US economic risk now higher.

The risk of a U.S. recession has increased compared to two weeks ago, based on recent economic indicators and forecasters:

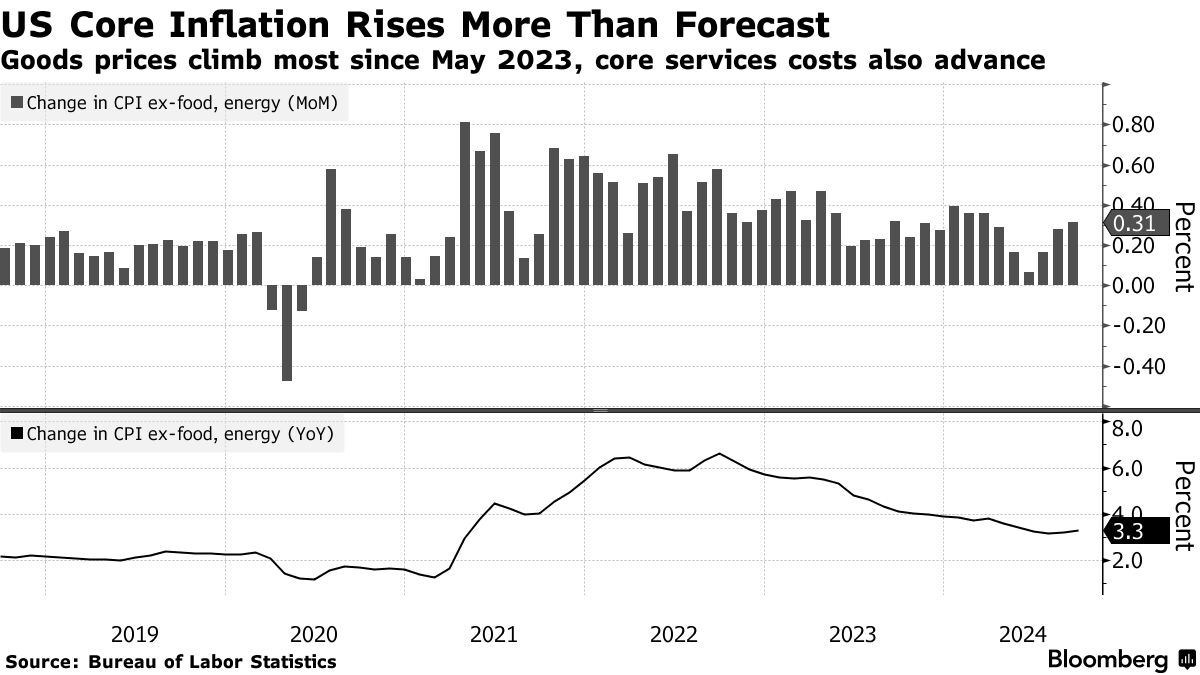

Morgan Stanley and Goldman Sachs have both revised their U.S. GDP growth forecasts downward for 2025, citing factors such as tariffs and inflationary pressures. Goldman Sachs also raised its 12-month recession probability to 20% from 15%. Meanwhile, the Atlanta Federal Reserve’s model predicts negative GDP growth for Q1 2025, signalling a potential contraction.

The reason for the negative print was a sharp increase in imports, which subtracted significantly from GDP. Specifically, imports surged by 29.7%, leading to a -3.72% impact on GDP. This spike was largely attributed to businesses stockpiling goods ahead of anticipated tariffs, which inflated import levels temporarily.

Prediction markets have raised the probability of a 2025 recession to 40%, up sharply in recent weeks. Financial market models from JPMorgan and Goldman Sachs also show increasing recession probabilities, with JPMorgan’s market-implied risk climbing to 31% from 17% in November.

Consumer and Business Sentiment: Consumer confidence has declined, with the Conference Board’s Expectations Index falling below recession-warning levels for the first time in eight months. Business uncertainty related to tariffs is also starting to show up in the surveys but the ISM PMIs remain resilient for now. Services PMI for February came in at 53.5, higher than the previous 52.8. Manufacturing slipped to 50.3 from 50.9

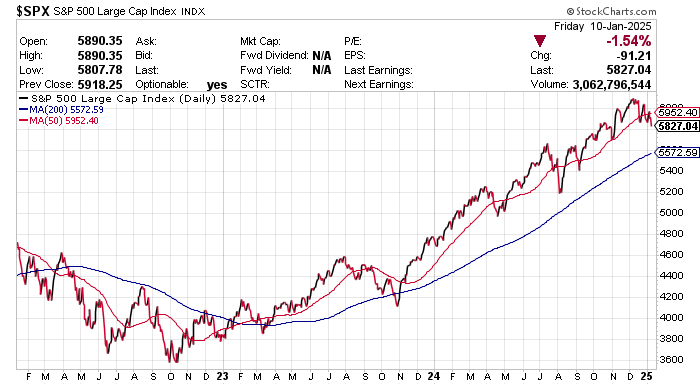

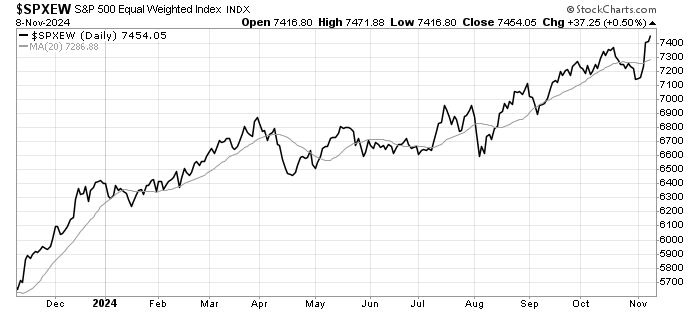

Overall, these factors suggest that the likelihood of a U.S. recession has risen over the past two weeks. With US stock markets richly valued, investors are right to be jittery. How markets recover from the sell off over the next few weeks will be crucial to the longer term outlook.