Overview

The United States has expanded sanctions to include Rosneft PJSC and Lukoil PJSC, Russia’s two largest oil producers. The measures freeze U.S. assets and prohibit American entities from doing business with them. More importantly, they introduce secondary sanctions, threatening non-U.S. firms that continue significant transactions with these companies via the U.S. financial system.

These sanctions aim to tighten restrictions on Russia’s energy revenues — but they also have significant implications for China, which has become Russia’s largest oil customer since 2022.

China’s Dependence on Russian Oil

China remains heavily reliant on Russian crude:

In 2024, China imported around 108.5 million metric tonnes of Russian crude oil — roughly 2.17 million barrels per day, or about 18–19% of its total crude imports. Russia has been China’s top oil supplier for two consecutive years, surpassing Saudi Arabia. Much of this crude is transported through the Eastern Siberia–Pacific Ocean (ESPO) pipeline and by sea via the Pacific ports of Kozmino and Primorsk.

Impact of Sanctions on China

1. Oil Supply Risk

The sanctions complicate Russia’s ability to export crude, particularly seaborne shipments that rely on Western-linked shipping, insurance, and financial services.

While pipeline flows via the ESPO route continue largely unaffected, seaborne cargoes face disruption and delays.

As a result, some Chinese state-owned refiners have begun curbing purchases of Russian oil linked to Rosneft or Lukoil until compliance risks are clarified.

2. Higher Costs and Reduced Discounts

China has benefitted from deeply discounted Russian crude since 2022, as Moscow redirected exports away from Western markets.

However, as sanctions tighten, shipping and insurance costs rise and the pool of non-sanctioned vessels shrinks. This erodes the discounts Chinese refiners previously enjoyed, potentially narrowing refining margins.

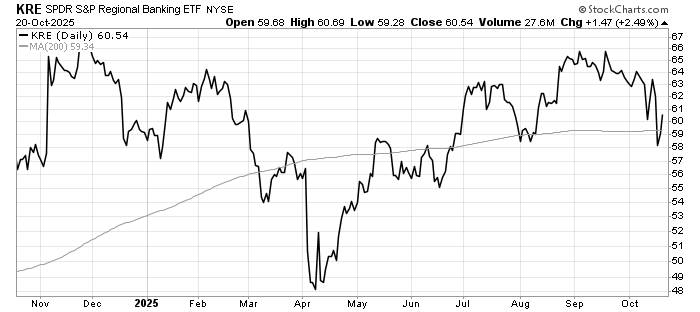

3. Financial and Reputational Risks

The inclusion of secondary sanctions introduces new compliance risks for Chinese banks and trading houses.

Transactions that touch the U.S. dollar system or involve Western intermediaries could expose them to penalties or loss of access to international markets.

Consequently, larger Chinese firms are becoming more cautious, leaving smaller independent refiners (“teapots”) to handle most Russian cargoes through intermediaries.

China’s Workarounds

Despite these constraints, China can technically continue buying Russian oil — provided transactions avoid the U.S. financial system. Key adaptations include:

Settling trade in yuan or rubles, rather than U.S. dollars. Using non-Western shipping and insurance networks, including Russian and Middle Eastern insurers. Receiving pipeline deliveries, which bypass maritime sanctions altogether. Employing smaller or state-linked banks to process payments outside SWIFT.

These workarounds allow the flow of Russian oil to continue, albeit at higher operational cost and with elevated compliance risk.

Strategic and Geopolitical Implications

China’s continued purchases underscore its energy security strategy and desire to reduce exposure to the U.S. dollar. Russia, in turn, is deepening ties with China through long-term crude and LNG supply contracts and expanded pipeline infrastructure. Over time, this trend could accelerate the yuan’s use in global energy trade, reinforcing Beijing’s push for financial independence from the West.

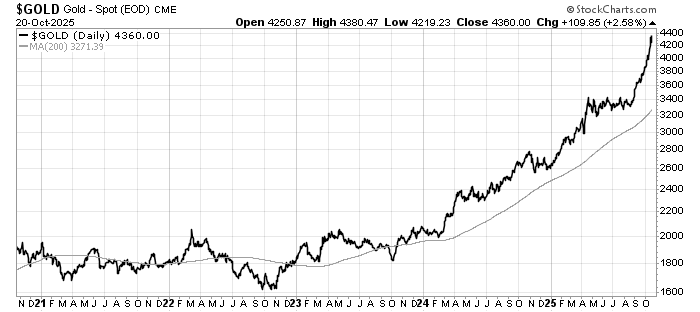

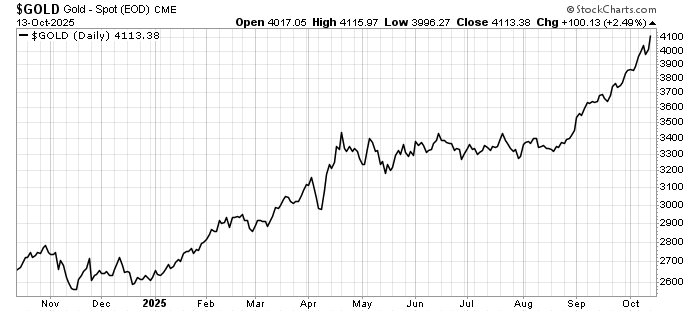

Investment Implications

Short-term volatility in oil prices Sanctions are likely to constrain Russian supply and put upward pressure on global oil prices. Energy-importing economies like China face higher import costs and potential inflationary effects. Refining margin compression in China Independent refiners reliant on discounted Russian crude may see shrinking margins as discounts narrow and freight costs rise. Yuan internationalisation gains The shift to yuan-settled energy trade supports the longer-term structural trend of de-dollarisation, potentially strengthening the CNY’s role in commodity markets. Energy diversification opportunity China may accelerate efforts to diversify supply — expanding imports from the Middle East, Africa, and Latin America, and boosting LNG investments to mitigate risk.

Conclusion

China’s oil trade with Russia is entering a more complex phase.

While technical avenues remain open for continued imports, they require navigating a narrow path between energy security needs and sanctions compliance risks.

In the near term, investors should expect higher oil prices, tighter margins for Chinese refiners, and a deeper Russia–China energy alliance built on non-dollar trade channels.

Over the longer term, these developments could further reshape global energy flows and accelerate the fragmentation of the international oil market.