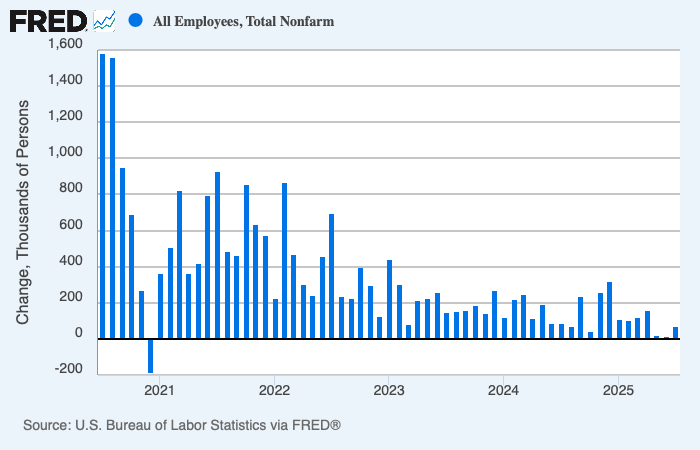

The Bureau of Labor Statistics reported that the U.S. economy added just 73,000 jobs in July, far below expectations. More concerning were the massive downward revisions: 258,000 jobs were revised downward for the prior two months, with economists calling these revisions “stunning”. President Trump reacted by firing the Bureau of Labour Statistics commissioner.

Breaking down the revisions: the U.S. created just 33,000 jobs total in May and June after the adjustments, painting a picture of a labor market that has essentially stalled since spring 2025.

Sector-Specific Trends

The job gains and losses show clear patterns:

- Government employment continues to decline, down 12,000 for the month and 84,000 since its January peak, partially attributed to efficiency initiatives

- Professional and business services lost 14,000 jobs

- Healthcare, retail trade, and social assistance showed some gains, but not enough to offset weakness elsewhere

Historical Context and Pattern Recognition

Looking back to January 2025, we see a deteriorating trend. The U.S. economy added 143,000 nonfarm payroll jobs in January, which already fell short of consensus expectations of around 175,000 jobs. The progressive weakening from 143,000 in January to essentially flat job growth in May/June and only 73,000 in July suggests a clear deceleration in hiring.

Financial Market Indicators and Recession Signals

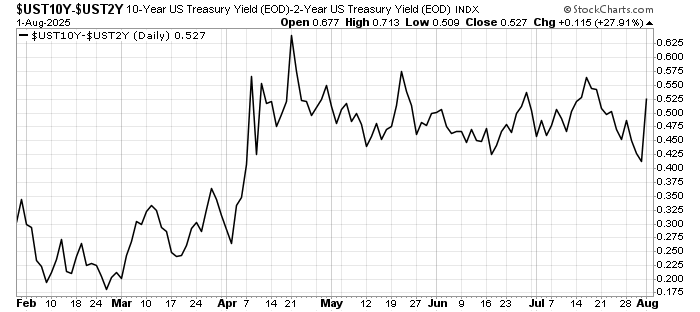

- No Yield Curve Inversion: The difference between the 10-year and 2-year yields rose despite the worse than expected data. Markets are expecting the Fed to cut rates while assuming no recession.

- Housing equities bucked the trend: Stocks were generally weaker across sectors after the dismal report, with the exception of Healthcare, Staples and Utilities. Surprisingly, housing and home improvement stocks gained. If the labour market is to deteriorate further, big tickets items should get hit, but that’s not what we are seeing.

- US dollar fell: In response to expectations of more Fed’s cuts, the US dollar fell.

Economic Outlook and Implications

Several factors point to continued challenges:

- Momentum Loss: The sharp deceleration in job growth and massive revisions suggest the labor market lost momentum much earlier than previously recognized.

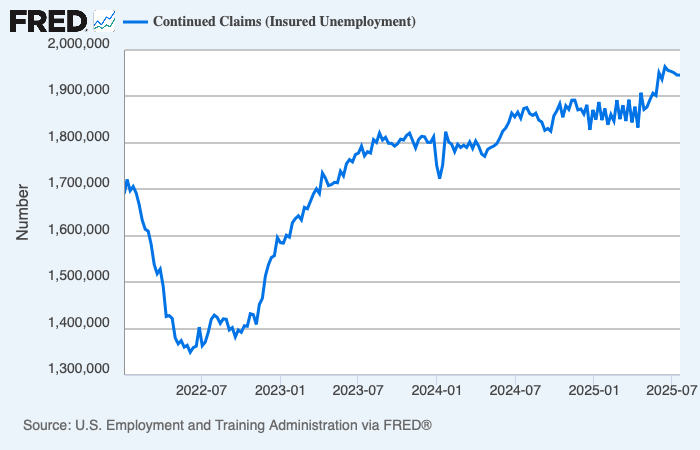

- Business Sentiment: ISM surveys on employment have been weak. The hard data is confirming. The weak hiring suggests companies are acting like “they’re in a recession”, pulling back on expansion plans and new hires. The good news is that layoffs are not accelerating. The trend of unemployment insurance claims remains steady.

Near-Term Risks and Considerations

- Recession Probability: Prediction markets did not indicate a significant rise in recession risk, still at a 15% chance of a recession in 2025 for the US economy.

- Policy Response: Markets will closely watch the Fed’s response. Easing of interest rates can help ease the financial constraints and allow the continuation of the economic expansion, providing a buffer to a weaker hiring outlook.

- Market Response: How will cyclical sectors like housing and banking perform in the next few weeks will determine if the risk of a bear market and hence recession has increased.

Leave a Reply