It was the most anticipated FED meeting in recent times. Even though FED chair set the stage for a rate cut at the Jackson Hole central banking symposium, markets and economic observers could not agree on the size of the cut – 25 or 50bp.

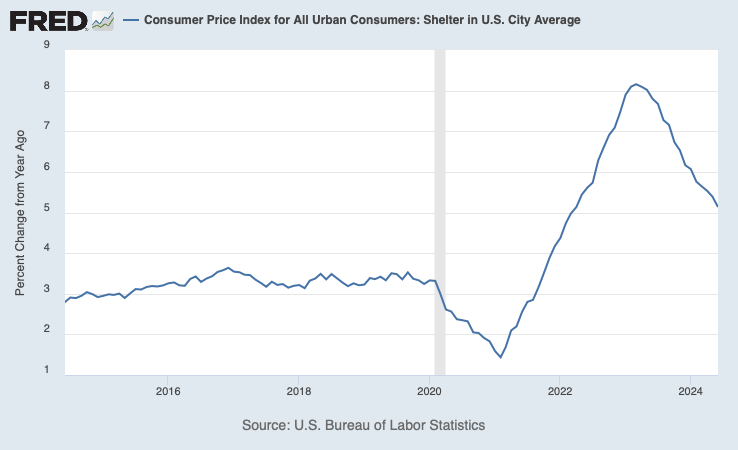

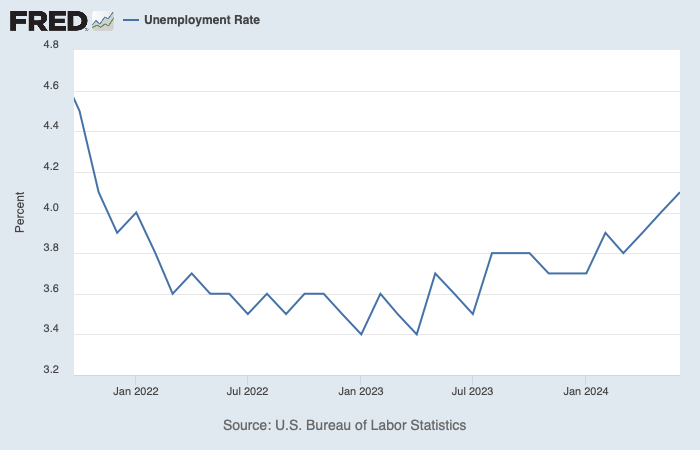

Eventually we got 50bp, with one dissent. FED chair did make it clear that the path forward remains data dependent, i.e. the health of the labour market and barring any negative surprise from the inflation front. Markets took another day to digest the news, sending stocks up across the board.

