US Equities Scale New Heights Despite First-Half Headwinds

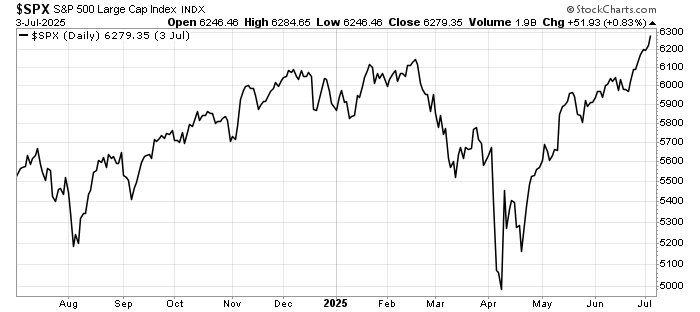

US stock markets closed the week on a triumphant note, with major indices reaching fresh all-time highs despite the significant challenges that defined the first half of 2025. The S&P 500 extended its remarkable run, adding 1.7% for the week. This performance underscores the market’s remarkable resilience and adaptability in the face of persistent geopolitical tensions, monetary policy uncertainties, and global economic headwinds that characterised the opening months of the year.

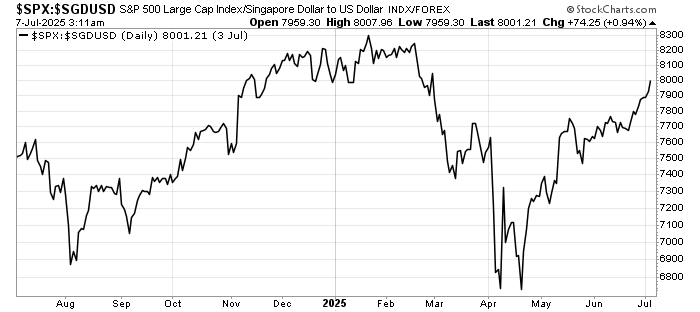

The sustained rally reflects investor confidence in corporate earnings growth and the underlying strength of the US economy. Technology stocks continued to lead the charge, with the sector’s momentum showing no signs of abating despite periodic concerns about valuations and regulatory pressures. One notable weakness, especially for international investors is the impact of a weak US dollar. In S$ terms, the S&P 500 is still in the red for the year.

Labor Market Resilience Confounds Pessimistic Forecasts

The US labor market continued to defy widespread predictions of deterioration, maintaining its robust performance through the first half of 2025. Employment data released during the week reinforced the narrative of a surprisingly durable jobs market, with unemployment rates remaining near historic lows and wage growth showing sustained momentum. This strength has been particularly notable given the numerous headwinds facing the economy, including trade tensions, geopolitical uncertainties, and the Federal Reserve’s non-easing stance.

OPEC Supply Increase Signals Amid Oil Price Weakness

In a surprising development that caught energy markets off guard, OPEC announced plans to increase oil supply despite the prevailing environment of weak crude prices. Despite concerns about demand, OPEC seems confident about market’s ability to absorb the extra supply as seen from Saudi’s hiked premiums for its flagship crude to customers in Asia.

Trade Tensions Loom as Tariff Deadline Approaches

Markets are bracing for potential volatility as a critical trade policy deadline approaches, with a temporary suspension of punitive import levies set to expire in the coming week. This development has created a significant watchpoint for investors, as the resolution of these trade tensions could materially impact global supply chains, corporate earnings, and market sentiment in the second half of 2025.

The trade uncertainty adds another layer of complexity to an already challenging global economic environment. Investors will be closely monitoring Washington’s policy decisions, as any escalation in trade tensions could disrupt the current market momentum and force a reassessment of risk assets across various sectors. Conversely, a resolution or extension of the suspension could provide additional tailwinds for the ongoing equity rally. As usual, the sound bytes coming out of the White House is not consistent: Trump says no extension, while Bessent hints extensions.

Leave a Reply