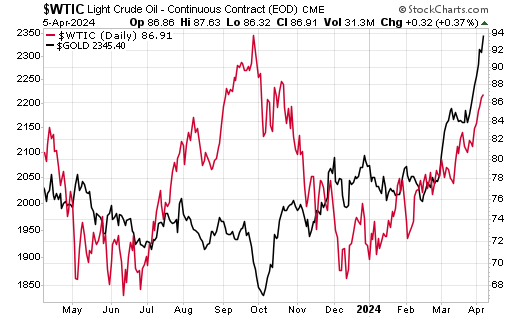

Markets reacted to the events in the Middle East, where Israel responded to Iran’s barrage of missiles and drones. A surgical strike without major damage reported by Iran and a lack of follow up by Iran would have settled any concerns of escalations in the oil producing region.

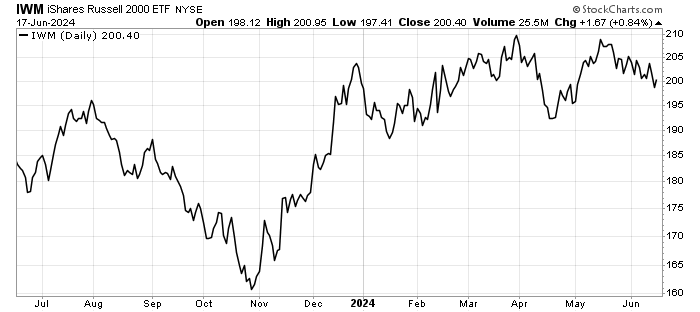

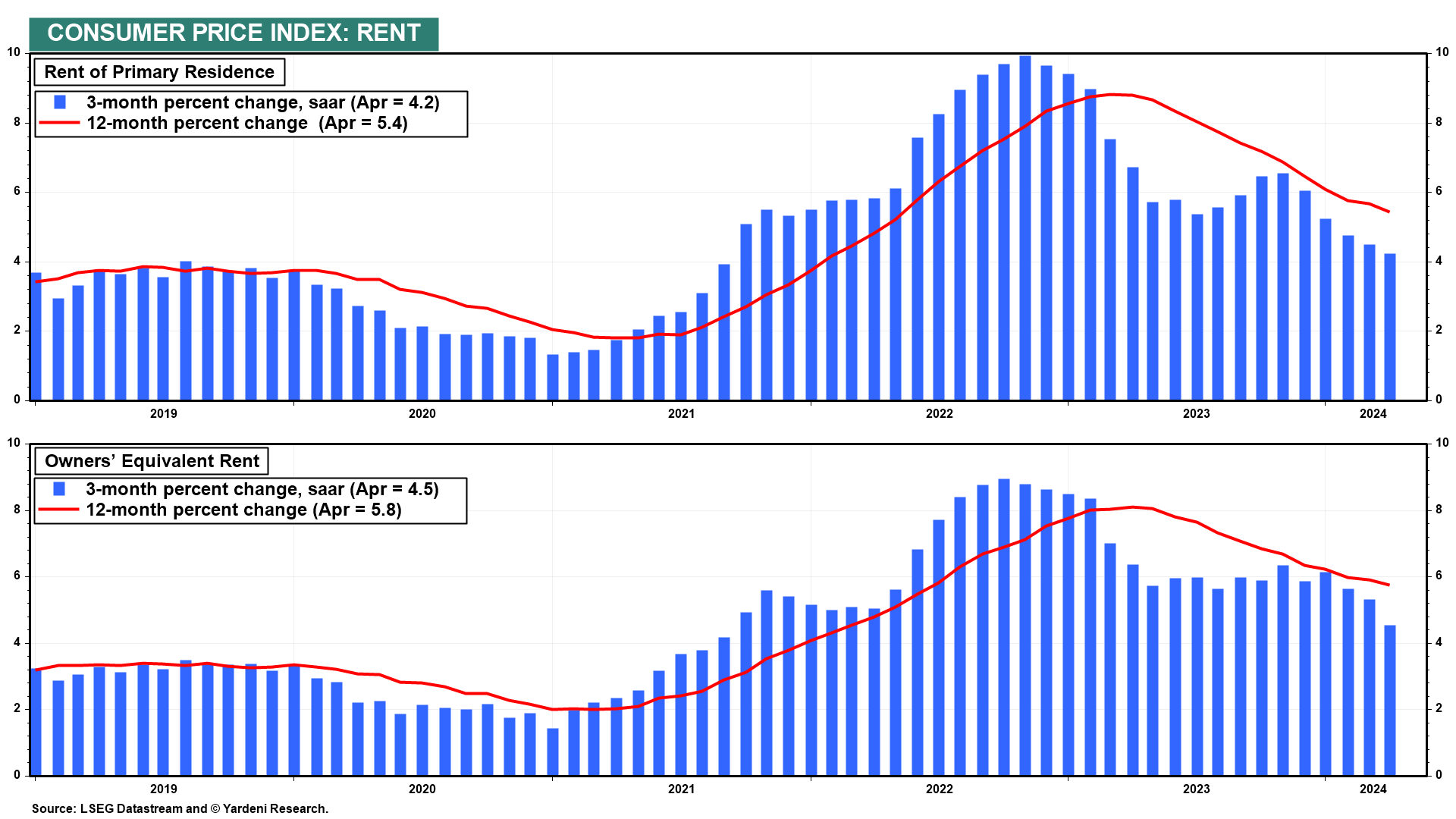

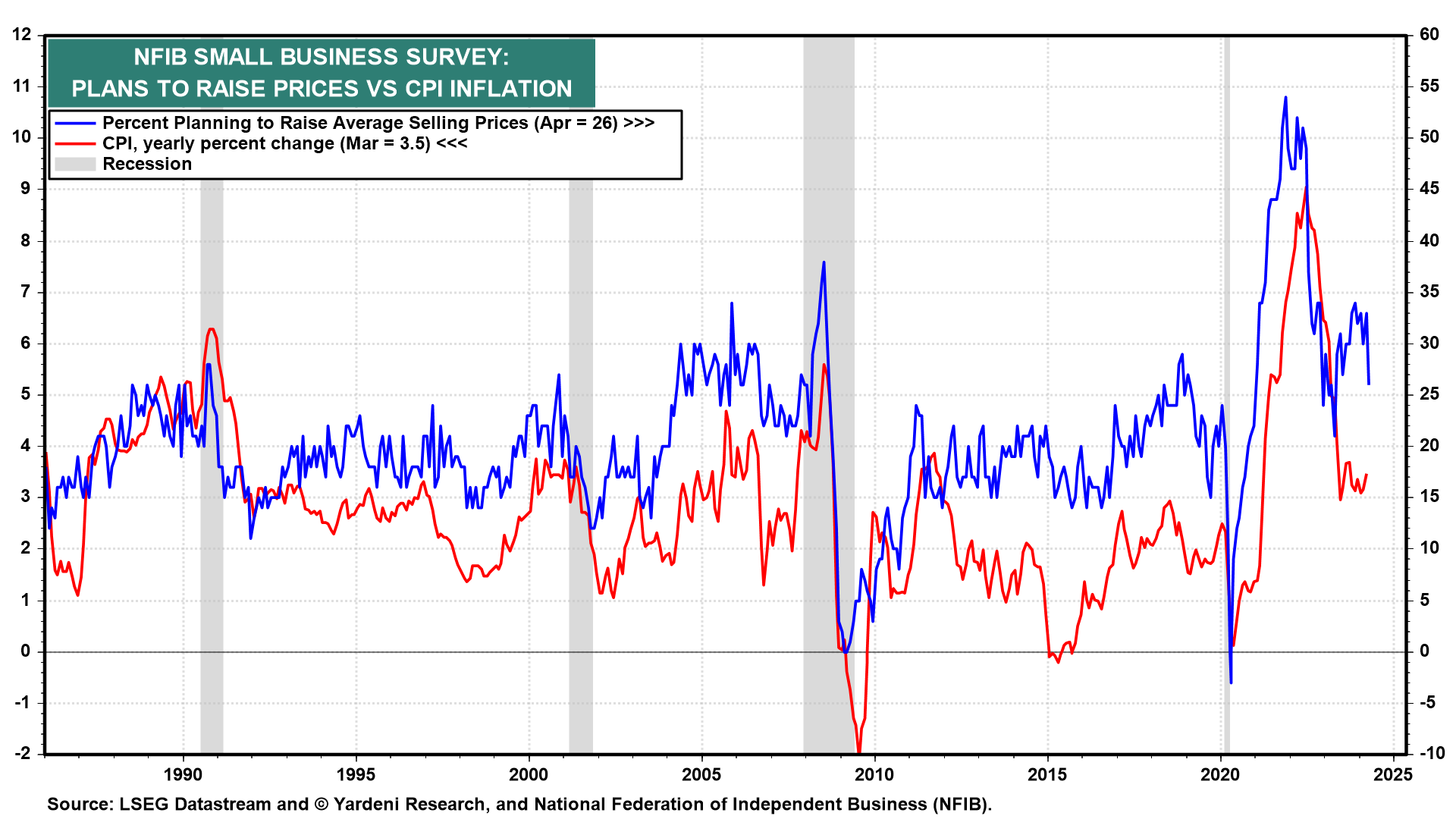

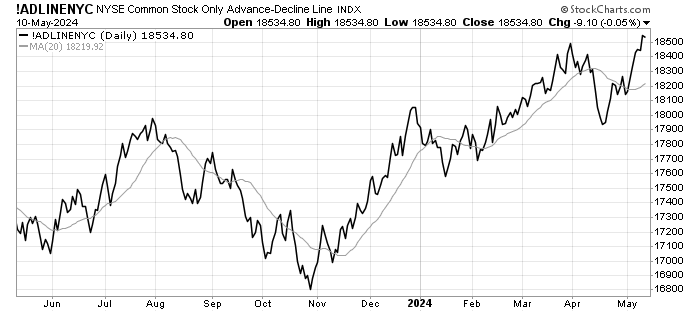

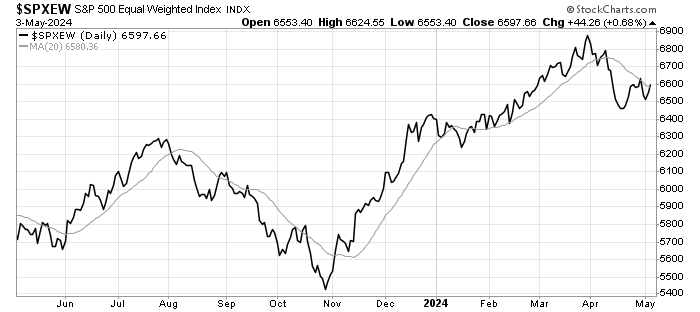

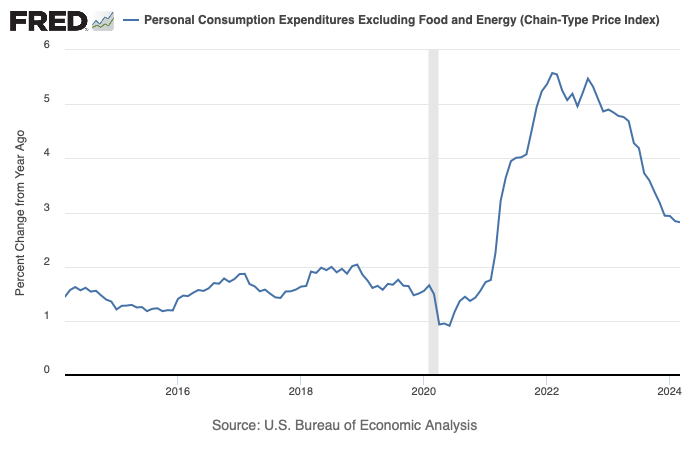

Nonetheless, equity markets continued to fall, driven by (1) profit taking after a three month rally which resulted in a overbought market, (2) bank earnings that were a little disappointing, (3) inflation reports that suggest the rate cuts could be off the table in 2024.

