Both saw their stock price fall on concerns about their CapEx ROI. Amazon is planning to spending $200bn while Alphabet has $175bn in mind.

Software Stocks Extend Selloff as Growth Expectations Reset

Claude’s latest model sent the already weak sector into another round of selling. While it is true that the sector is oversold, investors should look at how the relative performance of the software sector has underperformed the market for a while. Growth expectations for this sector need to be reset, making the case for further underperformance.

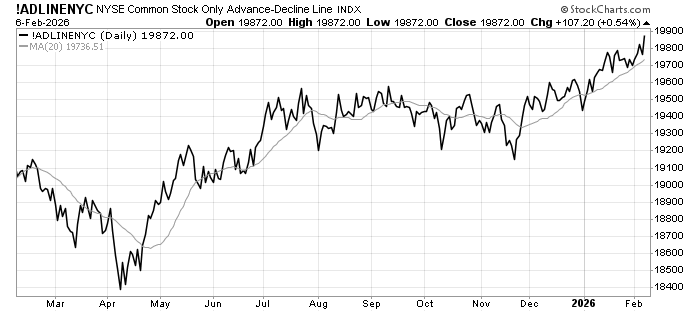

Rotation Out of US Large-Cap Growth Continues

The week saw investors maintaining the trend of favouring Ex-USA stocks over the S&P 500, Value over Growth and Small Caps over Large Cap stocks. This is a healthy sign of market rotation as the global growth outlook remains intact. In fact, market breadth in US equity markets remains positive.

Crypto vs Gold: What the Divergence Is Telling Investors

Bitcoin crashed before staging a meaning rebound on Friday. Gold spent the week clawing back some of the losses after the previous week crash. The market’s disdain for technology could be a reason why investors are favouring gold over crypto, in the same vein as how value is outperforming growth.

Leave a Reply