US-Chinese Trade Tensions Escalate

President Trump announced new tariff threats against China, proposing hikes from 30% to 100% effective 1 November as a response to China’s expanded rare earth controls and an investigation into Qualcomm. China retaliated with new port fees targeting US ships, causing market unease and triggering one of the steepest selloffs for the Nasdaq 100 in months. Investors now await the outcome of the potential Trump-Xi meeting at the APEC summit in November, which could further influence global trade relations.

Gaza Ceasefire Deal Reached

A historic ceasefire agreement was reached in Gaza, mediated by the US, Turkey, Egypt, and Qatar, focusing on a phased hostage exchange and increased humanitarian aid. This reduced geopolitical fears and sent oil prices sharply lower, with WTI crude dropping more than 5% to $58.90.

US Government Shutdown Impact

The ongoing US government shutdown moved into its second week, leading to layoffs in key federal agencies and delaying the release of vital economic indicators including the US CPI and jobs reports. The lack of fresh data complicated the Federal Reserve’s October policy assessment, although markets now expect a rate cut at the upcoming meeting.

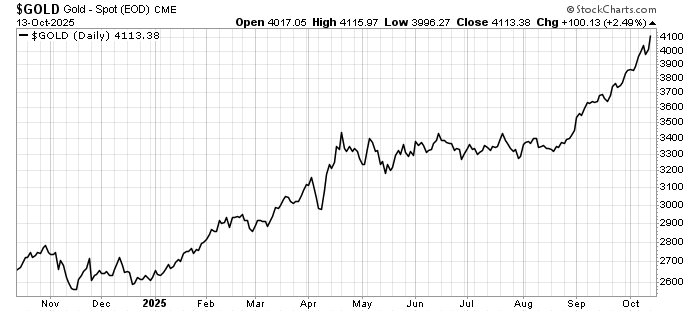

Metals Rally as Safe Havens

Gold broke through the $4,000 mark per ounce and silver surged past $50 for the first time, reflecting a rush to safe assets as investors worried over trade, inflation, and market volatility.

Leave a Reply