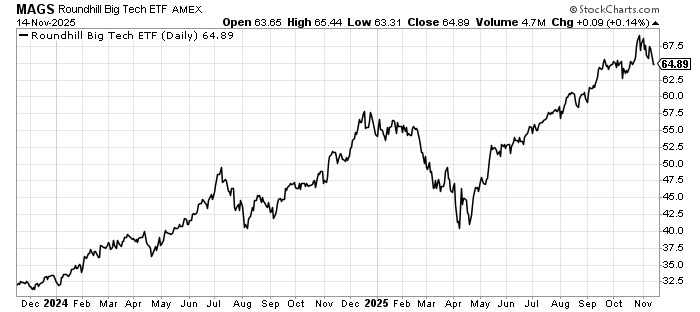

Tech Stocks Lost Their Shine

For most of the year, technology shares, especially those tied to artificial intelligence, powered global markets higher. But this week, that confidence cracked.

A sharp sell-off in major tech names dragged markets down, as investors began asking whether the “AI boom” has pushed valuations too far. Even giants were not spared after news of a major stake sale (Softbank selling NVIDIA) triggered a wave of profit-taking.

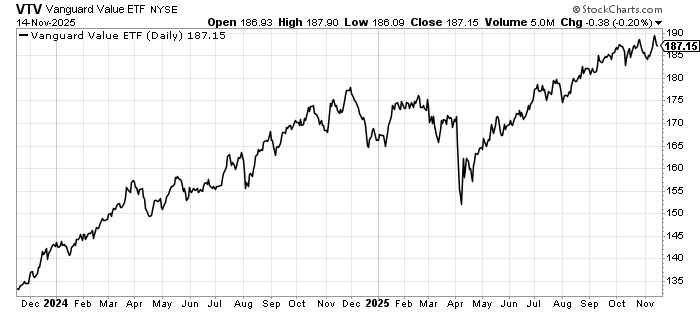

When tech stumbles, the entire market feels it. Investors may start shifting towards more defensive sectors or value stocks if the AI trade cools further.

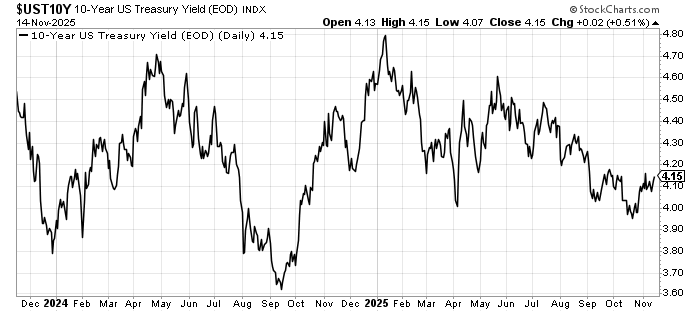

The Federal Reserve May Not Cut Rates Soon

Markets had been counting on the Federal Reserve to cut interest rates before the end of the year. This week, those hopes faded. Government bond yields crept higher as traders dialled back expectations for an imminent rate cut. With inflation still not fully tamed, investors now expect the Fed to stay cautious. If interest rates stay higher for longer, borrowing costs remain elevated — affecting mortgages, business loans, and the valuation of growth stocks. It also encourages investors to keep money in safer assets like bonds or cash.

The UK’s Budget Shocked Markets

Across the Atlantic, the UK government’s fiscal stance triggered market alarm. A decision to scrap planned income-tax hikes set off concerns about how the country will plug its budget gap. The reaction was swift: the British pound weakened, and UK government bond yields rose as investors questioned fiscal credibility. This episode is a reminder that even major economies can face sudden shifts in investor confidence. When governments surprise markets, borrowing costs rise and that can ripple through the broader economy. For global investors, it reinforces the importance of monitoring fiscal policy, not just monetary policy.

