Weekly Investor Missive:

S&P 500 Performance: Q1 Highlights

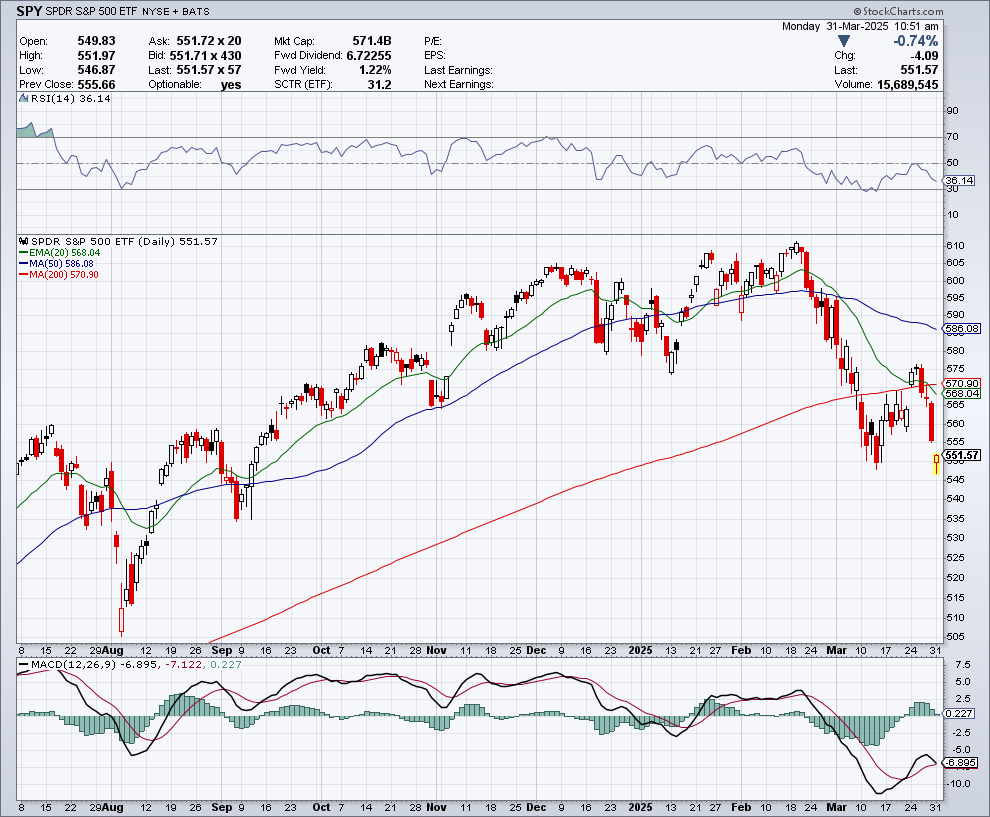

Despite Trump’s Tariff Turmoil (TTT), S&P 500 companies showed strength in Q1 2025. FactSet reported revenue growth of 4.7% y/y, slightly below the 10-year average of 5.1%, with 10 of 11 sectors growing, led by Tech, Utilities, and Health Care. Only 62% of firms beat revenue estimates, below the 5-year average of 69%. Yardeni Research noted a 4.6% y/y rise, under its 4.8% long-term average. Earnings per share (EPS) grew 12.9% y/y per FactSet, above the 10-year average of 8.9%, with 78% of companies beating estimates. Yardeni reported 11.1% EPS growth, exceeding its 9.0% average. Profit margins hit 13.0% (FactSet) to 13.3% (Yardeni), above the 10-year average of 10.8%.

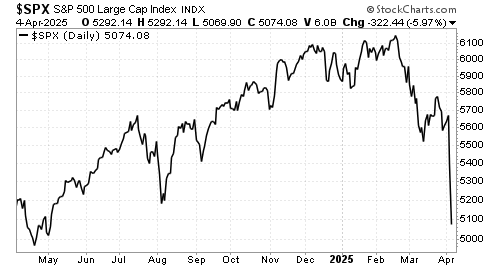

Analysts project 2025 revenue growth of 5.8% and EPS growth of 9.3%-14.8%, but TTT may slow growth if it sparks a global recession. Tariffs, mentioned by 411 firms in Q1 earnings calls, could act as a corporate tax unless offset by productivity gains or cost pass-through.

