US economy

Soft patch growing. More evidence of late to suggest that the US economy is slowing.

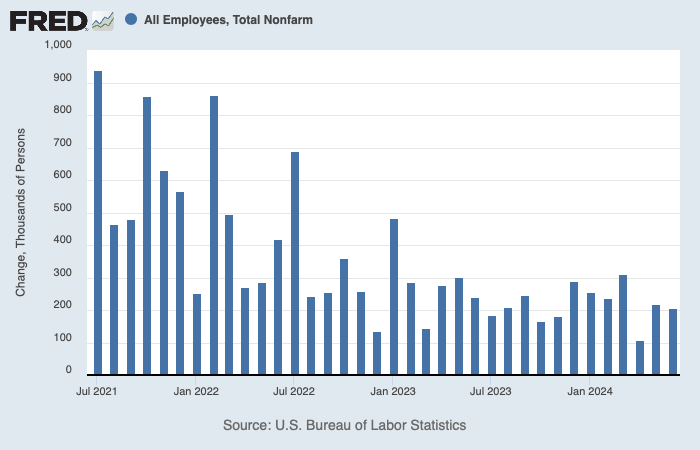

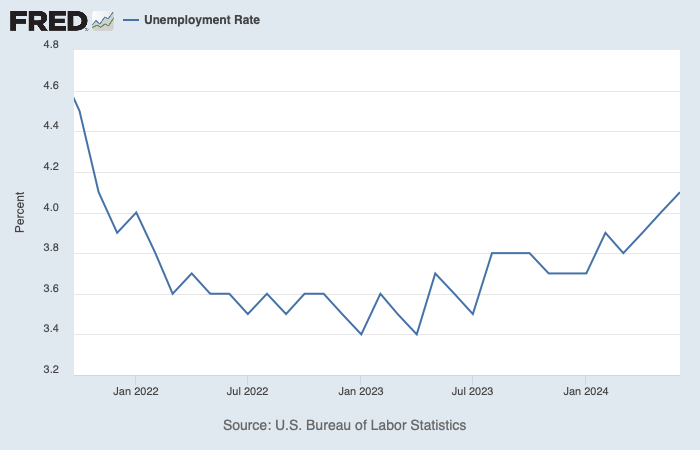

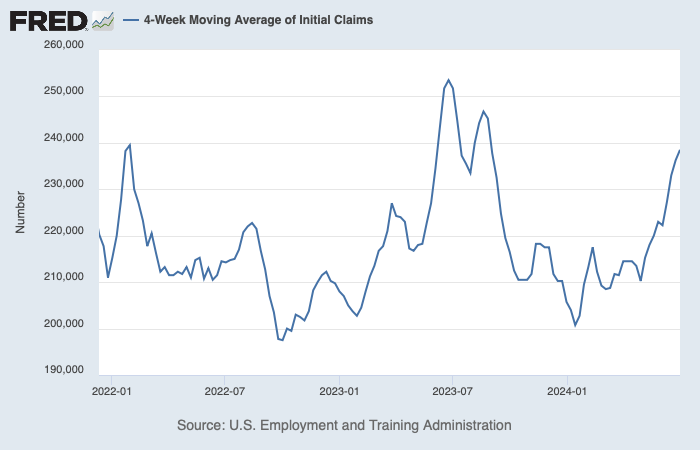

- Jobless claims have risen. Unemployment rate inched higher even though job creation remains plentiful. Not the time to worry but investors need to watch that it does not deteriorate further.

- GDPNow indicator down sharply. PMI for both manufacturing and services are down, below 50.

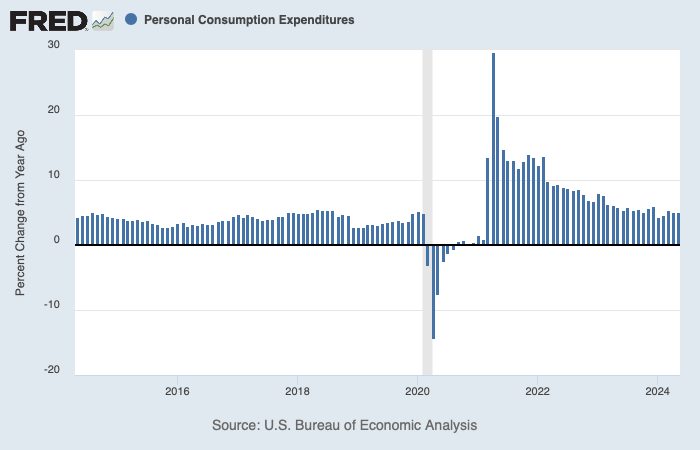

- Consumption remains robust, core PCE up 3.7% in Q1 2024. Consumer confidence still struggling, according to Mich. Consumer Survey.

- Market breadth is poor. Bull market still led by technology stocks. Equal weight S&P 500 holding up. If it holds the support line and breaks out, we could see a multi-month rally that is driven by fundamentals, rather than AI hype.

Elections:

UK – Labour party wins after 14 years. Financial market reaction is muted, without significant movement in UK stocks, gilts or the pound.

France – Round one to the Right, round two to the Left, albeit slightly. Without a clear majority by any party, there will be jockeying for power sharing arrangement. This could mean status quo for France.

Calls for Biden to dropout – It’s getting louder but what ever happens, it will probably not change much. Donald Trump is still expected to win the election in November.

Leave a Reply