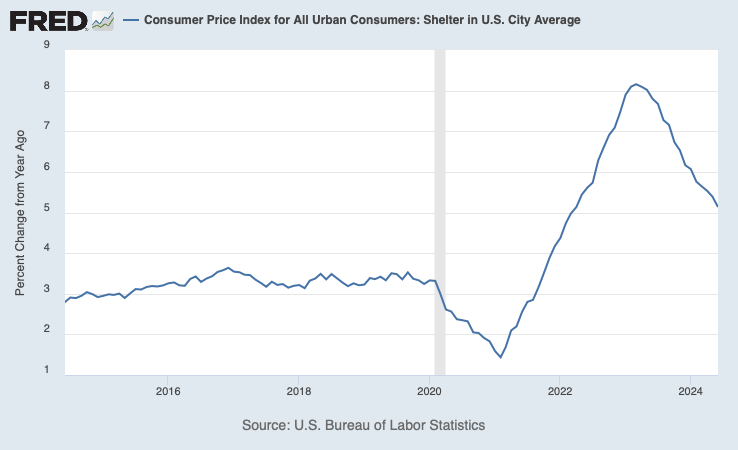

The biggest news have to be the continued cooling of US inflation. CPI increased 3% on year in June, fell 0.1% on month. The biggest driver was the decline in energy cost, while shelter continue to ease slowly, rising 5.2% on year. Although it continues to come down, it is still way above pre-COVID levels.

While the report is encouraging, the market reaction is important and requires some explanation. The S&P500 dropped 0.88% by the end of the day, with tech leading the losses (-2.5%). It would seem that investors were disappointed with the CPI report, or that investors are now worried that price weakness would translate to economic weakness.

However, given that small caps, banks and housing bounced back strongly, we feel that it is reasonable to conclude that investors are rotating back to non-tech stocks.

- Homebuilders (XHB) +5.88%

- Regional Banks (KRE) +4.21%

- Small Caps (IWM) +3.59%

Looking at equal weighted ETFs leads us to the same result. The equal weighted ETFs did better than the market weighted ETFs for both the broad market and also for sector funds.

- S&P 500 Equal Weighted (RSP) +1.21%; S&P 500 Market Weighted (SPY) -0.86%

- Tech Equal Weighted (RSPT) -0.85%; Tech Market Weighted (XLK) -2.5%

It is thus reasonable to conclude that investors are not bailout out of the market (fearing recession) but are rotating into other sectors/stocks, other than the Magnificent 7 or whatever mega cap stocks. This suggests that the odds of a soft landing is improving. We have earnings for Q2 coming in the weeks ahead. This, coupled with market’s reaction will give us clues as to the outlook for stocks and the economy in Q3 and Q4.

Leave a Reply