US stocks managed to close up on Friday, 14 March 2025. This is the first tentative sign of a bottom, as taking a bullish position over the weekend – where many tweets can be made – is brave for traders. Unlike investors, traders in the current environment want to see bullish news, rather than look forward to bullish factors like tax cuts and de-regulation.

It is notable that the cyclical and technology ETFs have made the strongest recovery on Friday.

Semiconductors were up 3.27% while Banks rose 2.98%. Markets are oversold, with the RSI below 30 for the S&P 500. We could see some further recovery on Monday, if the news on retail sales and the NAHB housing market index is well received.

For investors, it is important that the long term drivers of the bull market remain intact. Tax cuts and de-regulation remain on track. These are necessary to counter the pain inflicted by tariffs.

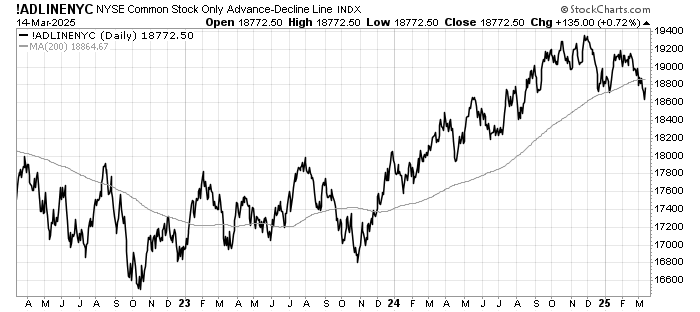

Still, the technical damage has to be repaired. We will need to see cyclical sectors leading the recovery. We need to have a recovery in market breadth. Like in Q3 of 2023, there were significant concerns about the economy and the S&P500 tanked 10%. Currently the damage is about 10%. A broad based recovery will be a good indicator of the current sell off is just a correction, and not something more sinister.

Leave a Reply