China disappoints or investors’ hopes misplaced?

China’s government failed to boost its economy over the past week, disappointing investors. After a week-long holiday, Chinese stocks jumped 11% on hopes for stimulus, but no new measures were announced. It subsequently lost 13% for the week, its worst drop since 2008.

This writer remains skeptical that central bank easing and limited fiscal measures can fix China’s economy. It doesn’t make sense for China to endure the past three years of pain just to revert back to a debt driven growth model that is clearly no longer working. All China is doing is to prevent further slowdown in the economy. As for long term investment into Chinese stocks, a shift back toward capitalism (favouring private sector and foreign investors) would be needed to make it investable long-term.

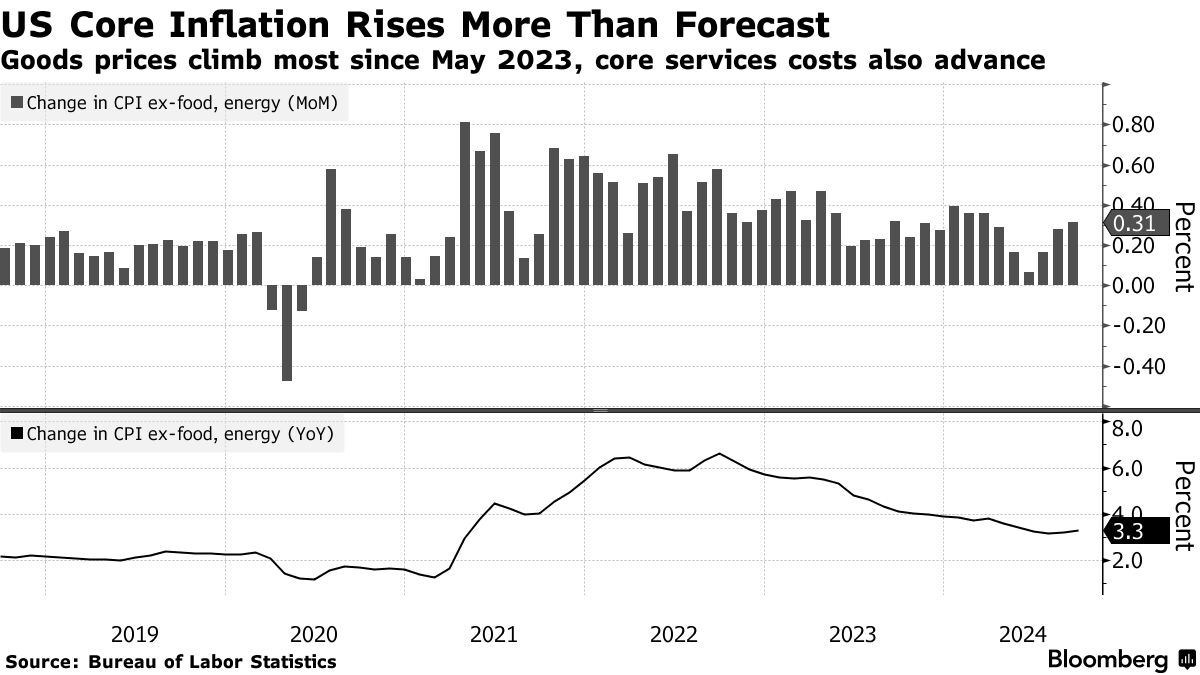

US inflation pressures remain

According to Bloomberg, underlying US inflation rose more than forecast in September, representing a pause in the recent progress toward moderating price pressures. Investors need to taper down expectations of more rate cuts by the Federal Reserve as growth is strong and price pressures are not easing significantly.

Middle East conflict update

Israel is still holding back on its retaliation on Iran. There has been a lot of chatter on the potential targets, oil and missiles facilities, giving Iran ample time to prepare. It is inconceivable that Israel has not planned before hand how it will retaliate should Iran attack them. This writer continues to believe that any strike on Iran will be surgical, as Israeli forces are already stretched in the North and the West. Note how oil prices are actually weak despite rising tensions. Also, Saudi Arabia and the UAE are noticeably quiet on this matter. The writer believes there is lots of diplomatic action behind the scenes to avert and all out war in the region.

Leave a Reply