US Election:

Looks like it’s a sweep by the Republicans and equity markets are loving it.

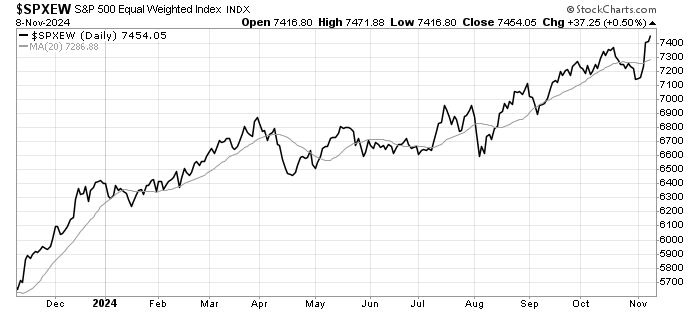

S&P 500 is up to new highs and market breadth is solid (equal weighted index is also up to new highs). The past five trading days show broad rallies, not just the tech sector, but also industrials (+6%) and financials (+5%).

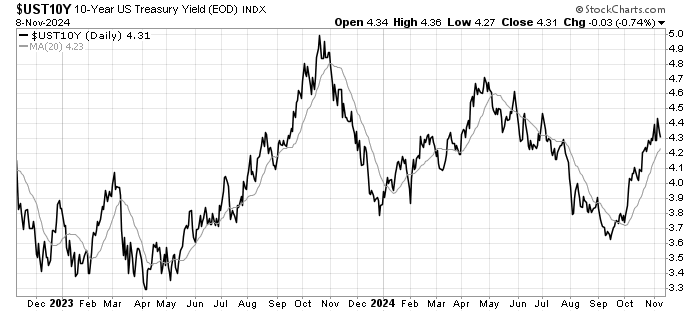

US bond yields are rising sharply. Should investors be concerned?

The fear that Trump may push the deficit higher is sending bond yields higher. Or could it be the result of unwinding the “hard landing” trade. After all, the US economy is doing very well of late, according to the IMF. Nonetheless, we still need to watch how the 10Y yield is behaving.

USD is rising – certain US assets are still attractive.

Stocks are a definitely an attractive asset for investors. US stocks are up 26% YTD while international markets are way behind, with the exception of China (super volatile and dependent on bazookas) and Taiwan (thanks to TSMC AI near-monopoly)

Geo-politics – Pro-Isreal, Pro-America

With the return of Trump, we could see less globalisation and more pro-America policies. This should favour American equities over international equities, worsening the underperformance of non-US equities relative to US stocks. In this context, overweighting US equities makes sense, despite the high valuation in US stocks. Of course, this works under the assumption that the economy continues to grow and interest rates are not going up. If signs emerge that the FED is thinking of raising rates or long term rates start to go beyond 4.6%, a new strategy is probably required.

Leave a Reply