US Earnings Growing –

According to LSEG/IBES data, US earnings is healthy:

- 24Q2 Y/Y earnings are expected to be 12.5%. Excluding the energy sector, the Y/Y earnings estimate is 13.3%.

- Of the 463 companies in the S&P 500 that have reported earnings to date for 24Q2, 78.8% have reported earnings above analyst estimates. This compares to a long-term average of 66.8% and prior four quarter average of 79.0%.

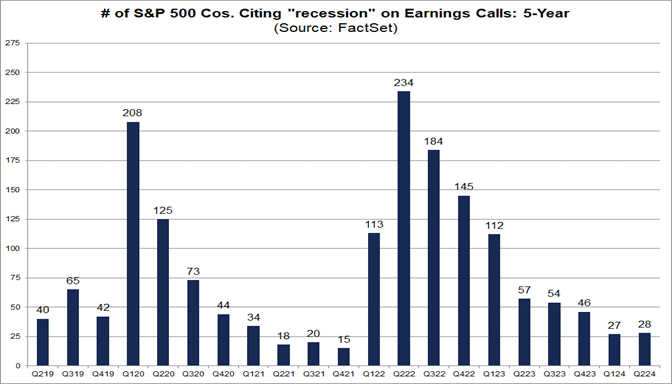

According to FactSet, the number of companies that cited recession on their earnings call is low. Really tough to see a recession either in the current quarter or the next quarter.

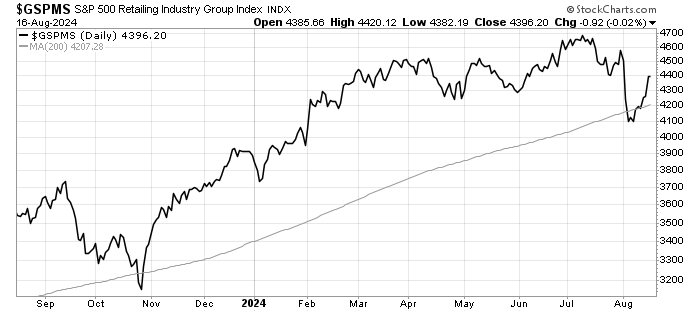

US Consumers Strength –

The July data for retail sales vindicated the strength of the American consumer. It is also confirmed by how retailing stocks are performing. Strong performance YTD and also a nice recovery of the panic selling on August 5.

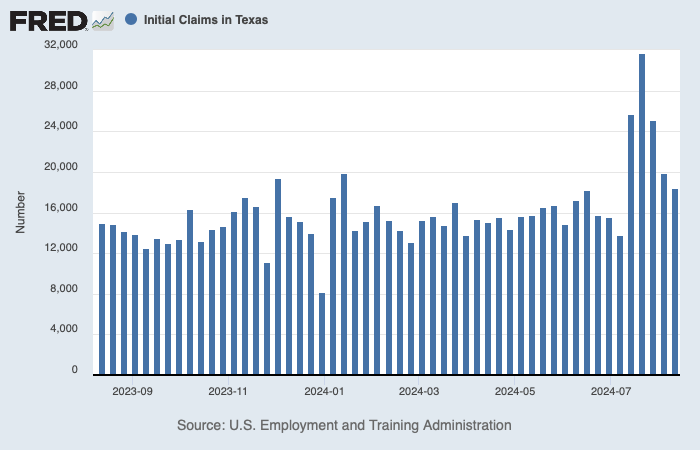

Unemployment Claims Support –

The drop in initial claims continue to support weather related argument on the weaker jobs data for July. Claims for Texas has fallen back to normal. There is still some resilience in the jobs market.

Mid-East Tensions –

Lots of military hardware movement in the region while the world awaits a response from Iran. Oil prices remain steady despite the tension. It helps that demand for oil is weak, as China continues to struggle. China’s first-half 2024 fuel oil imports slide 11% y/y, according to Reuters.

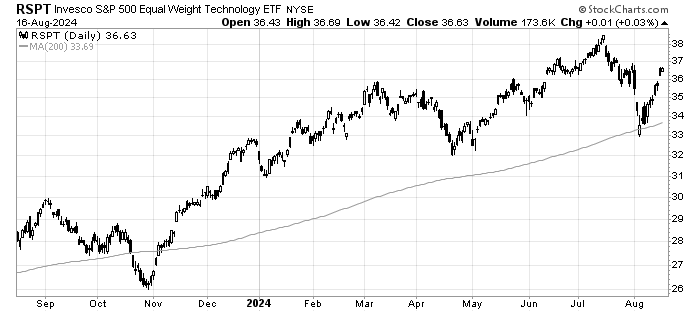

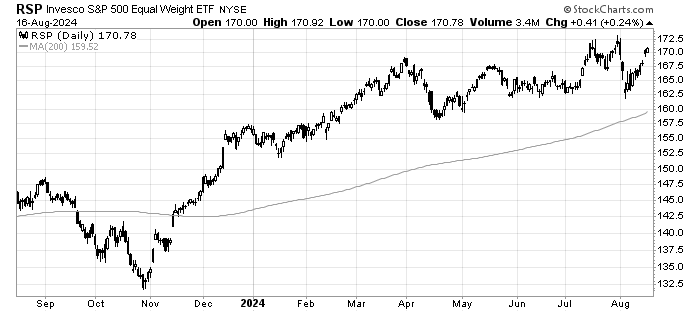

US Stock Market Recovery –

Against the bearish predictions, the US stock market is back. Looking at it from an equal weighted perspective, to strip out the effects from the mega-cap stocks, we see US stocks recovering from their Aug 2nd and 5th sell off. Even technology stocks, where AI remains a divisive conversation, has staged a strong recovery.

Leave a Reply