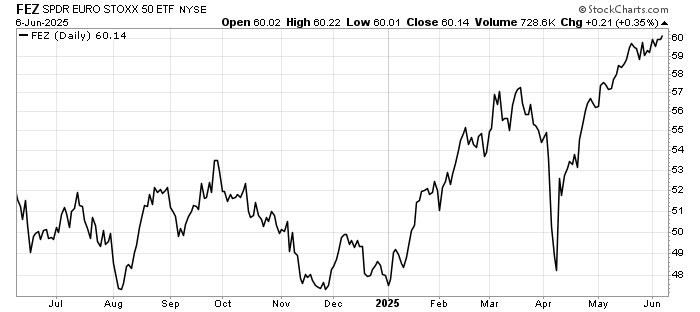

European Central Bank Rate Decision

The European Central Bank delivered its third rate cut of 2025, reducing rates by 25 basis points to 2%. The ECB hinted at a pause in its year-long easing cycle after inflation finally returned to its 2% target. ECB President Lagarde signalled a cautious stance going forward, with the bank maintaining its 0.9% growth forecast for 2025 despite ongoing trade policy uncertainties. European stocks and the euro are loving it.

US-China Trade Talks

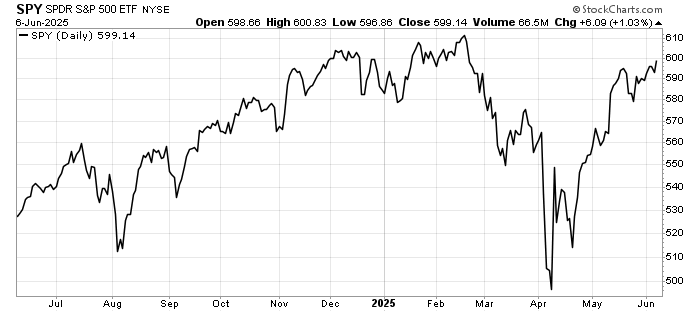

Financial markets showed muted reactions to President Trump’s “very good” 90-minute trade discussion with China’s Xi Jinping, with both leaders agreeing to mutual visits, as traders have grown accustomed to Trump’s volatile trade negotiations and remain unfazed even by rising concerns over Chinese rare earth mineral shortages.

President Trump sent countries a draft letter on 3 June requesting their best trade proposals across tariffs, quotas for US products, and non-tariff barrier remedies. Reuters reported that the document reflects urgency within the administration to complete deals ahead of their tight July 9 deadline, supporting analysts’ view that Trump’s tariff team seeks to resolve trade tensions quickly and move the issue out of public focus. Stock investors have increasingly aligned with this assessment since April 9 when Trump delayed reciprocal tariffs for 90 days, while also showing greater confidence in the underlying economic outlook.

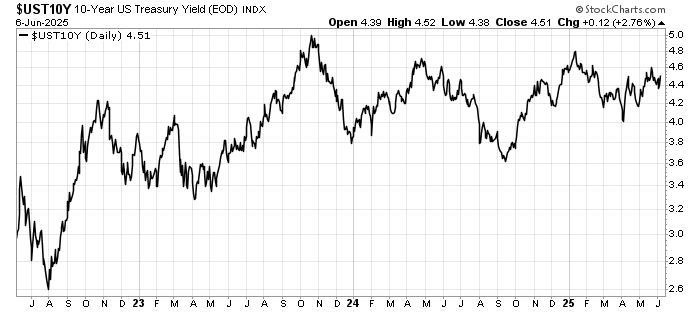

US Debt Dynamics

The 10-year US Treasury yield dropped to 4.36% today as bond investors focused on weaker-than-expected economic data from ADP private payrolls and ISM nonmanufacturing reports, while largely ignoring political tensions over federal spending. Despite Elon Musk’s harsh criticism of President Trump’s spending bill as a “disgusting abomination” and the Congressional Budget Office projecting the legislation could add $2.4 trillion to the deficit over a decade (with some estimates reaching $3-5 trillion), bond markets showed no signs of the debt crisis fears that had emerged just days earlier. Instead, investors appeared to prioritise the immediate economic data suggesting potential weakness, driving demand for Treasuries, though analysts maintain confidence in the underlying economic resilience despite these mixed signals.

US Jobs Market

This week’s standout economic data was the May jobs report, which showed employers added 139,000 jobs—beating expectations and pushing the three-month average to 135,000. However, the positive headline was dampened by significant downward revisions totaling 95,000 jobs for March and April combined.

The job growth showed concerning concentration, with just two sectors accounting for most of the gains: leisure and hospitality added 48,000 jobs while healthcare and social assistance contributed 78,000. This narrow hiring pattern across sectors will be important to monitor in coming months.

US Stock Market Recovery

Despite the uncertainties on Trump’s trade and budget policies, the economy continues to muddle along and risk of recession continues to fall. Prediction markets now puts the odds of a recession at 26%, down from a high of 66% back in April 7. The S&P 500 is close to its all time high made in mid-February.

Leave a Reply