U.S. Small Businesses More Confident

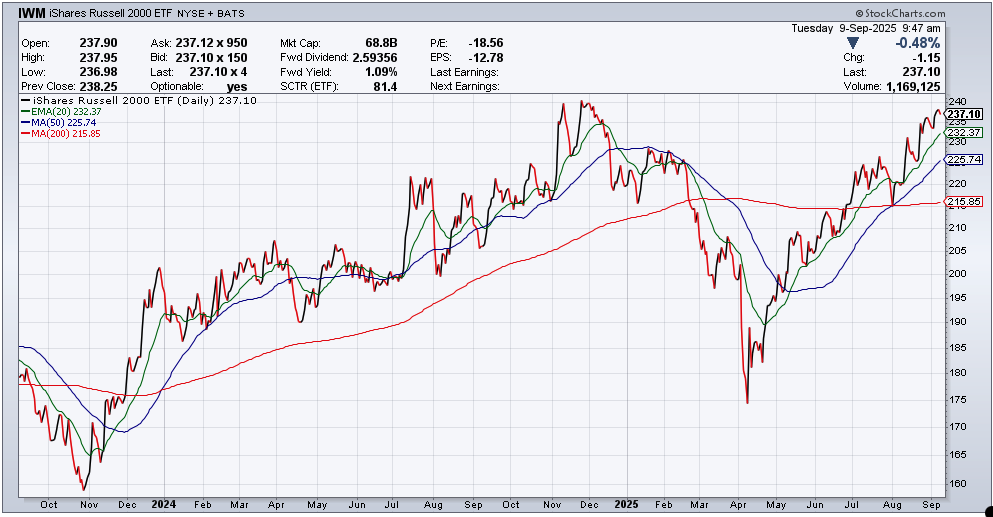

Small business sentiment continued to climb in August. The NFIB Small Business Optimism Index increase to 100.8. Growing sales prospects and solid earnings are said to be the driving forces behind the improvement. Small businesses also appeared to receive greater clarity amid the unveiling of the administration’s tariff policy and the successful passage of the One Big Beautiful Bill Act. A drop in job openings at small firms raises some caution, however. That said, small cap stocks continue to rally.

U.S. Job Growth Revised Down Significantly

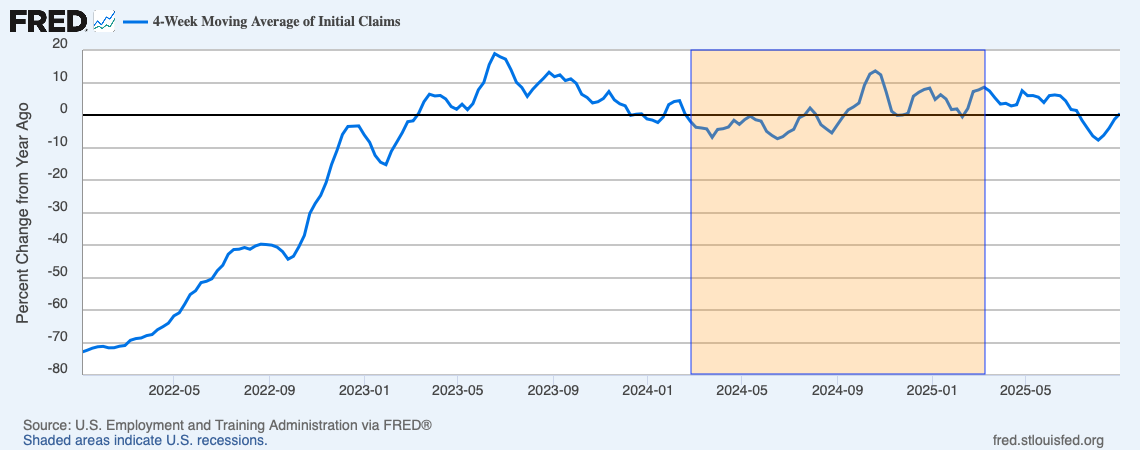

Annual revisions to nonfarm payrolls data for the year prior to March 2025 showed a drop of 911,000 from initial estimates, according to a preliminary report from the BLS. This is the largest since 2002 (the 2009 revision was -902,000). Clearly it showed that the economy was on shakier footing that it appeared. It is important to note that the revisions are not reflective of current conditions.

