The “Sell America” Trade Gains Momentum

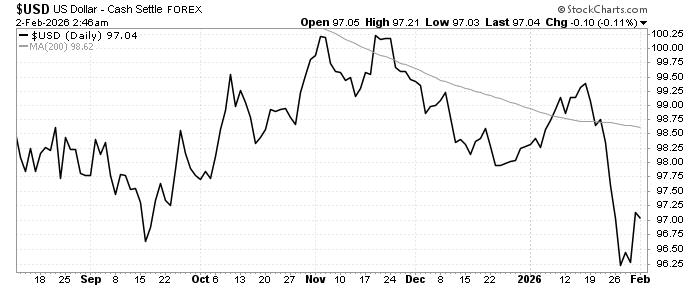

The US Dollar Index fell to approximately 95.5, its lowest level since February 2022. This decline coincided with President Trump’s comments expressing comfort with a weaker dollar and concerns about tariff policies. International investors reduced exposure to US assets, with the Euro rising to around $1.04-1.05 and the Swiss Franc gaining ground.

Precious Metals Hit Historic Highs, Then Retreat

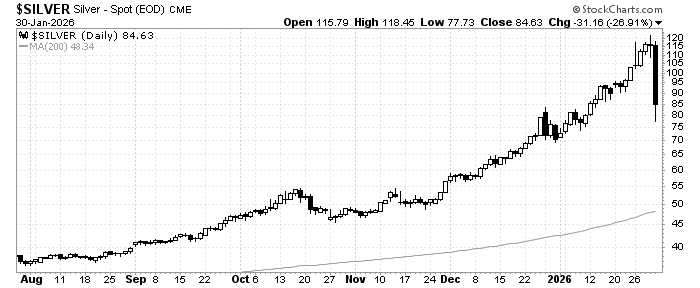

Gold broke through $5,000 per ounce on 26 January, reaching approximately $5,500-5,600 by 29 January before sharp corrections. Silver surged to near $120 per ounce, then suffered its worst single-day decline since 1980, falling 26-30%.

Expect a period of consolidation or correction as speculators are cleaned out.

Technology Sector Shows Diverging Fortunes

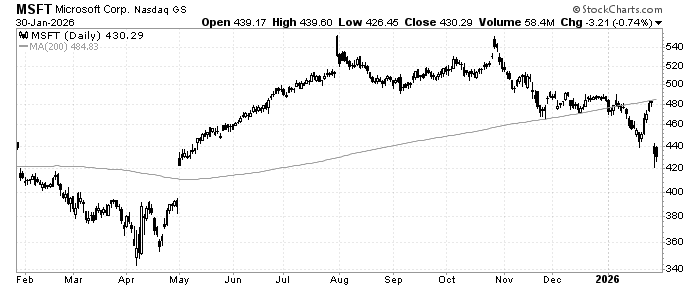

Meta’s shares surged 8-10% on strong AI-driven results, whilst Microsoft suffered its worst single-day decline since March 2020 (approximately 10%) due to slower cloud growth. Reports confirmed major technology firms have channelled over $120 billion in AI data centre financing through off-balance-sheet arrangements, raising transparency concerns.

Central Banks Navigate Currency Volatility

The Federal Reserve held borrowing costs steady at 3.5%-3.75% on 28 January, noting inflation “remains somewhat elevated.” More dramatic was the Japanese yen’s rally from near 159 to 154-155 after Japanese officials warned about “excessive” currency movements and the Federal Reserve Bank of New York made enquiries that often precede intervention. It may be tough for the new Fed Chair to cut rates further unless we get a material slowdown in the economy.

Leave a Reply