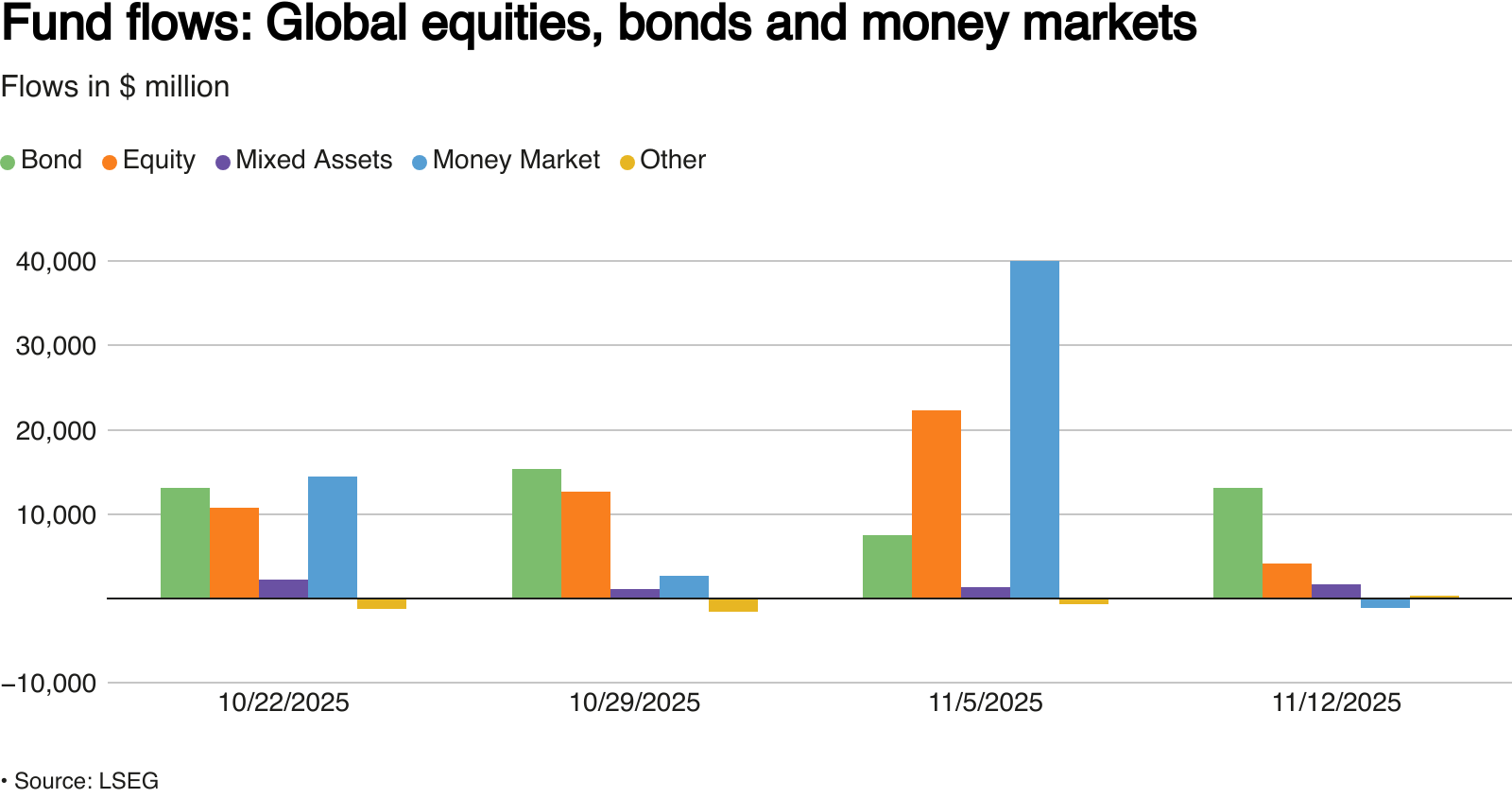

Investors Are Moving Into Safer Assets

This week saw a clear shift in investor behaviour. Money flowed out of equity funds and into bond funds for yet another week, marking a long streak of risk-off sentiment.

