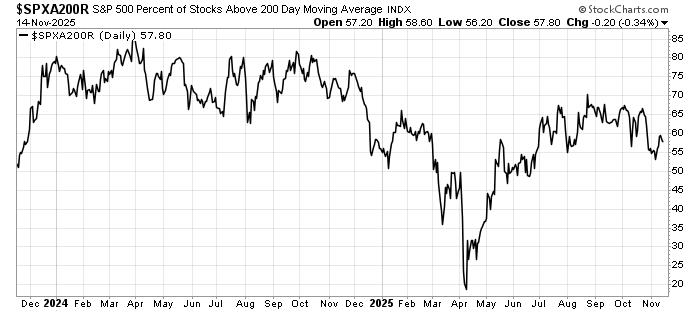

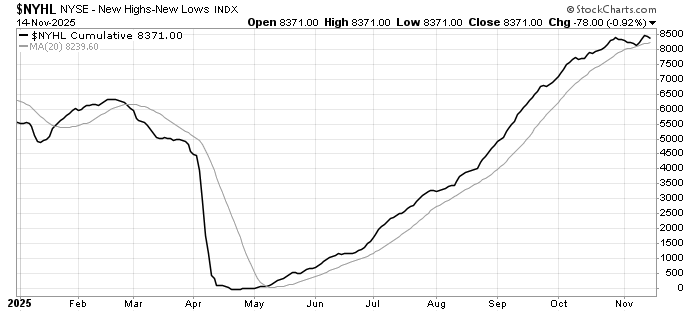

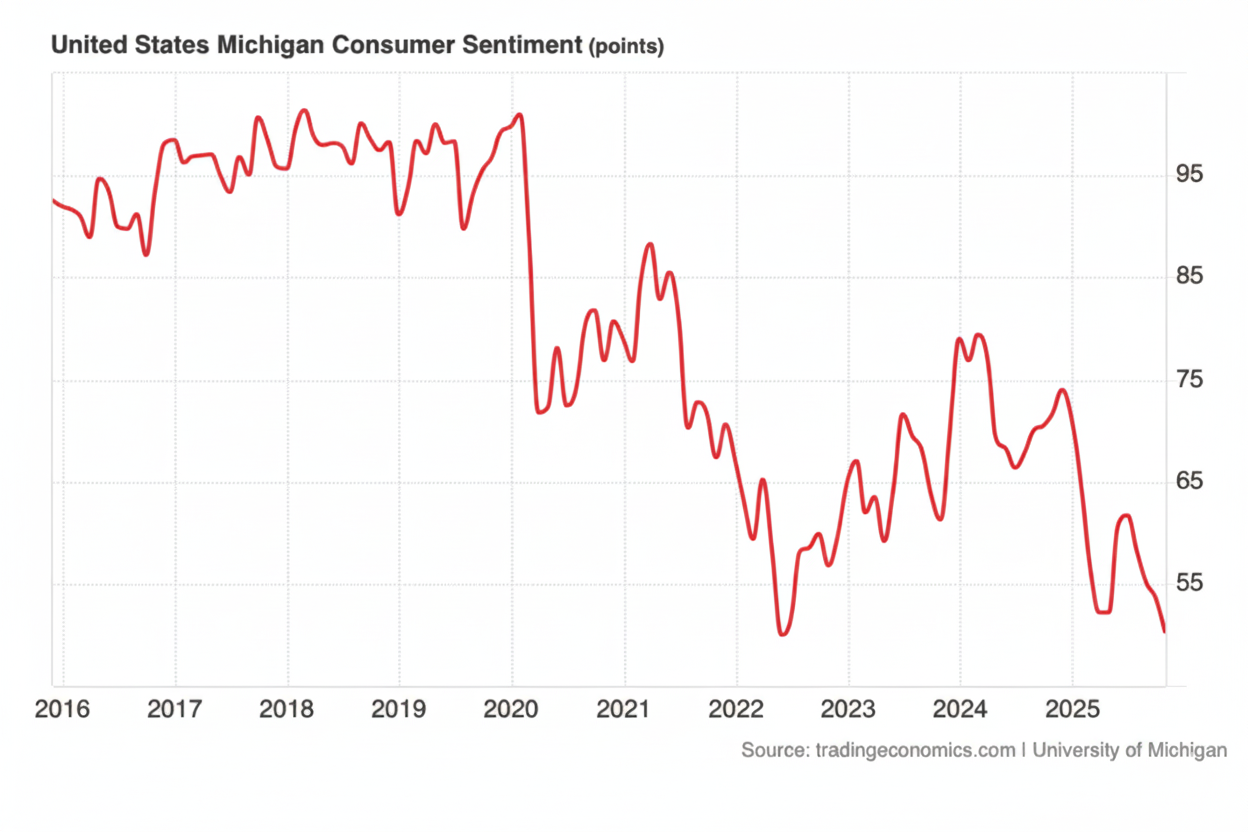

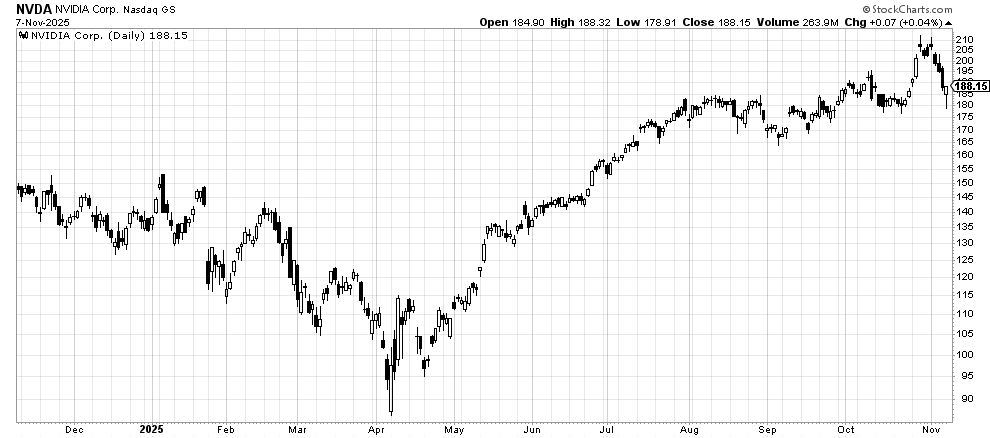

Looking back at 2025, the world adapted to trade wars under President Trump as inflation moderated and AI adoption accelerated. The global economy ends the year positively with central banks easing policy. Despite alarming headlines, geopolitical shocks remained mild whilst valuations became the key focus as AI-related stocks struggled in the final quarter. Looking ahead, investors need greater caution as strains emerge in parts of the global economy.

United States Economic Outlook: Uneven but Sustained Growth

The US expansion continues but unevenly, with strength concentrated in specific sectors and income groups. Consumer spending, representing 70% of GDP, increasingly depends on higher-income households supported by strong equity markets and accumulated wealth, even as lower-income consumers face tighter credit and higher costs.

