US Earnings Update: As the first quarter earnings season progresses, S&P 500 companies are performing strongly against expectations. A higher percentage of these companies are reporting positive earnings surprises, and the magnitude of these surprises exceeds the 10-year average. Consequently, the S&P 500’s earnings for the first quarter have increased compared to both last week and the end of the quarter. Additionally, on a year-over-year basis, the index is experiencing its highest earnings growth rate since the second quarter of 2022. Eight of the eleven sectors are reporting year-over-year earnings growth, led by the Communication Services, Utilities, Consumer Discretionary, and Information Technology sectors. On the other hand, three sectors are reporting a year-over-year decline in earnings: Energy, Health Care, and Materials. Hard to see a recession in the near term when earnings cycle is up.

US Economics: Labour cost rise by the most in a year, putting pressure on the FED to delay rate cuts. But lower than expected non-farm payrolls (+175K v 243K) introduced the prospect of slower end demand. Still a mixed bag when it comes to data that influence monetary policy.

US FED: No change, neither hawk nor dove. Powell continues to tread carefully to lower expectations of both hikes and cuts. US10Y has fallen in the couple of days but the trend remains up.

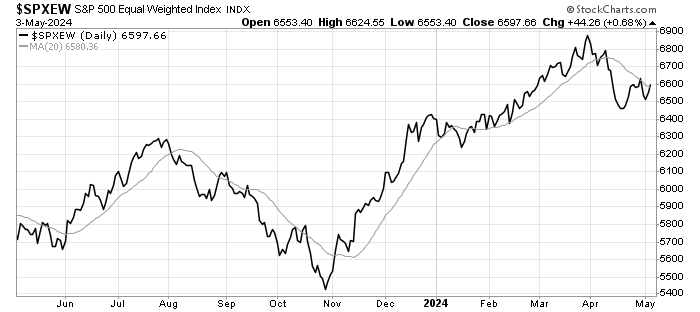

US Stock Market Action: After an initial scare to start the week, US equity markets ended on a stronger note. However, there is the 50dMA resistance to deal with. Equal weighted indices are also under pressure, so the short term outlook is cautious at best.

Leave a Reply