US Economy

US housing starts rebounded, up 11.2% in February. Industrial production gained 0.7% on month while retail sales rose 3.1%.

Sentiment among homebuilders remain weak, with the NAHB housing market index slipping to 39.

The biggest event was probably the FOMC meeting, where rates were left unchanged but FOMC participants raised inflation targets and lowered economic growth projections.

US Markets

It is important to note that financial markets reacted positively to the release of the FOMC’s projections. US stocks were up and yields were down. This could possibly signal that financial markets have priced in a slower economic growth and higher inflation environment.

US stocks are still trying to recover from the mid-February sell off. While there is no all clear signal, there are some encouraging signs.

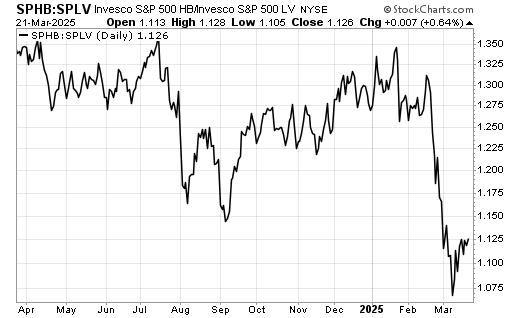

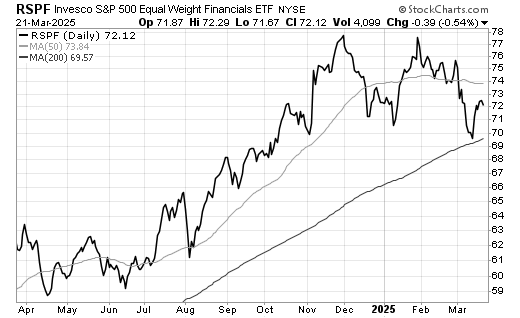

Relative performance of high-beta to low-volatility stocks is improving, suggesting that risk appetite is increasing, albeit slowly. Equal weight Financials ETF has recovered well, although the loss of momentum is evident.

So if this is not a dead cat bounce, then we need to have some positive catalyst to drive risk appetite. Besides a re-calibration of tariffs, there should be a shift in focus to tax cuts and de-regulations. For now, investors must be prepared for a significant probability of a period of market weakness.

Leave a Reply