US-China trade war truce

The US and China agreed to a 90-day pause on high tariffs, reducing the US tariff on Chinese goods from 145% to 30% and China’s tariff on US goods from 125% to 10%. This deal, reached after talks in Geneva, aims to ease trade tensions but leaves uncertainty for businesses planning long-term. Markets rallied, sending the S&P500 to positive for the year.

Moody’s downgraded US debt

US debt was downgraded by Moody’s Ratings on May 16, 2025. The credit rating was lowered from Aaa (triple-A) to Aa1, citing the nation’s growing $36 trillion debt, rising interest payments, and persistent budget deficits. This aligns Moody’s with Fitch Ratings (downgraded in 2023) and S&P Global Ratings (downgraded in 2011), meaning all three major agencies no longer give the US their top rating. The downgrade reflects concerns about fiscal sustainability, especially with proposed tax cuts that could add trillions to the deficit. Not much impact to markets as it was already priced in.

Walmart to raise prices due to tariffs

Walmart on Thursday warned that even softer tariffs on China could soon force the company to raise prices on certain items. Still, the Walmart executive emphasized that the retailer will do what it can to avoid passing the import taxes onto customers. Trump has told Walmart to eat the tariffs. It remains to be seen how much of tariffs will be passed through to consumers, since we have a 30% tariff on China that remains intact.

The AI Hiring Pause Is Here. Will Productivity Rise?

Bloomberg reported that Microsoft is reducing 6,000 jobs this past week, even as it heads into a boom in the software market. Outside tech, AI has made significant inroads on productivity. Norway’s sovereign wealth fund, the world’s largest, is to stop hiring more humans for now in an early indication of the disruption the emerging technology may bring to the workforce. A possible scenario where labour market weakens (not dramatically) but company profits continue to rise, may occur in the quarters ahead, sustaining the bull market is equities.

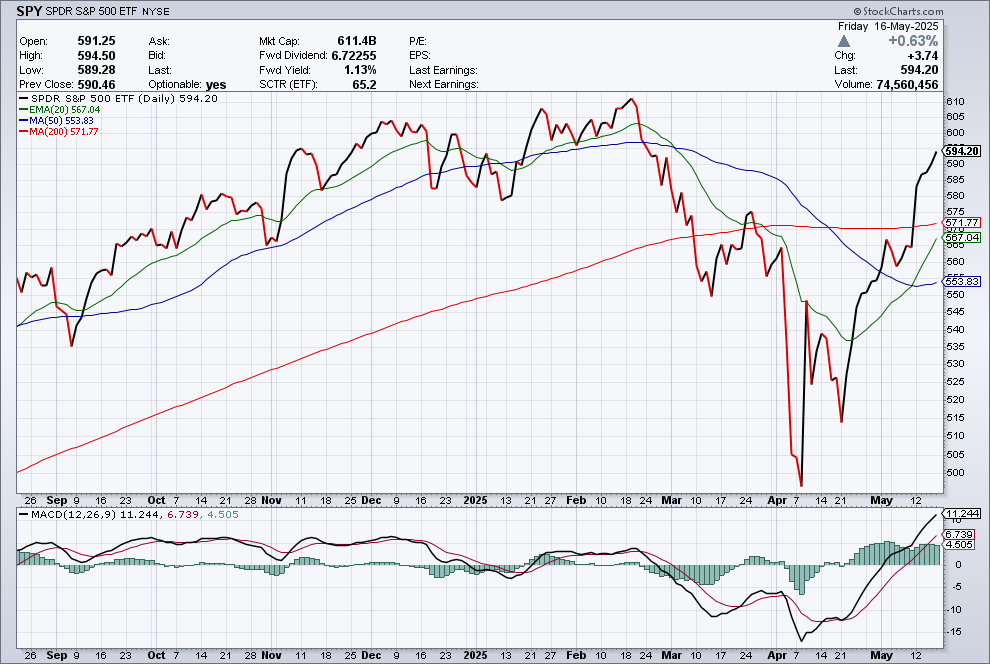

Market Repair Almost Complete

As the S&P 500 erases the year’s losses, it was confirmed by some positive market breadth indicators. The advance-decline index is almost back to the peak last seen in late November 2024. The strength of the increase suggests that the pullback in stocks is just a correction, and the bull market remains intact.

Leave a Reply