Trump’s Tariffs: A System of Checks and Balances

The U.S. operates as a federal republic with a constitutional system designed to prevent any single authority from holding unchecked power. This framework includes three branches of government—legislative, executive, and judicial—intended to balance each other and protect against overreach. This system is currently limiting President Trump’s tariff plans. On Wednesday, a lower court ruled against most of Trump’s tariffs, stating that the U.S. Constitution grants Congress exclusive authority over international commerce. A federal appeals court paused this ruling, and the matter may now proceed to the Supreme Court.

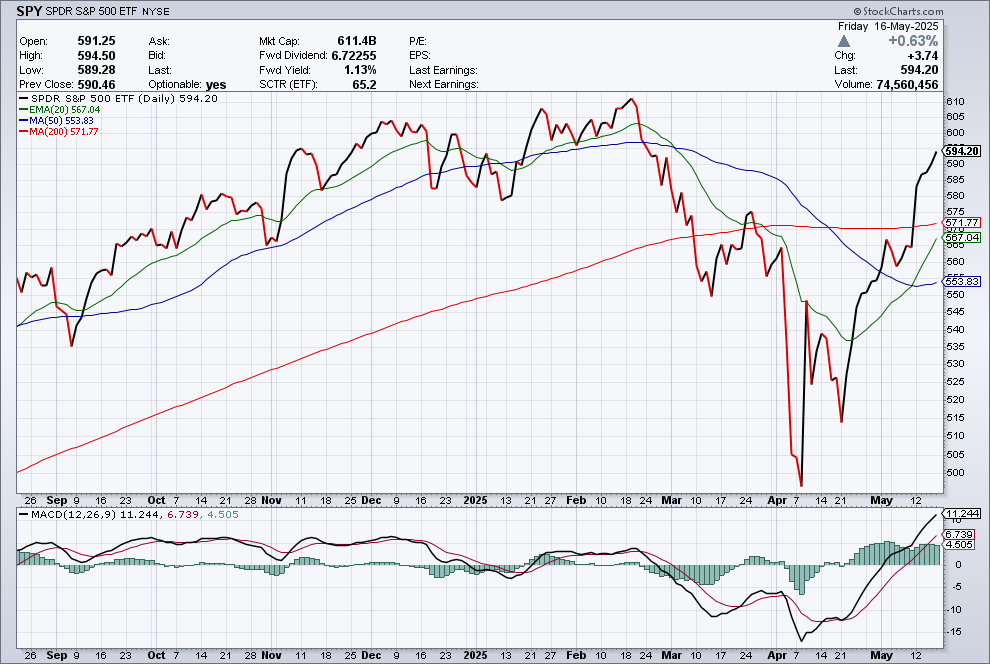

This built-in “gridlock” is a deliberate feature of the U.S. system, ensuring stability by preventing rapid, unilateral policy changes. Investors globally often view this as positive, as businesses tend to perform best when government intervention is limited. Stock futures surged after the court’s ruling, further supported by Nvidia’s strong earnings report.

Federal Reserve: Steady as She Goes

President Trump met with Fed Chair Jerome Powell on June 2, pushing for immediate interest rate cuts. However, Powell and the Federal Open Market Committee (FOMC) remain cautious, as noted in the May 6-7 FOMC minutes. The Fed sees no rush to lower rates, given the economy’s resilience. The federal funds rate futures market anticipates three 25-basis-point cuts over the next 12 months, but we remain in the “none-and-done” camp through year-end.

Q1 real GDP was revised to show a 0.2% annualized contraction, driven largely by a 42.6% spike in imports as companies rushed to beat tariffs. Despite this, the economy remains robust, supporting the Fed’s steady stance.

Nvidia and the AI Boom

Nvidia’s stock soared after a blockbuster Q1 report (ended April 2025), with datacenter revenues surging 73% y/y to $39.1 billion. Unlike Cisco’s crash during the Tech Wreck of 2000-2001, Nvidia’s growth is fueled by robust demand for AI infrastructure. Tech giants like Microsoft, Amazon, Google, and Meta plan to increase AI-related capital spending by 41% this year, totaling over $345 billion. This demand, driven by the broader Digital Revolution, suggests the datacenter boom is not a bubble but part of a long-term trend toward faster, cheaper data processing.

