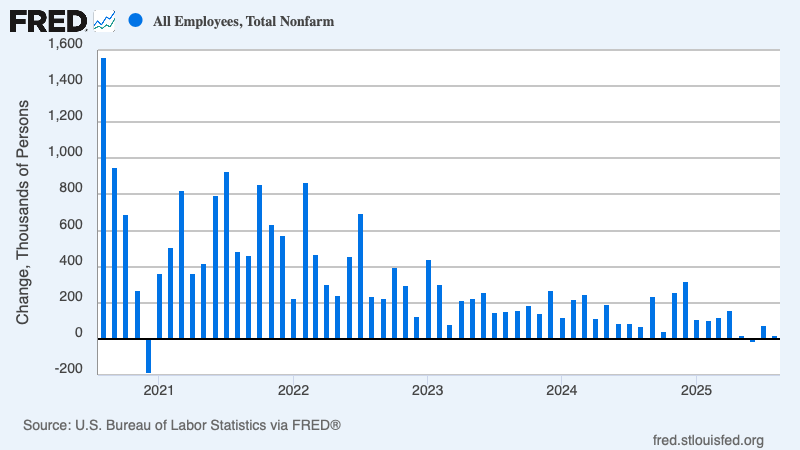

U.S. labour market weakens further.

The August 2025 US jobs report revealed a significant weakening in the labor market, with employers adding only 22,000 jobs while the unemployment rate rose to 4.3%, well below economists’ expectations of 75,000-76,500 jobs.

Job gains over the past three months have averaged less than 30,000, marking a dramatic slowdown from earlier in the year. The weak data has intensified expectations for Federal Reserve rate cuts, with markets now pricing in three quarter-point interest rate cuts by the Fed’s December meeting.

The S&P 500 lost 0.29% as Wall Street grappled with concerns about a weakening economy. Bonds gained as lower rates lifted prices. The disappointing employment data has essentially “all but sealed a 25-basis-point rate cut later this month” according to analysts, as policymakers face mounting pressure to stimulate economic growth amid clear signs of labor market deterioration.

U.S. ISM PMI New Orders index recovers

The US ISM PMI New Orders index showed a notable improvement in August 2025, marking a significant turning point for the manufacturing sector. New Orders Index expanded in August for the first time after six consecutive months of contraction, registering 51.4, compared to July’s figure of 47.1.

This expansion above the 50 threshold indicates that new orders are growing for the first time since early 2025, suggesting renewed demand for manufactured goods. This improvement in new orders could signal the beginning of a recovery in the manufacturing sector, as increased order flow typically precedes broader manufacturing expansion.

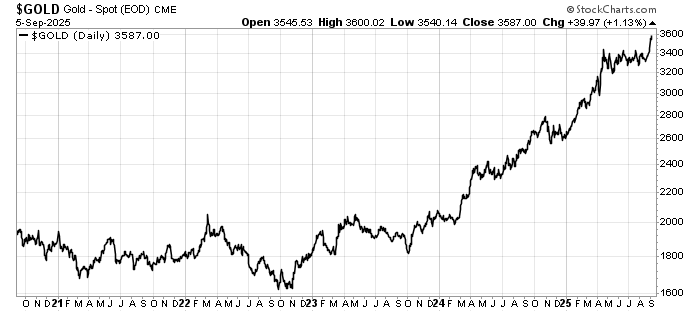

Gold prices surge to all time highs.

Gold prices have surged to new record highs over the past week, with prices climbing $3,653. The rally has been driven primarily by weaker-than-expected jobs data that has solidified expectations for Federal Reserve rate cuts, with traders now pricing in a near 100% chance of a 25-basis-point rate cut at the September 17 Fed meeting.

A weakening dollar has further boosted gold’s appeal, as the precious metal benefits from both lower interest rate expectations and currency debasement. However, risks remain elevated as non-yielding gold’s performance is heavily dependent on the low-interest-rate environment, meaning any hawkish surprises from upcoming economic data or Fed communications could trigger sharp reversals, especially given the rapid pace of recent gains that may have left the market vulnerable to profit-taking.

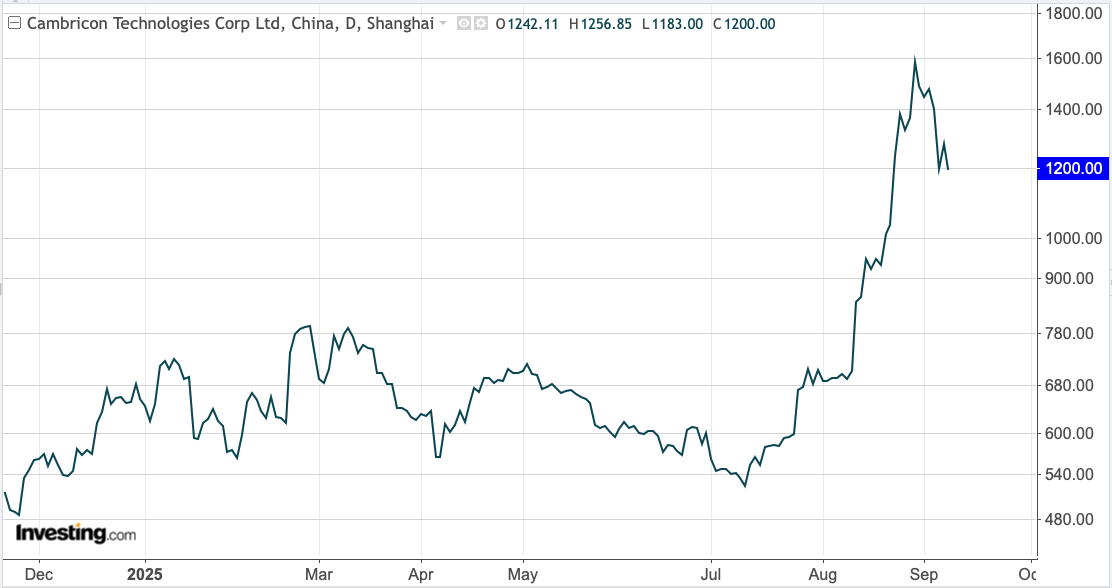

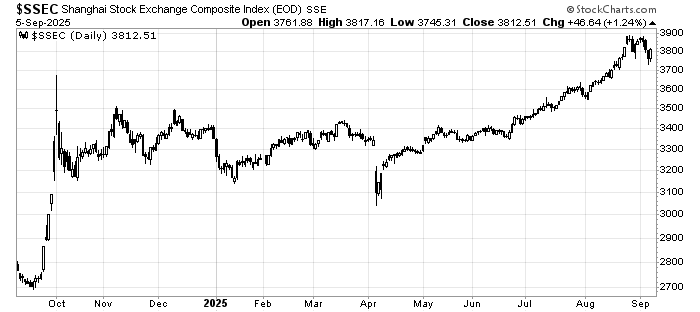

Correction time in Chinese stocks.

Over the past week, Chinese stocks have experienced a notable pullback after their remarkable rally earlier this year. AI darlings like Cambricon Technologies fell sharply after warning that investors may have gotten ahead of themselves.

This correction coincides with reports that China’s financial regulators are considering cooling measures for the stock market due to concerns about the speed of a $1.2 trillion rally since August. Market analysts attribute the recent weakness to “regulatory guard against a fast bull market and profit-taking pressure after the rapid gains”, suggesting that both government caution and natural profit-taking by investors are contributing to the current consolidation phase.

Leave a Reply