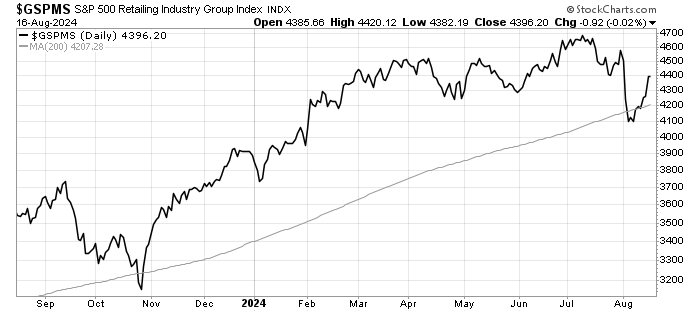

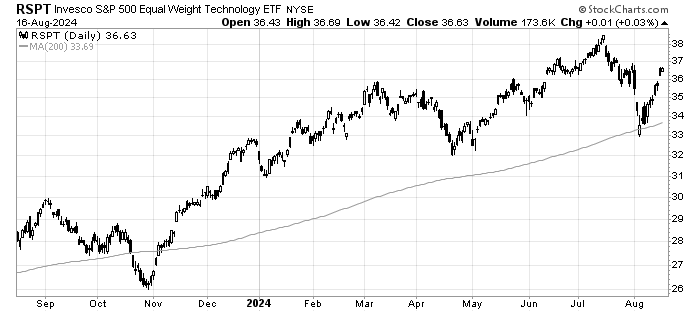

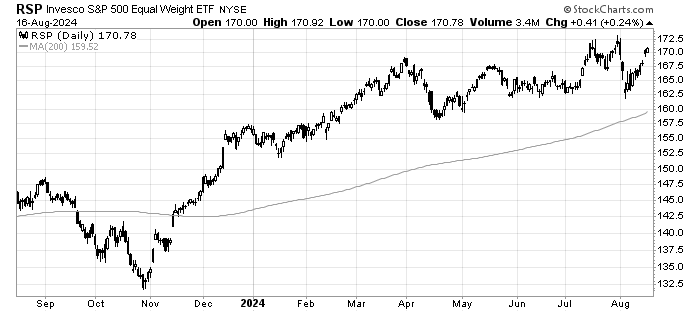

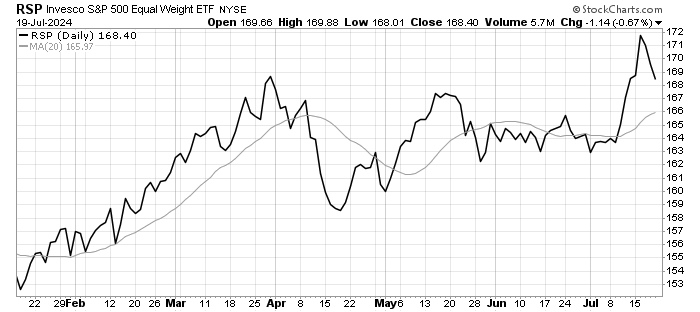

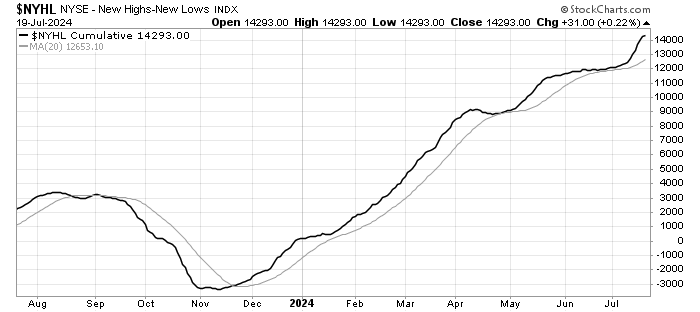

From a market breadth analysis, we see many positive signals from advance-decline index, new highs-new lows, and equal weight indices are making new highs. Strangely, the bears stop warning about bad breadth in markets anymore.

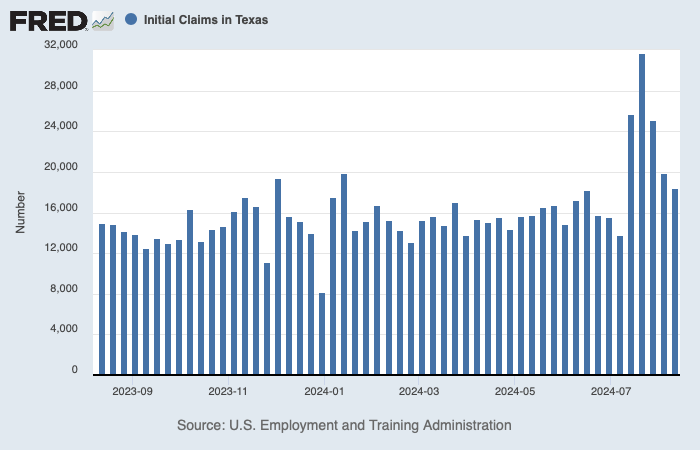

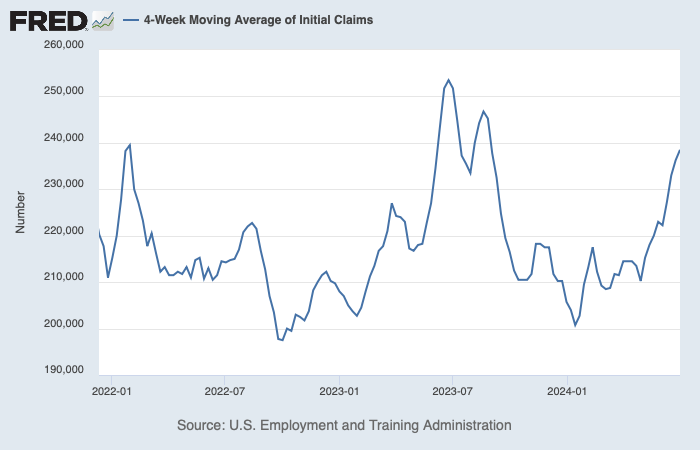

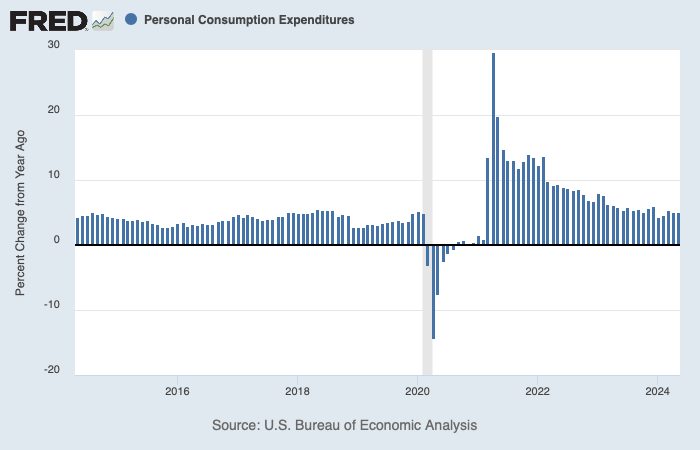

Economic data from the weak also added to the optimism and raised hopes of the elusive soft landing for the American economy. Retail sales, industrial production, NAHB housing market index, continuing jobless claims all came in better than expected, better than the previous month.