However, concerns about a potential Nvidia valuation bubble persist. Bloomberg Opinion columnist John Authers has compared Nvidia’s meteoric rise to Cisco’s during the dot-com bubble, noting that while Nvidia’s profits are rising faster than its stock price, its valuation remains stretched. In a March 2024 article, Authers argued that Nvidia’s rally, while supported by strong fundamentals, hinges on the sustainability of its earnings growth. He highlighted that Nvidia’s market cap surged by over $275 billion in early 2024, drawing parallels to the 1999 dot-com melt-up, though he noted the AI boom is less extreme than the dot-com era. The introduction of DeepSeek in January 2025 raised fears that Nvidia’s “economic moat” could be disrupted by cheaper AI alternatives, potentially threatening its dominance. Despite these concerns, Authers emphasized in May 2025 that Nvidia’s ability to keep increasing profits, even amidst tariff challenges, continues to drive market optimism. Still, investors should remain cautious, as valuations assume aggressive revenue growth—potentially over 80% annually for the next five years, according to some analyses—raising “buyer beware” risks.

Global Markets: Japan’s Bond Woes

Japan’s government bond (JGB) market sparked global concern after a weak 20-year bond auction, the worst since 1987, signaled dwindling demand. Yields on 30-year JGBs hit a record 3.14%, and 40-year yields reached 3.6%, reflecting investor worries about Japan’s fiscal stability, with a debt-to-GDP ratio of 260%. Factors driving this included the Bank of Japan’s (BOJ) paused tightening due to “tariff haze,” Prime Minister Shigeru Ishiba’s comparison of Japan’s fiscal situation to Greece, and persistent economic challenges like inflation above the BOJ’s 2% target (3.6% in March 2025). Yields later fell to 2.85% for 30-year JGBs after reports that Japan’s finance ministry might reduce super-long bond issuance.

This matters to global investors for several reasons. Japan holds $1.13 trillion in U.S. Treasuries, making it the largest foreign holder, and its investors own $2.3 trillion in foreign bonds, including significant U.S. and European debt. Rising JGB yields could prompt Japanese investors to repatriate capital, reducing demand for U.S. Treasuries and pushing up global borrowing costs. This could exacerbate U.S. yield pressures, with 30-year Treasury yields already breaching 5% amid weak auctions and a Moody’s downgrade. Additionally, the yen carry trade—borrowing in low-yield yen to invest in higher-yield assets like U.S. bonds—is unwinding as JGB yields rise, potentially strengthening the yen and disrupting global markets. A July 2024 BOJ rate hike triggered a 6% S&P 500 drop, showing the global ripple effect. If Japan’s bond market loses confidence, it could signal broader sovereign debt concerns, raising borrowing costs and liquidity risks worldwide, especially for debt-heavy economies like the U.S.

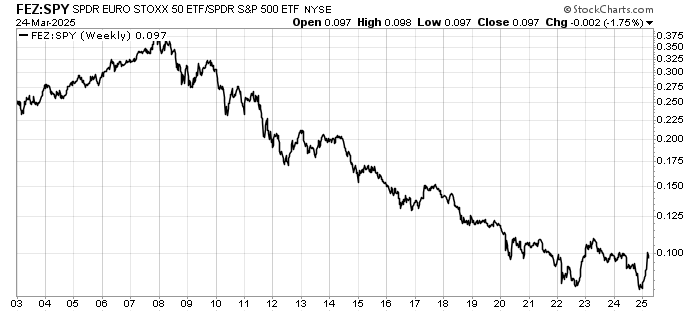

Trade Talks: A Glimmer of Hope

President Trump’s weekend call with EU Commission President Ursula von der Leyen brought positive developments. Trump postponed his threat of 50% tariffs on the EU from June 1 to July 9, citing progress in trade talks. European officials expressed readiness to advance negotiations swiftly. These developments, along with Nvidia’s earnings, buoyed stock markets.