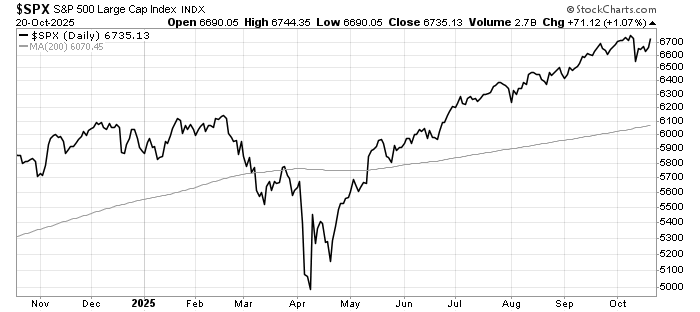

US-China Trade Policy Shift Sparks Major Rally

In a reversal, President Trump announced he would not proceed with previously threatened tariffs on certain Chinese imports. This policy shift sent a wave of optimism through global markets. On Monday, the S&P 500 surged by over 2.3% in its strongest single-day move since May; the Dow and Nasdaq followed, climbing 1.8% and 2.6% respectively. The news also softened volatility indices and led to a risk-on tone. Chinese ETFs like the iShares MSCI China ETF (MCHI) posted gains of up to 4% for the week.

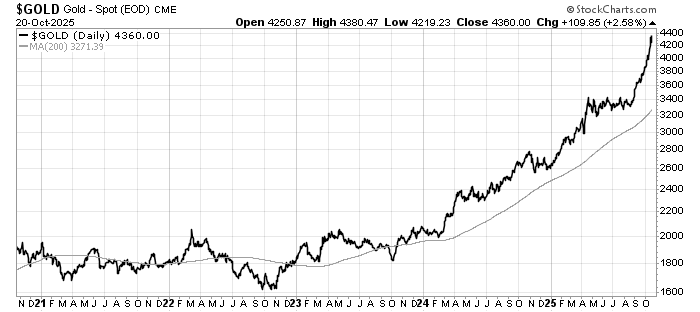

Gold Hits New Record Highs on Market Anxiety

Gold took center stage as its price broke new ground, finishing the week above $4,380 per ounce for the first time ever. This milestone was fueled by persistent investor unease over global credit tightening and a run of mid-sized US regional bank downgrades. On October 15, the SPDR Gold Shares ETF (GLD)—a bellwether for gold investment flows—saw net inflows of $1.2 billion, its highest one-day spike in six months. The rally also reflected rising demand for defensives; precious metals miners like Newmont and Barrick surged between 5–7% over the week.

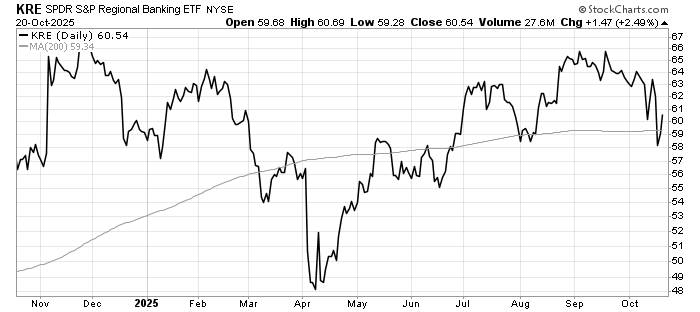

US Banking Sector: Strong Results Shadowed by Zions’ Loan Losses

America’s top banks delivered robust Q3 earnings, led by JPMorgan’s net income of $13.6 billion and a sector-wide profit jump of 19%. Strong investment banking and ongoing consumer lending were the main drivers, underpinning market resilience.

However, this upbeat outlook was seriously challenged when Zions Bancorporation announced mid-October it would write off $50–60 million in commercial loans after a high-profile incident of alleged borrower fraud. The loss stemmed from a complex arrangement involving California Bank & Trust and several investment funds, prompting lawsuits aimed at recovering funds and addressing management failures. The immediate impact was dramatic: Zions’ stock plunged 13%, and its market value fell by about $1 billion in a single session, triggering selloffs in regional bank indices and widespread investor concern about credit quality.

Despite these problems, Zions’ Q3 results outperformed analyst expectations, with EPS of $1.48–$1.54 and revenue at $872 million. The episode has put a spotlight on risk management and oversight at US regional lenders, intensifying market scrutiny even as major banks continue to report healthy profits.

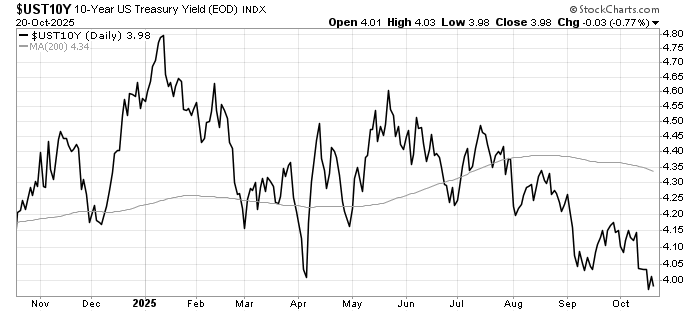

Federal Reserve Poised to End Quantitative Tightening

Federal Reserve Chair Jerome Powell signalled that the central bank is ready to halt its quantitative tightening program, which has reduced the Fed’s balance sheet from its pandemic-era peak above $9 trillion to around $6.6 trillion as of October. This dovish message, delivered in a speech on October 14, led to a sharp drop in Treasury yields: the 10-year yield fell from 4.45% at the start of the week to 4.27% by Friday. The Fed’s announcement sparked another leg up in equities and offered relief to the housing market and rate-sensitive companies. Analysts now predict the FOMC may officially suspend the balance sheet runoff during its October or December meeting, responding to rising repo market rates and liquidity worries due to larger than usual T-bills issuance.

Leave a Reply