Key developments:

- China’s challenge: Industrial profits slump. The focus on hi-tech manufacturing is facing critical challenges already. As profitability slumps, it’s more challenging to sustain manufacturing activity in a market economy. However, the push to continue investment into manufacturing could see mis-allocation of capital, which is a long term negative.

- Tech earnings: Mixed results but investor reaction is rational, not bubble-like. Microsoft and Alphabet did well, but Meta shares fell as it announced large investment into AI. Tesla profit miss didn’t hamper its stock price, although it is important to note that its share price has tanked 40% since the start of this year. Announcement about cheaper cars propelled the stock higher but the trend remains bearish.

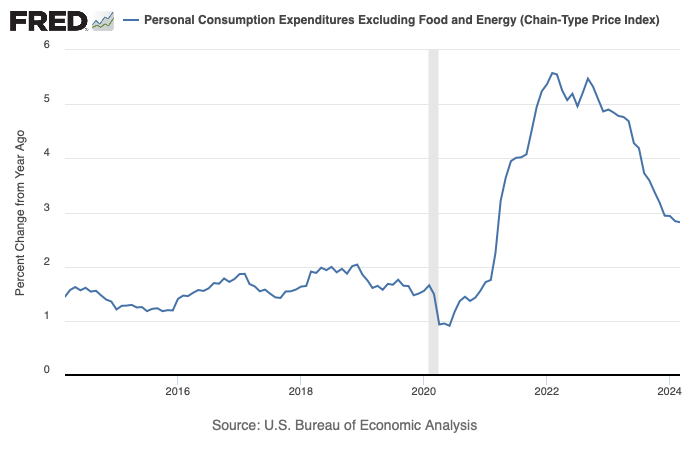

- US economy: Q1 GDP growth is lower than expected. Gross domestic product increased at a 1.6% annualised rate last quarter. Economists polled by Reuters had forecast GDP rising at a 2.4% rate after growing at a 3.4% rate in the fourth quarter. But this is the first estimate. High chance that it will be revised higher. But PCE price index remains elevated, pushing up the “higher for longer” factor. A key risk is that rates may actually go up if inflation remains persistent.

- US bond yields are heading higher: Inflationary pressures and a less dovish FED is pushing bond yields up. Will it start to hurt the real economy? Need to watch homebuilders closely as mortgage rates hit a new high. If homebuilding stocks turns bearish, the risk of a consumer pull back is higher. Right now, homebuilders are in neutral, the long term trend is bullish (above 200dMA) but at risk (below 50dMA).

Leave a Reply