US-EU Trade Deal

On July 27, 2025, the EU and US announced a trade deal to stabilize transatlantic commerce, finalized at Trump’s Turnberry golf course. The agreement sets a 15% tariff on most EU goods exported to the US, lower than the threatened 30% but higher than the current 10%, potentially generating $90 billion in US revenue.

The EU will invest $600 billion in the US and purchase $750 billion in US energy (LNG, oil, nuclear fuels) over three years, boosting US industries and replacing Russian energy imports. Zero tariffs apply to aircraft, semiconductors, generic drugs, and some agricultural products, though pharmaceuticals may face higher tariffs, creating uncertainty.

European futures markets reacted positively. The agreement aligns with similar US deals, like Japan’s 15% tariff framework. It would seem that a 15% base rate will be applied to all nations.

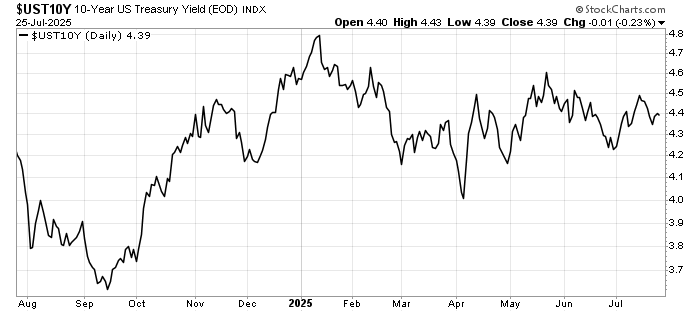

US Treasury Yields Stable

US Treasury bond yields have stabilized over the past month, with the 10-year yield at 4.39% and the 30-year at 4.93% as of July 25, 2025, showing minimal fluctuations. This follows a period of volatility driven by policy uncertainty and tariff announcements. Stabilization is attributed to a resilient economy, with steady labor market data reducing expectations for Federal Reserve rate cuts. Mixed foreign demand for Treasuries, coupled with sufficient interest at current yield levels, supports market balance. Concerns over rising government debt and potential inflation from tariffs have eased, though investors remain cautious. The Fed’s focus on anchoring inflation near 2% further contributes to this stability. While short-term yields are influenced by Fed policy, longer-term yields reflect expectations of sustained economic growth and moderate inflation.

US Recession Risk Drops

Recent economic data and prediction markets indicate a reduced risk of a US recession in 2025. Polymarket, a leading prediction platform, shows recession odds dropping to 18% in July 2025, down from a high of 70% in April. This shift reflects growing optimism driven by stabilizing economic indicators.

The Atlanta Fed GDPNow model is forecasting Q2 GDP coming in at 2.4%. Retail sales and industrial production have come in better than expected. Consumer confidence has risen, supported by stable job openings and household spending. J.P. Morgan lowered its recession probability from 60% to 40%, citing de-escalating trade tensions. Corporate earnings have also been resilient, countering bearish narratives.

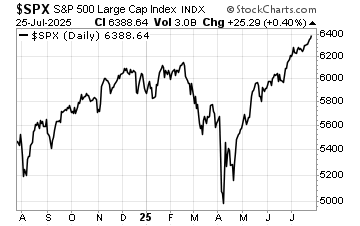

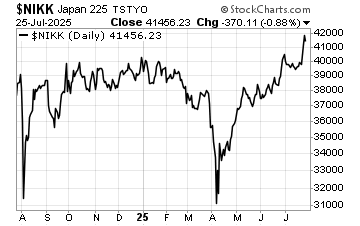

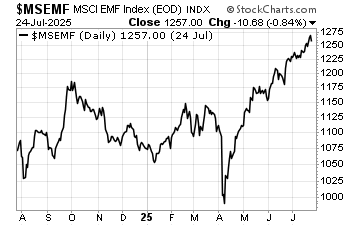

Stock Markets Making New Highs

With tariff uncertainty fading, investors are bidding up equities as confidence returns. US, Japan, UK, and EM stocks are making new highs. With global monetary policy easing slightly (with only the FED holding out for now), the outlook continues to improve.

Leave a Reply