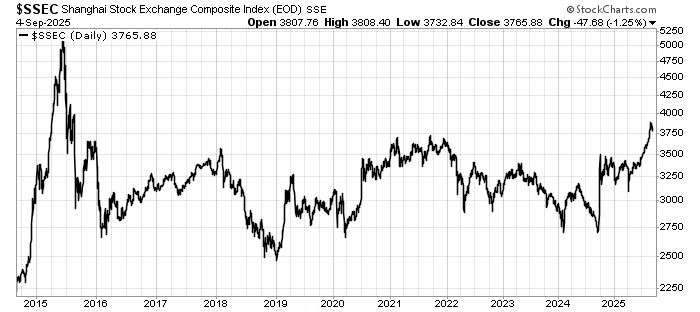

China was labelled “uninvestible” in 2021–2022 due to regulatory crackdowns, zero-COVID disruptions, and unpredictable policy shifts. However, conditions have changed significantly. While risks remain, the policy environment has stabilised, valuations are compelling, and government support is stronger, making the case for renewed investment in Chinese equities.

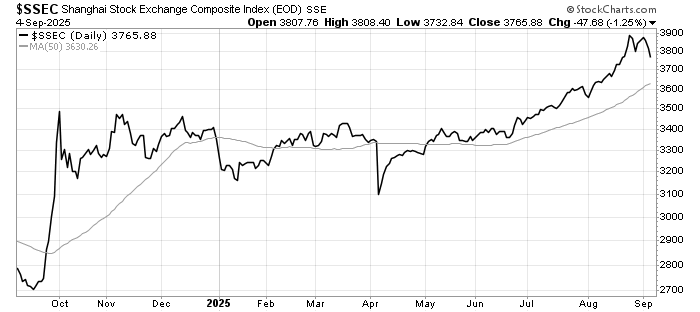

After the 20th Party Congress (Oct 2022), Beijing recognised the economic costs of over-tight regulation. The leadership pivoted to prioritising stability, growth, and employment over ideological campaigns.

Regulatory Cycles Are Maturing

- Tech platforms: Rectification declared ‘basically complete’ in early 2023.

- Education: Reforms have stabilised, with no new sweeping restrictions.

- Property: Shift from punitive measures to support, including credit easing and state-backed restructuring.

Regulators now issue forward guidance more consistently, reducing the risk of policy shocks. Examples include pre-signalled stock market support measures, limits on short selling, and equity allocation incentives.

Post-Zero COVID, fiscal and monetary policies shifted towards restoring growth. Measures include tax cuts, green subsidies, and multiple PBoC rate and RRR cuts.

Leave a Reply