Business investment in artificial intelligence, data centres, semiconductors and automation lifts capital expenditure across manufacturing, healthcare, finance and logistics. Companies are also mobilising capital to strengthen supply chains and critical materials amid national security concerns.

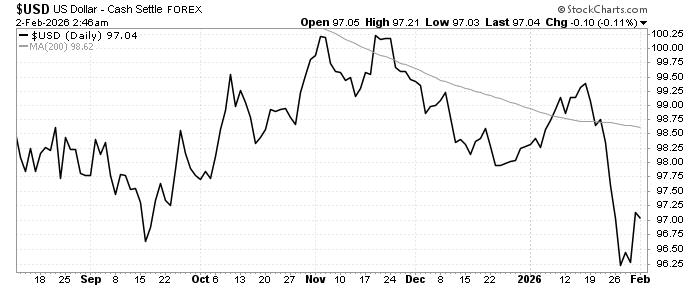

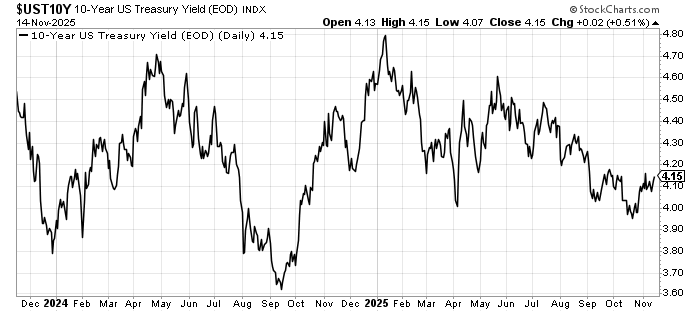

Monetary policy becomes less restrictive as the 10-year Treasury yield falls from 4.8% to 4.2%, easing pressure on households and businesses, though inflation risks remain. Fiscal policy stays supportive through Trump’s One Big Beautiful Bill, boosting 2026 growth via tax cuts that enhance household incomes by 5% on average, alongside infrastructure and manufacturing incentives.

