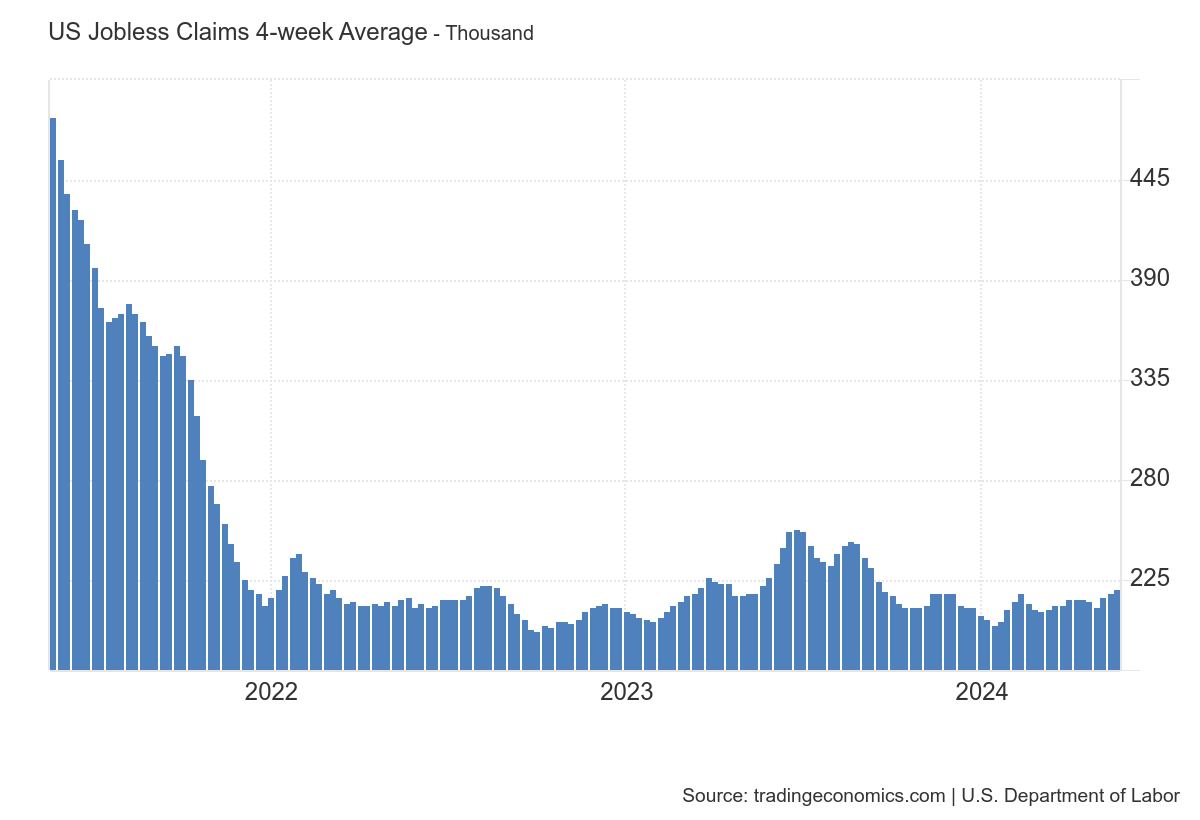

US labour market: some initial signs of stress creeping up in jobless claims. The 4-week moving average is inching up, albeit very slowly. While not a concern currently, investors should watch it very carefully to get a sense of whether the labour market finally breaks down due to high interest rates.

US home sales hit by higher mortgage rates: Mortgage rates jumped to over 7% in mid-April, causing new home sales to fall 4.7%. Homebuilders are beginning to struggle now, but is it a case of consolidation before rallying again or is it a turning point for the US housing market? Watch this space carefully.

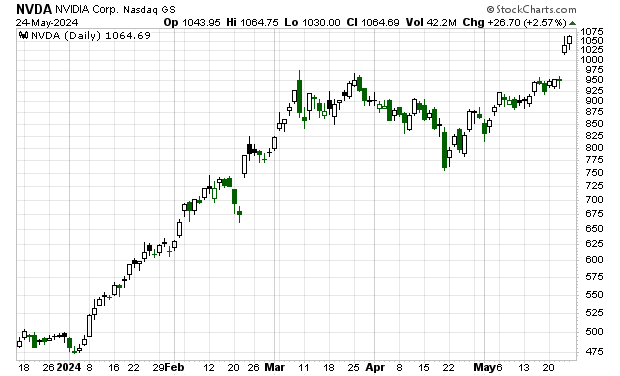

Nvidia’s earnings: Wow, blew past estimates. This suggests that the momentum is strong for AI investments and demand.

“Analysts were expecting adjusted EPS of $5.65 on revenue of $24.69 billion, according to data from Bloomberg. The company reported adjusted EPS of $1.09 on revenue of $7.19 billion in the same quarter last year. In the current quarter, Nvidia expects revenue of $28 billion, plus or minus 2%. That’s better than the $26.6 billion analysts had expected.”

Importantly, the stock popped. Investors are still trying to catch up, so that means investors are still cautious about AI demand, providing the necessary ammunition to continue to rally. Big Tech should continue to outperform.

Leave a Reply