What’s Happening in France?

France, Europe’s second-largest economy, is experiencing severe political instability that has captured global attention. The French government led by Prime Minister François Bayrou has collapsed after losing a vote of no confidence, with public trust in the political class having collapsed and anger spilling onto the streets.

This crisis didn’t happen overnight. After President Emmanuel Macron called snap elections in June 2024, France ended up with a hung parliament split between the left-wing New Popular Front, the right-wing populist National Rally, and Macron’s own Renaissance party. No party or coalition achieved the 289-seat threshold needed for a governing majority, making the Assembly “hung” and vulnerable to frequent government collapses or votes of no confidence.

This fragmented political landscape has resulted in two short-lived minority governments, both collapsing over budgetary disputes. The core issue: France needs to reduce its massive government spending, but every proposal to cut expenses or raise taxes faces fierce opposition from different political groups.

Why This Matters For Europe

When a major economy like France becomes politically unstable, financial markets react nervously. Here’s why investors are concerned:

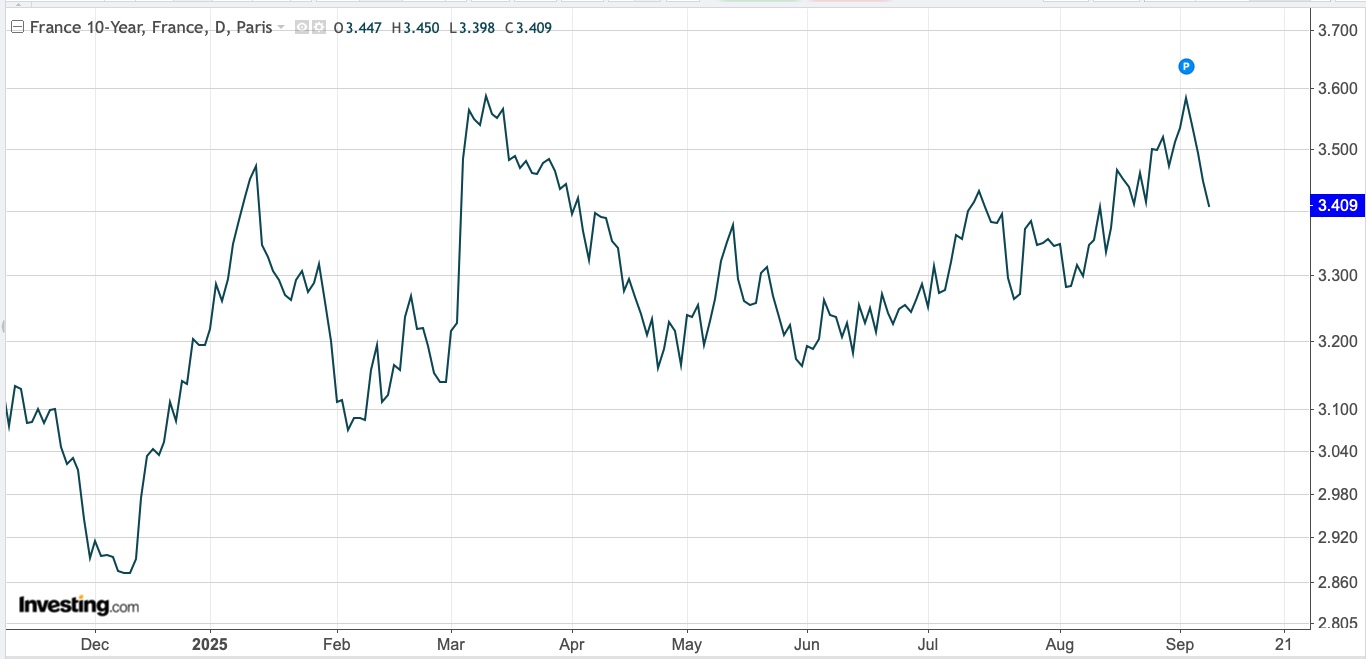

Bond Market Turmoil: Government bonds are essentially IOUs that countries issue to borrow money. French bond yields have risen above those of Greece, who were once struggling with their own crisis. When investors lose confidence, they demand higher interest rates to lend money, making it more expensive for governments to finance their operations. However, judging from the recent moves in French 10Y bond yields, investors seem to be taking all this in their stride.

Economic Uncertainty: Business leaders warn that political uncertainty triggers immediate consequences, including “freezing of investments, loss of confidence, increased risk of bankruptcies, and job destruction”. Companies delay major decisions when they don’t know what policies the next government might implement.

Broader European Impact

By right, the Euro currency should weaken, as a political crisis in Europe’s second-largest economy could reduce investment flows and drag on the Euro’s value. However, the Euro is holding up well, against the US$ and also the stable Singapore dollar.

What Comes Next?

The immediate challenge is forming a stable government that can address France’s fiscal problems. Further attempts to tackle the country’s enormous debt could be stalled until after the next presidential election in 2027. This prolonged uncertainty could increase the uncertainty in French financial markets. The downside risk appears to be muted but prolonged uncertainty dampers the potential for upside.

Leave a Reply