The U.S. economy can, and has, grown even when the jobs market is weak. This phenomenon, known as a jobless recovery, has been observed after several recent recessions.

GDP growth indicates that the economy is expanding, but it doesn’t always reveal how that growth is being achieved. For example, growth can be driven by a small number of highly productive workers, new technology that automates tasks, or increases in productivity from existing employees. This means that a country can become wealthier overall even if the number of people employed or looking for work remains stagnant or declines.

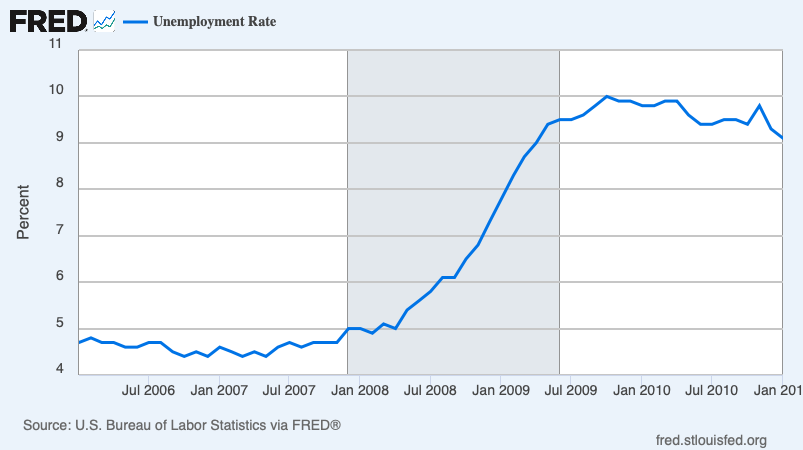

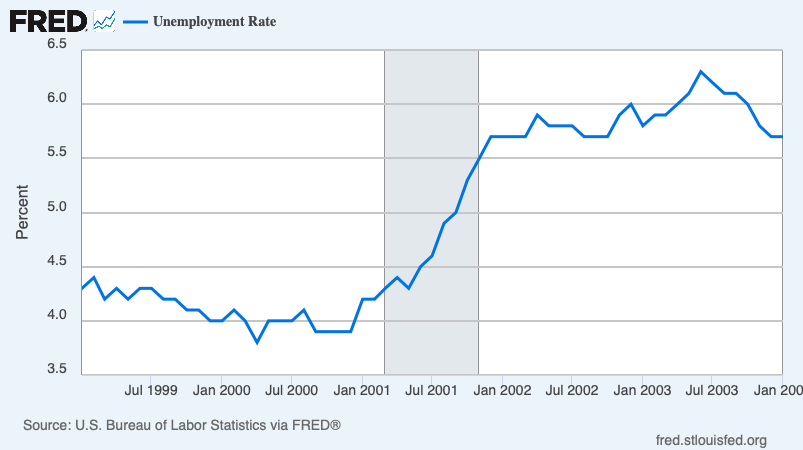

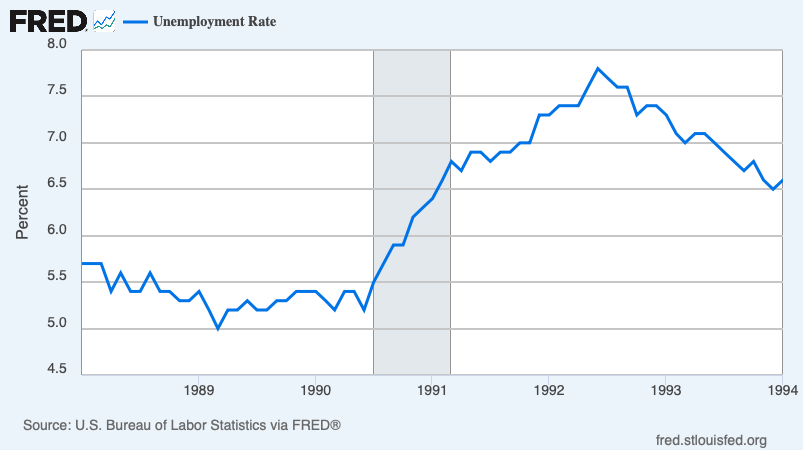

The most prominent examples of jobless recoveries in the U.S. occurred after the recessions of 1990-1991, 2001, and the Great Recession of 2007-2009. In each case, GDP growth resumed, but the unemployment rate either continued to rise or stayed elevated for an extended period, creating a disconnect that was widely reported in news headlines and economic analyses.

Why the U.S. Is Not Necessarily Slipping into a Recession

While a weak jobs market can be a cause for concern, there are several reasons why it does not automatically signal a looming recession in the current economic climate:

- Productivity Gains: A key reason for a jobless recovery is increased productivity. This can be due to new technologies (like automation and AI) or businesses streamlining operations to become more efficient. In this scenario, companies can produce more with fewer workers, which boosts GDP but doesn’t necessarily create new jobs.

- Data Revisions and Lagging Indicators: Economic data is often subject to revision. What initially looks like a weak jobs report can be revised upward later. Furthermore, the jobs market is a lagging indicator, meaning it typically changes after other parts of the economy have already shifted. GDP, consumer spending, and corporate earnings can be better real-time indicators of the economy’s health.

- Strong Corporate Fundamentals: Many U.S. companies have strong balance sheets, which can help them weather periods of slow growth without resorting to widespread layoffs. Solid corporate earnings and continued business investment, particularly in technology and infrastructure, suggest that the economy’s underlying foundations are still stable.

While a slowing jobs market is a legitimate concern, it is not a sure predictor of an impending recession. The complex interplay between productivity growth, labor force dynamics, and the lagging nature of jobs data means that the economy can continue to expand and thrive even when the unemployment rate is beginning to raise alarm. Looking at forward indicators, like financial market price action, would give investors a better sense of economic recession risk.

Leave a Reply