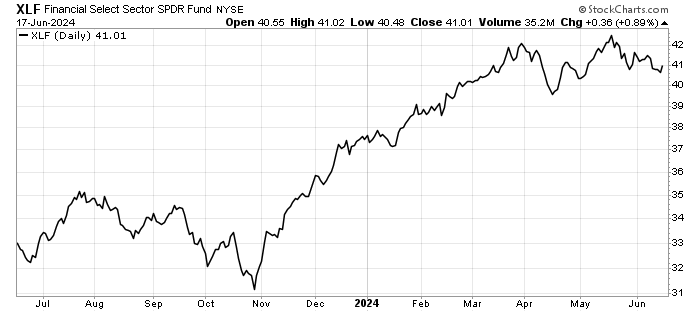

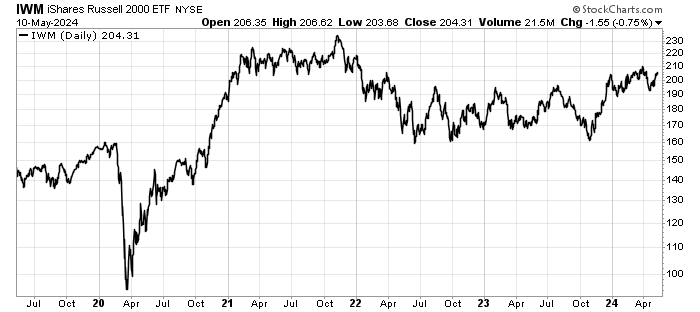

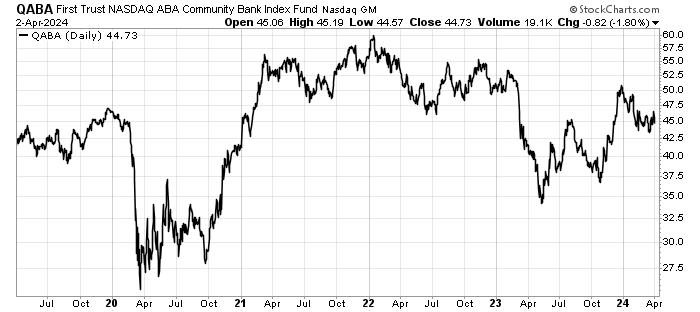

On point (2), although some banks reported less than stellar earnings, the overall trend of bank stocks appear to be healthy for the large banks (KRW), and cautious for the smaller regional banks (KBW). Banks are unlikely to be the key driver of the market weakness.

