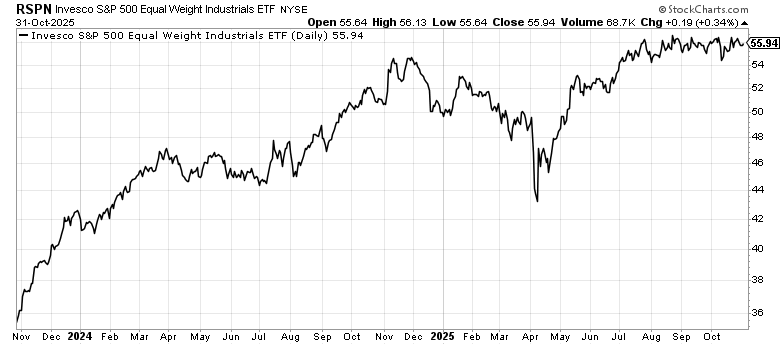

US Stock Market Breadth Starting To Narrow

Although Tech is leading the advanced, thanks to a slew of positive earnings results and huge backlog orders, the rest of the market is weak. Key cyclicals like consumer discretionary, financials and industrials have struggled, especially when seen on an equal weight basis (takes away the impact of mega-cap stocks). Investors need to watch if this phenomenon can be resolved, if not it is likely that the stock market outlook in Q1 of 2026 could be weak.

Flood of AI-related Bond Issuance

The FT has an article “Credit market hit with $200B food of AI related issuance” for 2025. The top companies listed were Meta ($30B) and Oracle ($18B). Other notable companies include Softbank and the Chinese Internet giants. As more companies fund their AI investment via debt markets, financial discipline becomes more important, especially if interest rate rises. This is likely to add pressure on these AI companies to begin monetising the AI assets sooner, rather than later.

US and China Announced A Deal (Truce?)

The meeting between Trump and Xi in South Korea produced a framework trade truce. China agrees to buy US soybeans (after pausing for the past several months), ease some rare earth export controls for 1 year, and step up control on fentanyl drugs exports. In turn, US eased up on the tariffs (down to 47% from 57%). This is no deal, but it does help both countries buy time to buffer their economies against further damaging actions. If economic resilience does not improve by then (e.g. rare earth self-sufficiency), it would likely hit the economy and investors’ confidence again.

Leave a Reply