Market Review for week ending 5 April 2024

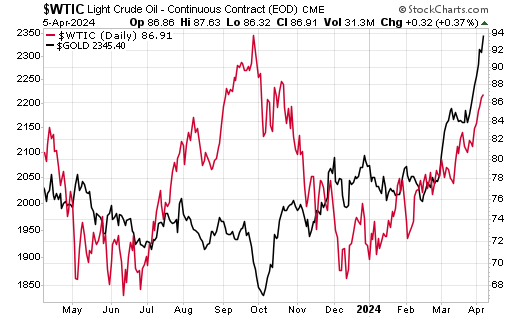

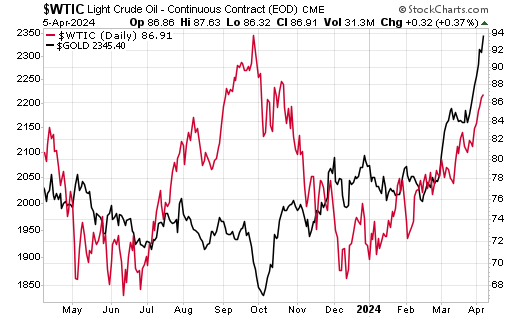

- Oil and gold prices heading higher. Is it a cause for concern? Two key commodities that are influenced by geopolitics have surged in recent weeks. West Texas crude is approaching $90/bbl while gold is hitting $2350. It should be noted that during this period, the US dollar index did not decline, indicating true strength in the oil and gold rally. The potential for Israel-Iran conflict should be seen as a trigger for supply disruption while the pick up in manufacturing could see demand going up in the next few quarters. The all important question is if this would translate to higher inflation.

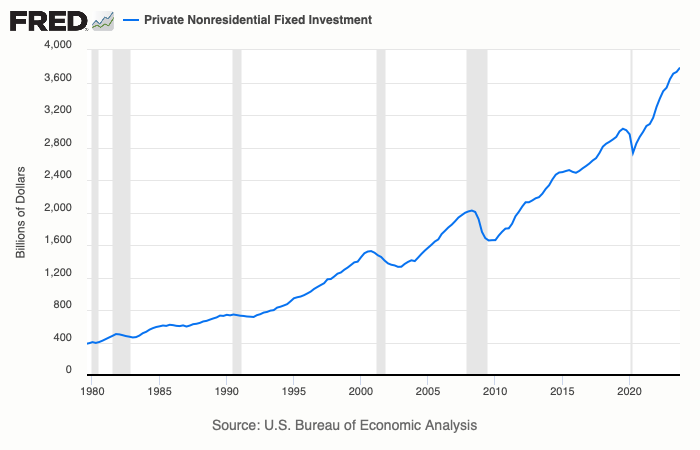

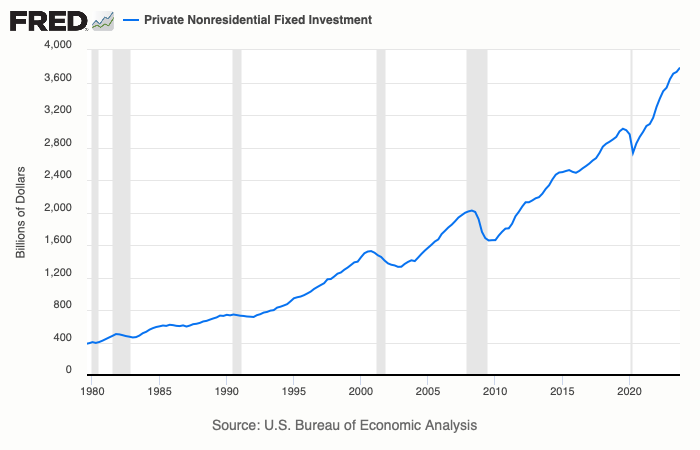

- US manufacturing is back! No landing in the US. Capital spending defies higher interest rates. After a year of aggressive rate hikes, US capital spending shows no signs of slowing down. Made in America is helping to keep investment humming for now. Manufacturing PMI poised for recovery. Recession risk continues to be low for now.

- No rate cuts this year? FED speakers tame rate cuts expectations. The strength of the economy, couple with sticky inflation, is seen as a reason for the FED to hold back on cutting rates. The June rate cut odds have fallen, from 57% a month ago, to the current 46%. The odds for keeping rates unchanged has risen to 51% from 26%. Risk free bonds are likely to underperform in this environment.

- Weakness in stock market spotted! Volatility rising. Time for a correction. Thursday’s bearish engulfing candle shows investors are skittish about the rally. Equal weight Tech and Discretionary ETFs are starting to roll over. Markets are overbought, so a correction is inevitable but the underlying tailwinds (economic growth to propel earnings) remain intact. Traders to take profits while investors can buy the dip.

Leave a Reply