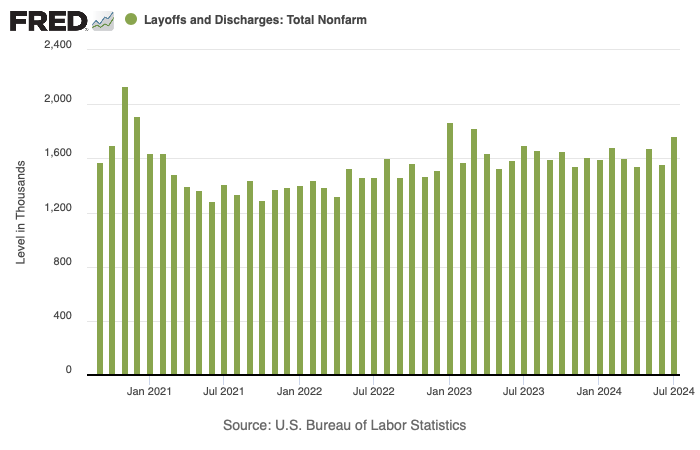

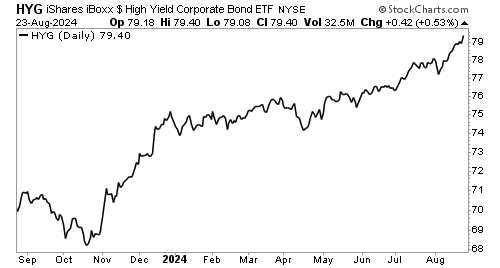

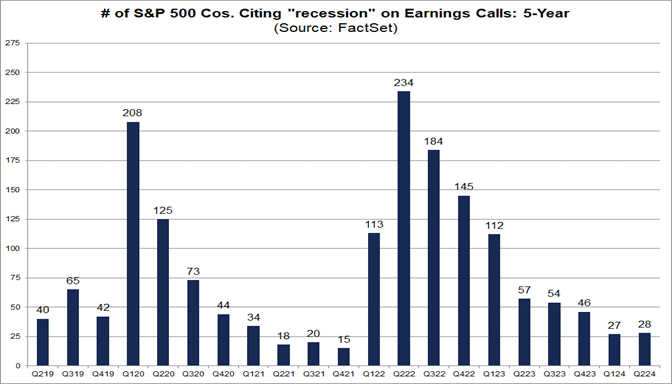

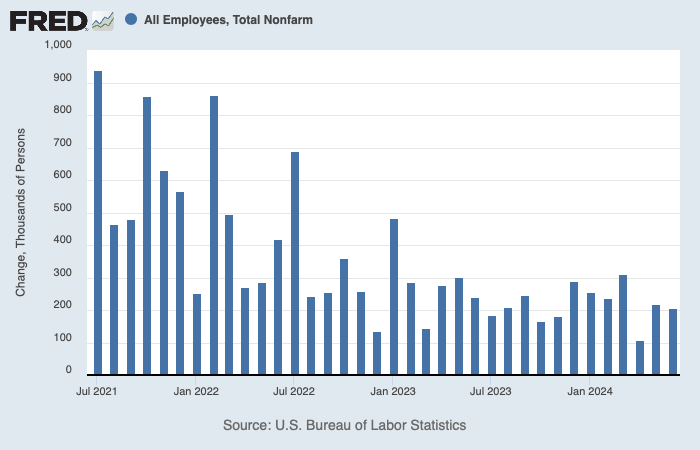

Still, this writer is aware that there are enough data points to suggest that the weaker is not 100% healthy. Manufacturing sector PMI remains weak (under 50), delinquency rates is on the rise, and companies are not really hiring much. This is a difficult economy to predict, let alone describe, which is why the optimist and the pessimists are aplenty. It is akin the story where three blind men were trying to describe an elephant. They each describe the it as a snake, a tree and a wall, depending on where they touch. That is why relying on financial market signals would be better off as it collects all the inputs from the economy.

So for now, this writer remain bullish on US equities and positive on the US economy and see a higher chance of a soft landing. So does the Atlanta FED GDPNowcasting model, which shows a Q3 growth of 2.9%.