Jackson Hole outcome:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks”

Words from the most powerful central banker. A rate cut in September is baked in as policy makers have pivot from fighting inflation to taming the rise in unemployment. According to the FED, the upside risks to inflation have diminished, and the downside risks to employment have increased. The focus is now on stemming the rise in the unemployment rate, which if they are successful, will dramatically increase the odds of a soft-landing in the world largest economy.

Kamala Harris economic policy:

- Harris has proposed keeping rates in place for those making less than $400,000, while raising taxes for higher earners. She is also pushing for an increase in the corporate tax rate to 28%, up from the current 21%.

- While details remain vague, Harris has called for a federal law against price gouging on food and groceries.

- Harris has proposed as much as $25,000 in down-payment support for first-time home buyers. She has also suggested a tax incentive for builders who work on starter homes and called for the creation of a $40 billion innovation fund to spur innovations in housing construction.

Still in the early stages of the presidential campaign, so the impact on markets is likely to be limited. Prediction market is still split on who will be the next President. There is also no clear winner on who will control the government (which is a good thing!).

Market’s response to dovish tilt:

The dovish tilt by FED chair led investors to bid asset markets higher. The S&P500 is whiskers away from its all time high set on 16 July 2024. Nobody talks about the 5 August market panic anymore.

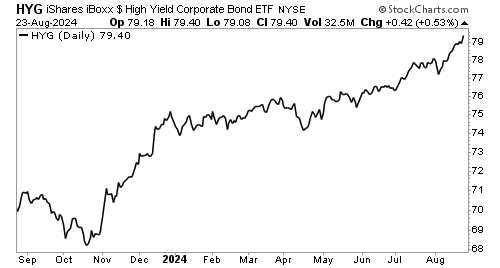

Tech-heavy Nasdaq 100 is back on positive momentum. There is broad participation in cyclical sectors like small caps, industrial and financial stocks. Even bonds are having a good day. High yield bonds are making ATH!

Mid-East tensions

Someone made a move on Sunday. Hezbollah launched hundreds of rockets and drones at Israel early on Sunday, and Israel’s military struck Lebanon with around 100 jets to thwart a larger attack. The two sides have exchanged messages that neither wants to escalate further, with the main gist being that the exchange was “done”, two diplomats told Reuters. More important is the reaction of oil prices. Brent crude futures climbed 37 cents, or 0.5%, to $79.39 a barrel by 2300 GMT while U.S. crude futures were at $75.19 a barrel, up 36 cents, or 0.5%. Again, not much of a reaction from oil markets. Investors can keep calm and carry on, for now.

Leave a Reply