Global markets have spoken on Trump’s universal tariffs on everyone. 54% on China, 46% on Vietnam, 20% on EU, and 10% minimum on all others.

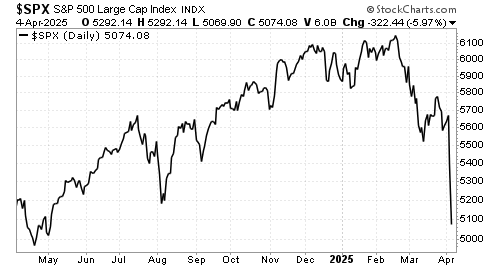

By Friday, S&P 500 plunged 10.5% over two days, while Monday futures indicate another 2.5% decline as of writing. Asian markets are also falling, HSI is down 11.3%, TOPIX is down 12.4%. Investors are piling into government bonds, with the US 10Y yield falling to 3.5% from 3.9%. Safe haven currencies like the JPY is up. Clearly, this is a risk off event as investors worry about global recession, rather than stagflation.

How should investors respond?

How markets react will be based on whether the tariffs can be negotiated and retracted. Besides China (that has already retaliated) and the EU that threatened to retaliate but could not come to agreement among its member states, most other countries are choosing to negotiate. Trump himself has already said that he had a call with Vietnam and the direction is going towards negotiation.

However, the key will still be US-China relations. If there are no signs of negotiations, it may be difficult to see how markets can stabilise, especially if the tariffs escalates (worst case scenario).

Before market stabilises, investors probably need to see signs to indicate a willingness to talk. We could be in for more pain, i.e. more pain in financial markets before both sides are willing to negotiate.

Based on the price action in markets, the US is expected to experience a mild recession. The S&P 500 is down 20%, Small caps -28%, and Nasdaq even more, all from their last peak.

Further declines would probably mean a bigger crisis, i.e. deeper economic contraction or credit event (GFC in 2008) or the COVID shock in 2020. Due to the gaps in the sell off, i.e. there were large price differences between the opening and previous closing prices, there seems to be some form of capitulation going on. So for a further sell off in markets, i.e. another 15-20% decline in US stocks, we would need to see another round of escalation in the trade war, which would slow global economic growth dramatically.

Given the high level of uncertainty, it is probably unwise to make any investment decisions (more than 6 months). Investors should gather more evidence before re-positioning their portfolios.

Leave a Reply