On Tuesday, 24th September 2024, the People’s Bank of China (PBOC) introduced major changes to its monetary policy aimed at boosting the economy. The central bank announced a 0.5% reduction in the reserve requirement ratio (RRR), which is the amount of cash banks must hold in reserve. This move will inject 1 trillion yuan ($142 billion) into the financial system, roughly 0.8% of China’s GDP.

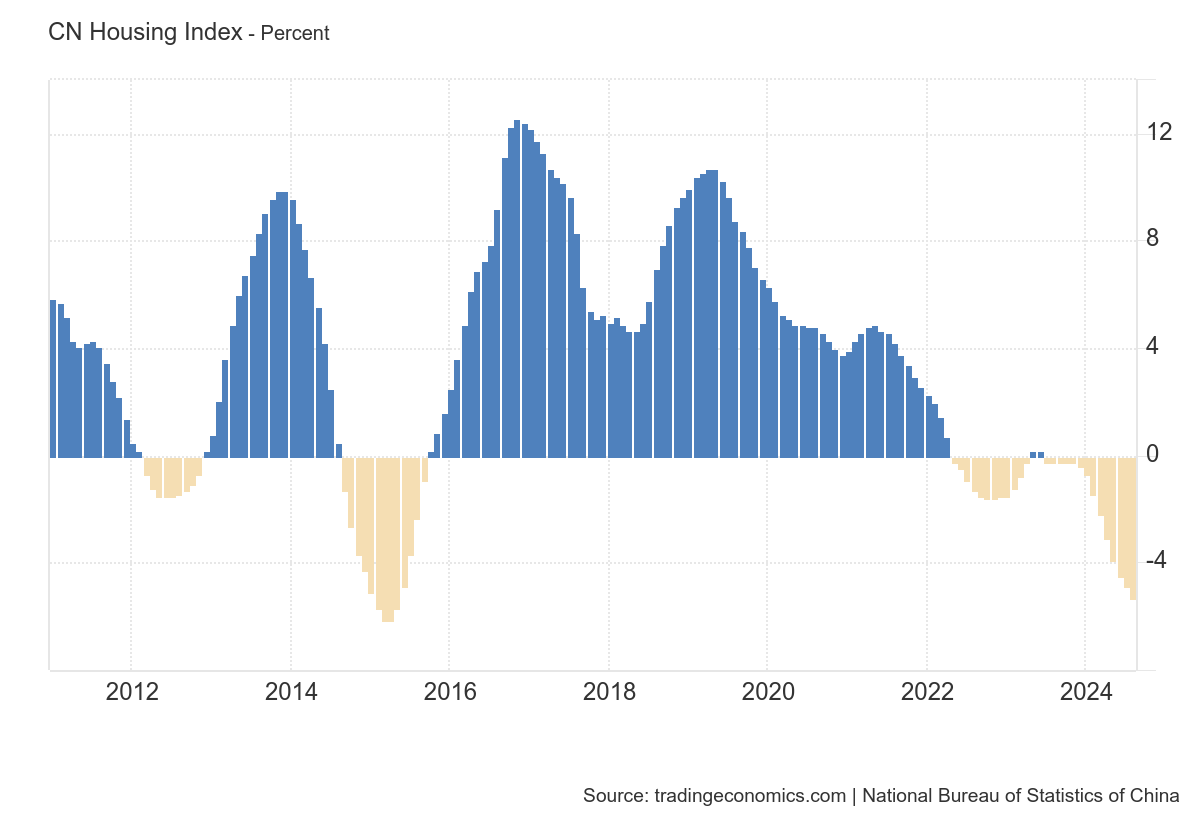

In addition, China will lower mortgage rates by 0.5%, including for existing borrowers, and reduce the downpayment requirement for second-home purchases from 25% to 15%, making it easier for buyers to enter the property market.

To support the stock market, the PBOC will allow funds and brokers to access central bank funding to purchase stocks. A new swap facility will enable securities firms, funds, and insurance companies to obtain liquidity from the central bank to buy shares. There are also plans to offer special refinancing for listed companies and major shareholders to facilitate share buybacks.

This comprehensive package of measures is designed to stimulate economic activity and stabilize the stock market.

The bait has been set. Now, we wait for demand to bite.

This writer has reasons to be doubtful that it will lead to a full fledge boom in the Chinese economy. Cheaper financing makes it easier for buyers of stock and property, on the condition that their prices DO NOT fall. If buyers do not expect prices to rise, why would they even buy with cheaper financing (although it makes it more palatable for those who have been instructed to do so). We have yet to see a turnaround in the fortunes of the property sector, where prices continue to fall. Ditto the stock market.

So, in short, the measures are meant to arrest the slowdown in the Chinese economy. The writer still does not see a return to stellar growth for the economy, profits or the stock market. China is also not expected to sink deeper into lower growth territory.

Leave a Reply