Summary of Main Events:

- FED Chair pushes back on March rate cuts, but rates have peaked.

- US jobs report was stellar! Payrolls: 353K vs 185K.

- US Q4 economic performance outperformed expectations (3.3% vs 2%).

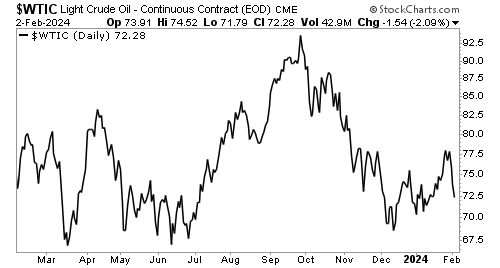

- Mid-east escalation: US servicemen killed, US strikes back but oil prices steady.

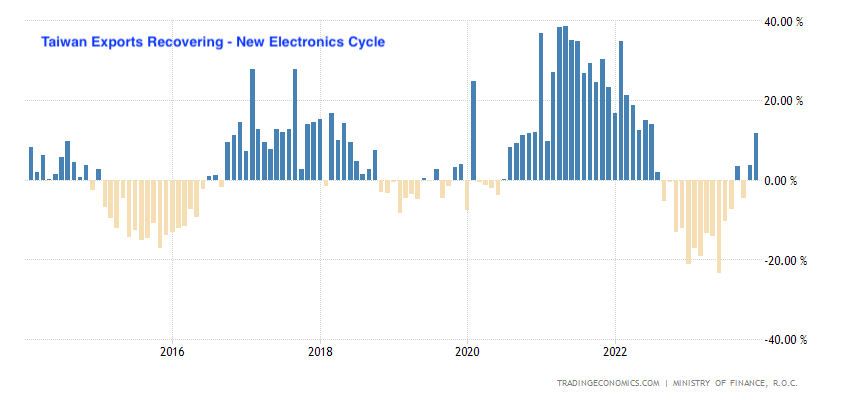

- Taiwan exports point to new electronics cycle

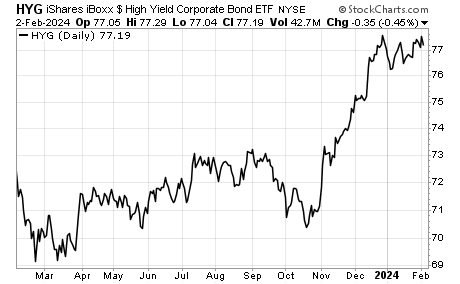

Things to consider: Is the current FED funds rate too restrictive? Are financial conditions too tight that will trigger a recession?

- Junk bonds have held up despite the disappointment. No fear of recession in high yield bond prices.

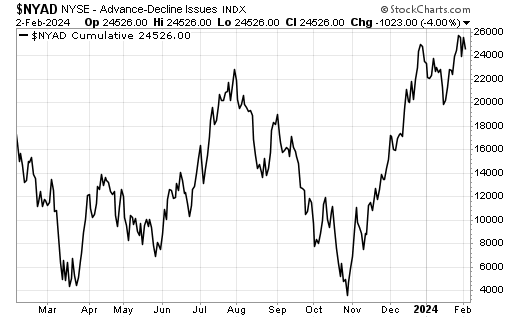

- Market breadth is still positive. More stocks rising than falling as risk appetite remains good.

Leave a Reply