US recession chatter is louder: Weaker ISM reports for both manufacturing and services, and a soft labour market report has prompted more recession calls. Investors ought to remember that recessions are caused by 1) a monetary-tightening-induced financial crisis turns into a credit crunch; 2) a geopolitical crisis causes oil prices to soar; or 3) speculative asset bubbles burst. All three have caused recessions in the past.

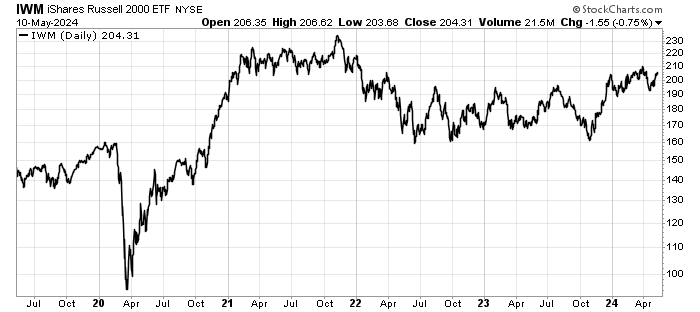

We have experienced a mini financial crisis early last year when a couple of banks failed, but the economy survived and while bank lending standards tightened, businesses continued to operate normally. Small businesses are the most affected, as the NFIB small business optimism index reached the lowest level since 2012. However, inflation has been cited as the main reason for low business confidence. Furthermore, small cap stocks have held up well although it has underperformed large cap stocks by 30% over 5 years. The odds that small businesses, which are focused on the domestic economy, will not fall into a recession are not increasing. That is good news.

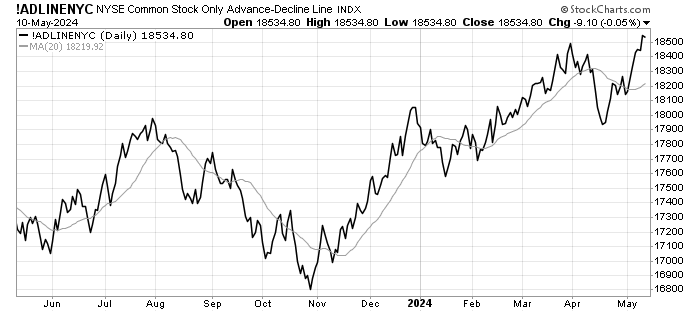

A single month of weaker economic report does not cause us to change our minds on the health of the US economy. Importantly, we see positive signals from financial markets. Market breadth has been improving, correcting the damage done by the recent sell off. The NYSE Advance-Decline index has risen to a new high, that is bullish!

Leave a Reply