What is a Government Shutdown?

A U.S. government shutdown occurs when Congress fails to pass appropriations bills or a continuing resolution to fund federal agencies. Non-essential federal employees are placed on unpaid leave, and many government services pause. Essential services, such as national security and public safety, continue. It is distinct from a debt-ceiling crisis, which threatens U.S. Treasury default and carries much greater systemic risk.

Historical Context

Shutdowns became more common after the 1980s, following legal rulings that required agencies to cease operations without appropriations. Notable shutdowns include the 1995–96 standoff (21 days), the 2013 shutdown (16 days), and the 2018–19 partial shutdown (35 days, the longest in history). These events disrupted federal operations and caused temporary economic costs, but markets generally recovered.

How Markets React

Historically, markets tend to view shutdowns as short-term disruptions rather than systemic risks. The S&P 500 often shows volatility during the event, but performance three months later is typically more influenced by macroeconomic and monetary factors. Treasury markets generally remain stable unless linked to debt-ceiling risk. Sector-specific effects are more pronounced, particularly in defence contractors, healthcare services reliant on federal approvals, and regions with heavy federal employment.

S&P 500 Performance During Past Shutdowns

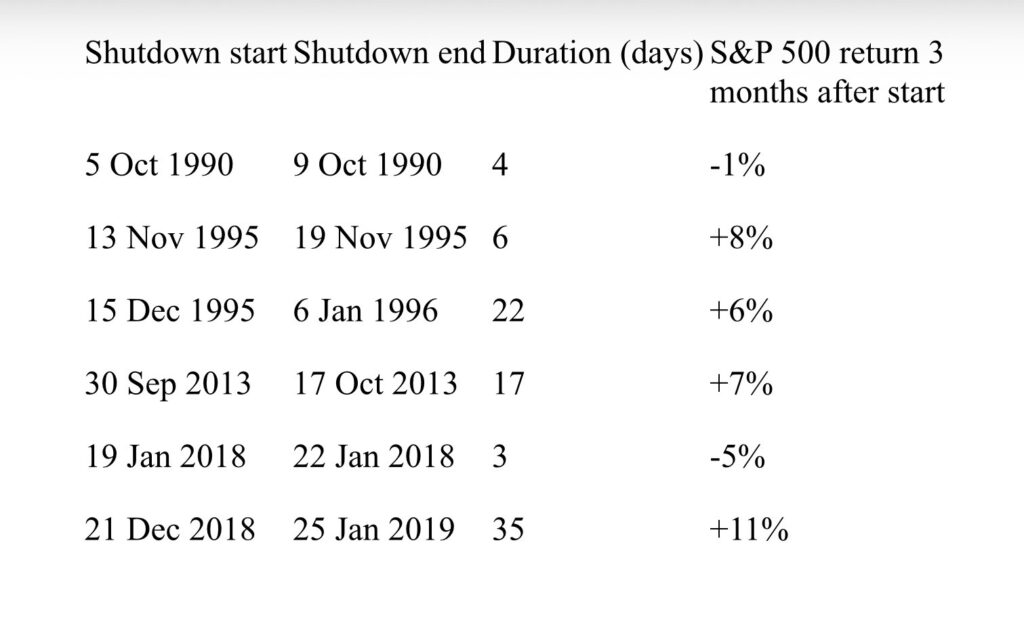

The table below summarises the S&P 500’s performance three months after the start of major U.S. government shutdowns since 1990.

Near-Term Implications for Financial Markets (Next 3 Months)

In the near term, shutdowns can cause headline risk and elevated volatility. Short shutdowns (days to two weeks) tend to have limited impact, with markets resuming prior trends quickly. Prolonged shutdowns (three weeks or longer) can weigh on GDP growth and earnings season, particularly in sectors tied to federal spending. However, history suggests shutdowns alone do not trigger systemic downturns unless tied to a debt-ceiling standoff.