It was a week marked by worries over the economy. ISM manufacturing numbers were worse than expected, although it was better than the previous month. The New Order component came in weaker than the previous month, suggesting no improvement for the manufacturing sector in the current month.

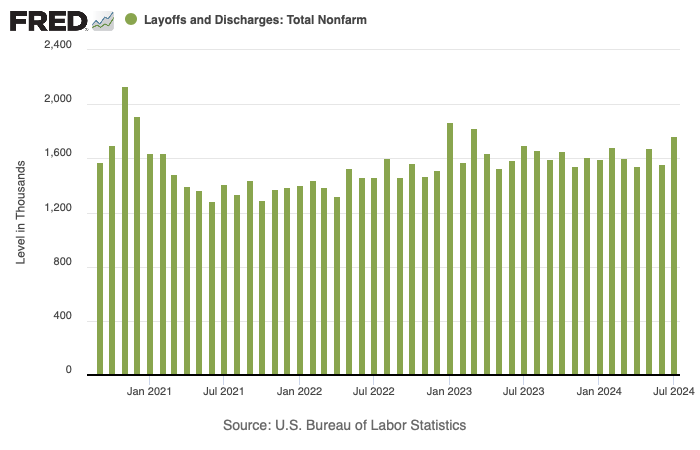

The labour market also disappointed, although the data improved from the previous month. The July non-farm payroll was revised downwards (from 114K to 89K). The August report was 142K, lowered than the expected 160K. Unemployment rate inched lower to 4.2%. The JOLTS report did not indicate a rise in layoffs, but hiring has eased.

Nonetheless, markets were worried about growth, sending stocks down and bonds up. The S&P500 was down 4% while the 10Y Treasury yield fell to 3.7% from 4%. The VIX surged to 20.3% from 15% as investors sought protection.

Clearly, as we enter into the final quarter of 2024 and the upcoming election, volatility is increasing. Coupled with the delicate task of soft landing the economy, it is natural that investors are on edge. We have been positive on risk taking based upon the positive signals from markets (broad market participation and cyclicals remaining in an uptrend). We need to find confirmation from the data to show that the economy is not stalling, and equities can regain its footing. Otherwise, the alternative scenario, where a soft landing is not achieved, will have to be consider the base case.

Leave a Reply