Rocky start to the new year.

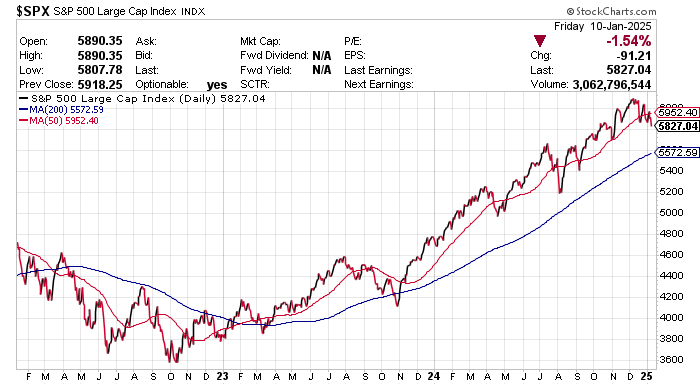

S&P 500 is down 0.93% year to date, down about 4.5% from its last peak in mid-December.

The biggest driver is the move in bond yields, with the UST10Y rising to 4.76% as stronger than expected jobs report tamper expectations of a FED rate cut.

How should investors think about this?

In my opinion, investors ought to consider 1) if the FED does not cut rates anymore, will it lead to a bear market in stocks and an economic recession? 2) will a 4.7% or even 5% bond yield lead to a recession and bear market in stocks?

Bond yields are rising because the US economy is not slowing down sufficiently. Non-farm payrolls for Dec came in at 256K versus expectations of 160K and the previous reading of 212K.The unemployment rate fell, from 4.2% to 4.1%. ISM Services PMI registered 54.1 versus expectations of 53.3 and the previous 52.1. The Atlanta FED’s GDPNow for real GDP growth is 2.7%.

The US economy did fine in 2023 and 2024 when the 10Y rate was ranging between 3.5% and 5%. Unless we see signs that the yield is breaking above the 5% range, it is not time to worry about the impact of higher rates on the economy.

Still, investors should respect the signals generated by markets. For now, despite the weakness in market breadth and a correction in the index, the broad trend remains up so long as the 50dMA is trading above the 200dMA.

The drivers of US economic growth remains unchanged and buyers should begin to emerge as both stocks and bonds provides an attractive entry point to enter.

Leave a Reply