S&P 500 and Nasdaq Hit Record Highs as Market Breadth Shows Signs of Improvement

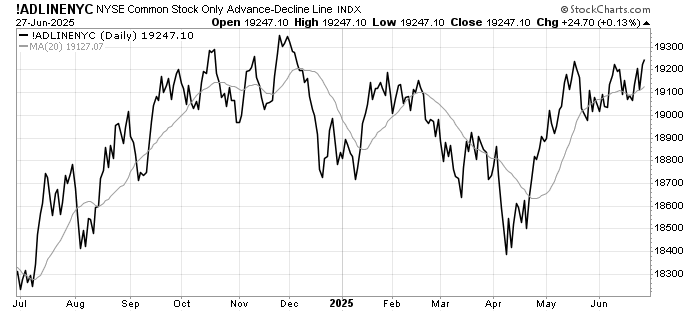

The S&P 500 closed Friday at 6,173.07, marking a new record high, while the Nasdaq also reached record closing levels as investors brushed aside trade concerns. The broad rally capped a strong week that saw major indices shrug off mid-week volatility to finish at all-time highs. Encouragingly, market breadth indicators suggest broader participation is returning after months of concern, offering hope for more sustainable gains.

July 9 Trade Deadline Looms Without Clear Resolution

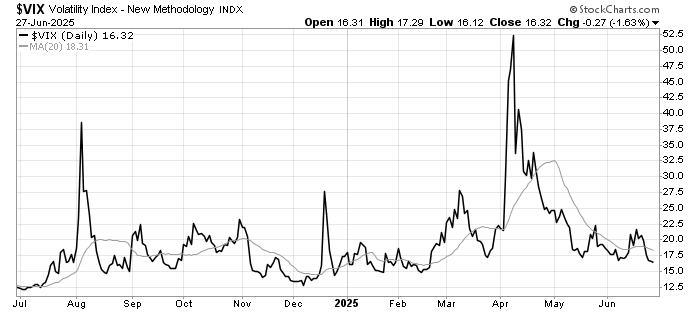

The much-anticipated July 9 trade deadline approaches with mixed signals from Washington. While no definitive agreements have been reached, recent developments suggest potential flexibility in enforcement. “No, we can do whatever we want,” Trump said at the White House when asked if his deadline was set in stone. “We could extend it. We could make it shorter.” Markets have shown resilience to trade-related headlines this week, suggesting investors are either pricing in favorable outcomes or becoming desensitized to the ongoing uncertainty. The VIX continues to trend lower.

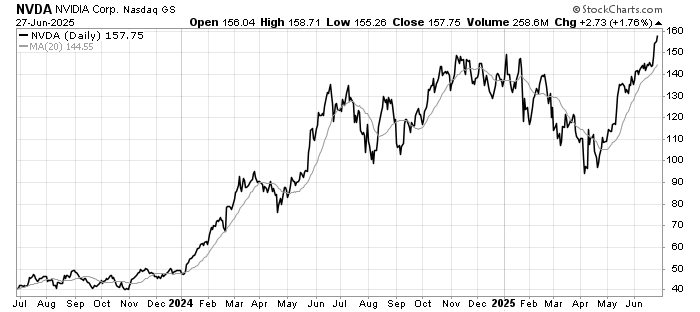

Nvidia Powers Higher on Middle East AI Expansion

Nvidia secured major AI deals during recent Gulf state visits, including selling hundreds of thousands of AI chips to Saudi Arabia, with an initial 18,000 “Blackwell” chips going to Humain, a new AI startup launched by the Saudi sovereign wealth fund. The U.S. also has a preliminary agreement allowing the UAE to import 500,000 of Nvidia’s most advanced AI chips per year starting in 2025. These geopolitical AI partnerships represent a significant expansion of Nvidia’s addressable market and underscore the strategic importance of semiconductor technology in international relations. The stock’s breakout reflects not just strong fundamentals but also the company’s central role in global AI infrastructure development.

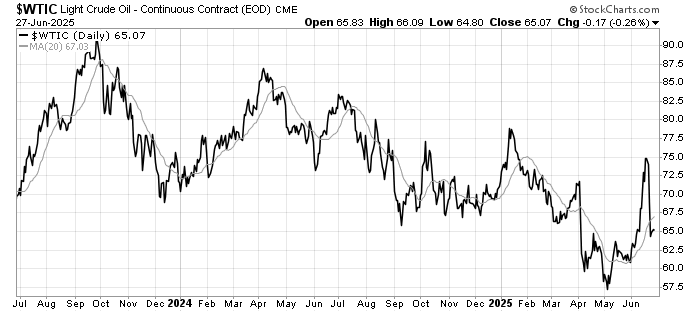

Oil Retreats to $60s as Middle East Tensions Ease

Oil prices fell 6% on Tuesday to settle at a two-week low, as the ceasefire between Israel and Iran reduced expectations of Middle East supply disruptions. The dramatic retreat from recent highs provides welcome relief for inflation-sensitive sectors and consumers. The geopolitical risk premium that had pushed oil higher earlier in the month has largely evaporated, with markets now focusing on fundamental supply-demand dynamics. The return to $60s pricing removes a key headwind for economic growth and gives central banks more flexibility in their policy decisions.

Looking Ahead

The coming week brings critical inflection points across multiple market drivers. The July 9 trade deadline will test market resilience, while earnings season approaches with heightened focus on AI beneficiaries and their ability to justify lofty valuations. The improvement in market breadth indicators suggests the rally may be gaining broader support, which could provide a more sustainable foundation for continued gains. With geopolitical tensions subsiding and oil stabilizing, attention returns to fundamental earnings growth and Federal Reserve policy as primary market catalysts.

Leave a Reply