Biden quits: It’s official. He has announced on X that he quits and endorses Harris. It seems to improve the odds that Donald Trump would win the November election. Odds from bettings sites suggest that the probability of Trump winning the election has improved after the announcement. Markets have been discounting the news that Trump will win the election, so we do not expect much impact on financial markets.

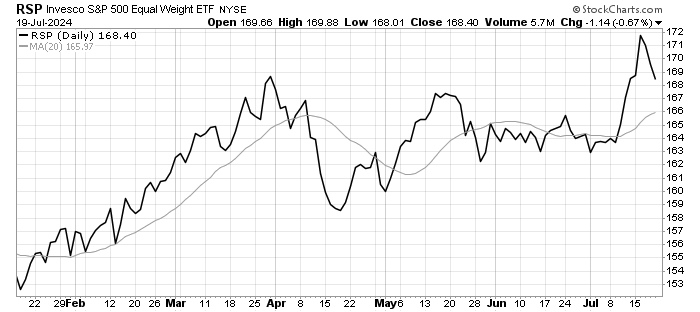

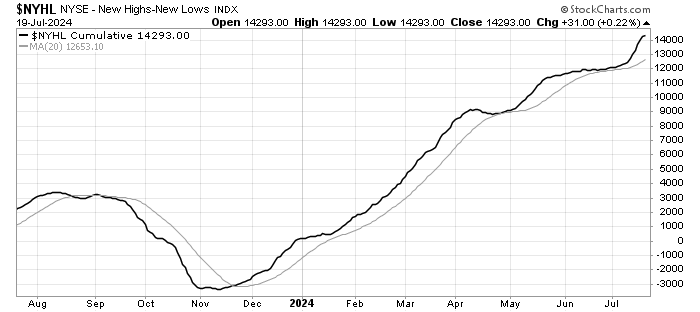

US stock market rotating/broadening: The week saw a continuation of the rotation out of Big tech into cyclical sectors like Industrials, banks and small caps. However, they ended the week on a weaker note, but still positive for the week. Market breadth indicators are pretty positive right now, with advances, new highs, equal weighted indicators all turning positive. We should see some momentum carried through in the next few weeks as the earnings report start to stream in.

US earnings: More importantly, we kicked off Q2 earnings reporting in the US. According to Factset, “Of the 70 companies in the S&P 500 that have reported earnings to date for 24Q2, 82.9% have reported earnings above analyst estimates. This compares to a long-term average of 66.8% and prior four quarter average of 79%”. Earning season just started, so we will be watching how companies coped in Q2, and more importantly how markets react to the news.

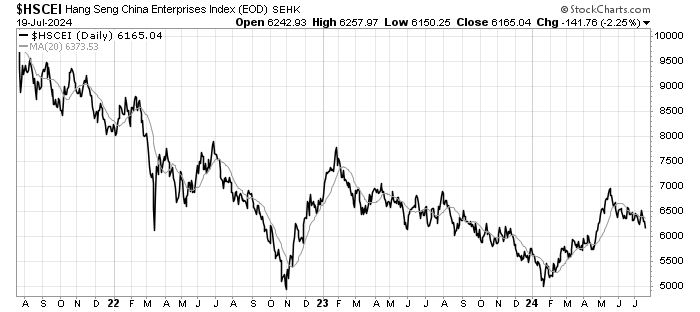

China plenum: No surprises here. Expectations were low that there will not be a pivot to re-charge the world’s second largest economy. The initial readout continues to echo what has been said over the past few months, with a focus on advanced manufacturing as the new growth driver while maintaining economic stability. This strategy is not without risk, given that the West is worried about Chinese dumping their excess goods on them. We think that China is unlikely to make consumption the main growth driver. Hence, corporate profits and economic growth will be subdued in the next few years. The performance of the Chinese stock markets reflects this forecast.

Leave a Reply