Looking at initial claims would give a clearer picture of the health of the labour market. For now, there isn’t a significant increase in initial claims for unemployment, unlike the period where the data was revised. Market action was relatively muted. The S&P 500 gained 0.23% while the US dollar was flat. The 10Y Treasury bond yield inched up by 4 basis points.

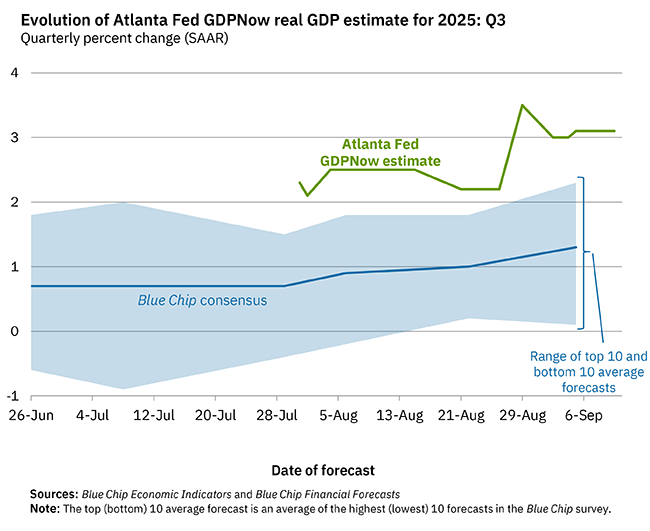

US Q3 Economic Growth Resilience

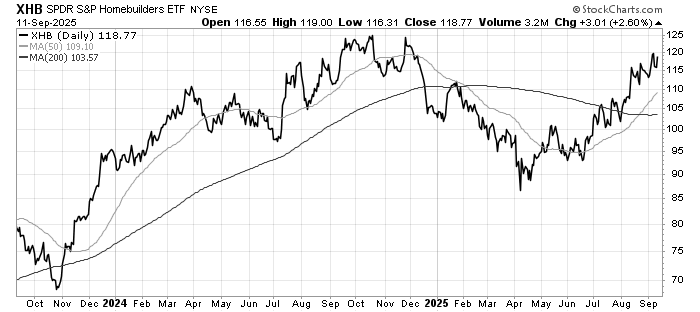

Cyclical sectors like homebuilding is rallying again. With long term rates lower, housing may be given a boost, leading to greater discretionary spending by consumers.

ECB Kept Rates Unchanged

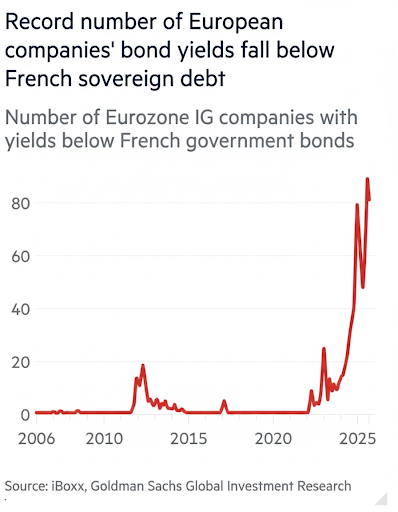

The European Central Bank (ECB) left interest rates unchanged and signalled that it will likely keep them at the current level for some time. In the ECB’s assessment, downside risks to growth and inflation have diminished, reducing the scope for a more accommodative policy. The crisis brewing in France has yet to make an impact on French or European markets for now, as French corporates continue to enjoy lower interest rates than the government.

Leave a Reply