Investors appear nervous about everything from expensive tech valuations to global economic uncertainty, and they are choosing safety over risk. When large numbers of investors move into bonds, it usually signals caution. It can also hint at slower growth ahead, as people choose safety over chasing returns.

China’s Economy Is Showing Signs of Strain

China posted a rare decline in fixed-asset investment, a key measure of spending on infrastructure, factories and property. This raised fresh concerns about the country’s economic health. With China being one of the world’s biggest growth engines, signs of weakness tend to make global investors uneasy. A slowing China affects everything from commodities to Asian markets to global supply-chains. If Chinese growth continues to stumble, the knock-on effects could be wide-ranging. Still, Chinese leaders are holding off large scale stimulus, as Xi tolerates slower growth in China’s richest province, a sign that indicates acceptance of slower growth rates as the economy grapples with the ongoing problems with the property sector and global trade tensions.

U.S. Stock-Market Breadth Is Weakening (and That’s a Red Flag)

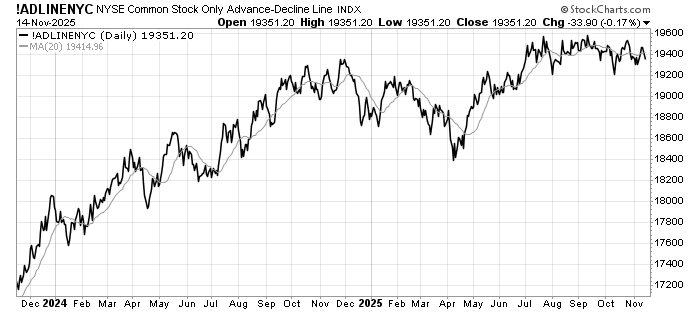

- The NYSE Advance Decline Index for common stock has stalled, neither going up nor down. This indicates a tension between the bulls and the bears.

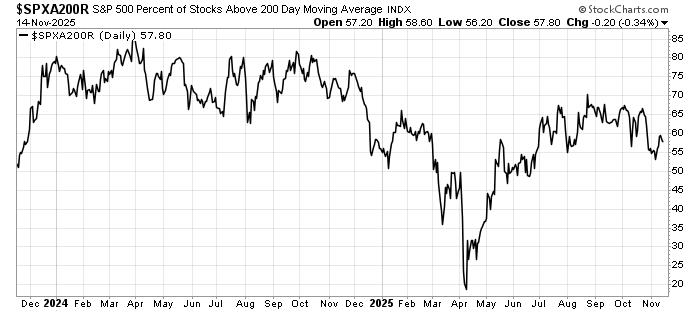

- As of 14 November 2025, roughly 58% of S&P 500 stocks are trading above their 200-day moving average. The trend has been coming down since September.

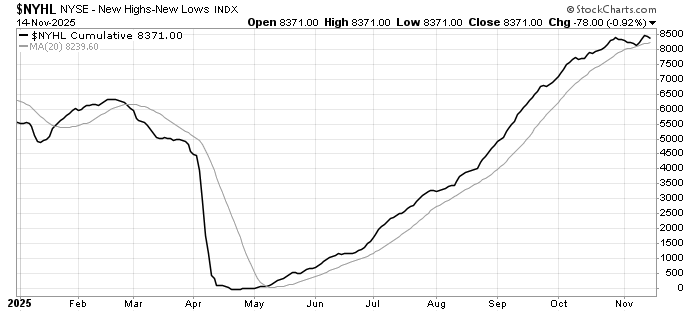

- The High Low index has also stalled. Like the Advance Decline index, it is consolidating, with no clear direction.

These readings suggest the current rally is relatively narrow. A recovery in market breadth is necessary for the bull market to continue.

Leave a Reply