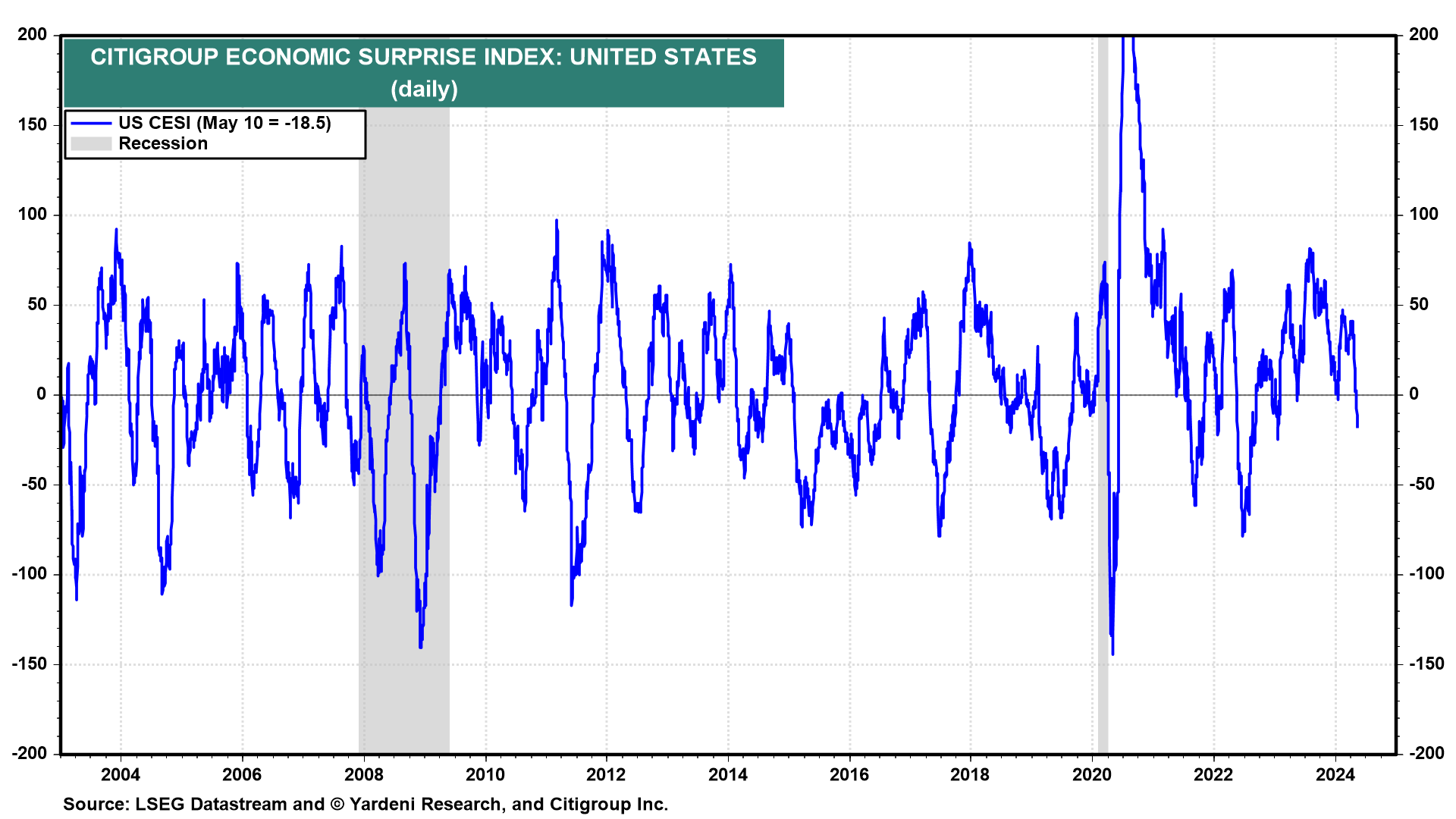

More likely, a combination of an overbought market and three consecutive months of sticky inflation reports led to the sell off in equity and bond markets. FED funds probabilities of no rate cuts for 2024 have risen from 0% to 17%, pressuring stock valuation and bond yields.

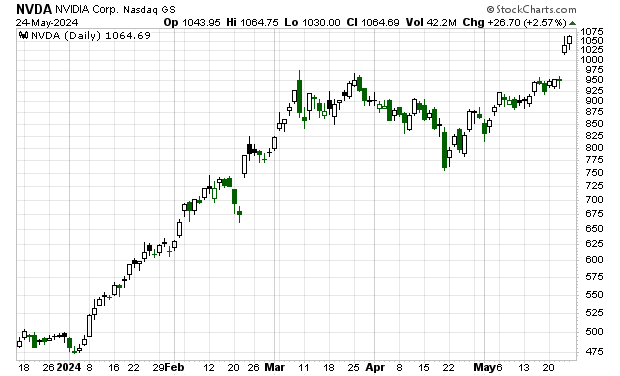

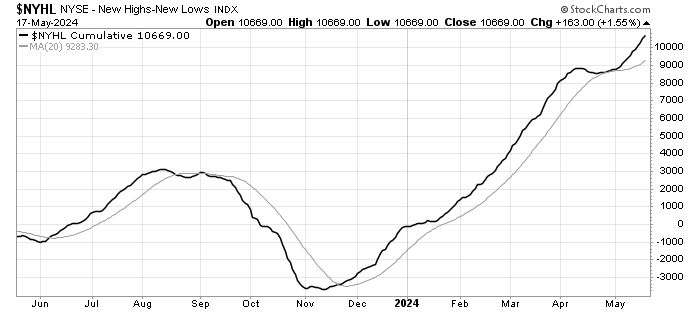

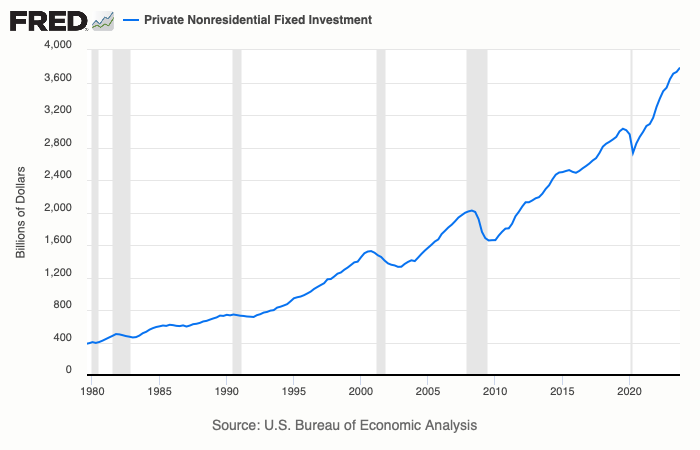

Conclusion: We are still of the view that this is just a correction, and not the beginning of a bear market. Economic growth is intact, and corporate profits are growing. This week will see the Tech giants report earnings and give an insight into AI driven demand. Technically, we are looking at the S&P 500 settling at the 200-day moving average before starting another rally before the US elections heat up.