The labour market cools but doesn’t collapse, with slower job growth and moderately rising unemployment. Trade policy and geopolitics remain key uncertainties that could add costs and weigh on confidence.

China Economic Outlook: Quality Over Quantity

China shifts from property-driven growth towards economic quality and resilience. Beijing prioritises technological resilience and domestic demand through income support, better safety nets and service access. Consumer spending in services, travel, healthcare, education and leisure provides a stable growth base, though households remain cautious.

Innovation-led growth drives investment into AI, automation, semiconductors, robotics and advanced manufacturing for productivity gains and geopolitical resilience. Exports contribute meaningfully in high-tech and green industries, but policymakers emphasise quality over volume to reduce vulnerability to trade tensions.

Policy remains supportive but targeted towards consumption, strategic industries and infrastructure rather than broad credit expansion. The property sector remains a structural headwind following China Vanke’s near-default and a 39% Q4 sales drop for listed developers, reinforcing Beijing’s urgency to nurture new growth drivers.

European Economic Outlook: Stabilisation and Balance

Europe’s economy shifts towards stabilisation with more balanced, internally driven growth. Household consumption re-emerges as the primary engine as eased inflation allows real wage recovery and near-record employment supports confidence.

Investment improves through lower interest-rate pressure, EU Recovery and Resilience Facility disbursements, and Germany’s fiscal loosening supporting infrastructure, digitalisation, energy transition and defence. Labour markets remain stable with historically low unemployment and positive wage growth supporting productivity gains through technology adoption.

Monetary policy becomes more predictable as inflation nears the ECB’s target, offering businesses and households greater visibility. Exports contribute modestly whilst exposure to global trade uncertainty limits upside, though cheaper imports help contain inflation.

Japan Economic Outlook: Self-Sustaining Momentum

Japan shows signs of durable expansion as household consumption emerges as a genuine growth engine. A tight labour market delivers meaningful wage gains whilst moderating inflation towards the Bank of Japan’s 2% target should improve real incomes and support discretionary spending.

Corporate Japan enters 2026 with healthy balance sheets and elevated profits, channelling capital expenditure into automation, digitalisation, AI and green technologies. Labour shortages accelerate productivity-enhancing investment whilst governance reforms encourage better capital allocation.

The Bank of Japan’s gradual policy normalisation will anchor inflation expectations and reduce market distortions. Lower, more stable inflation should support household purchasing power despite modestly higher borrowing costs. Exports remain important in semiconductors and precision machinery but won’t be a major driver given global uncertainty.

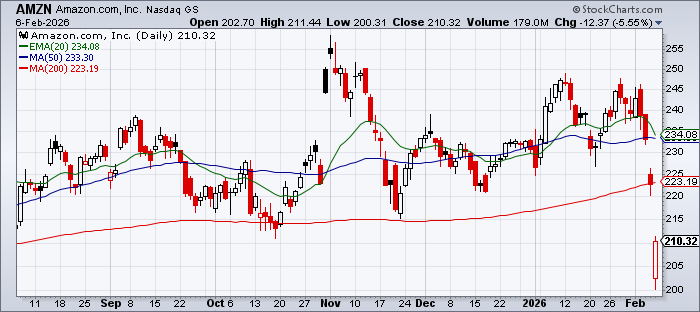

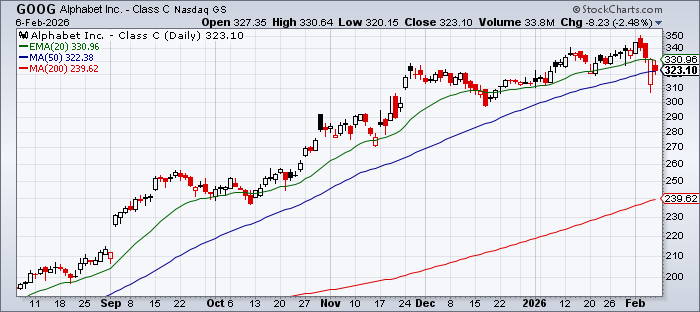

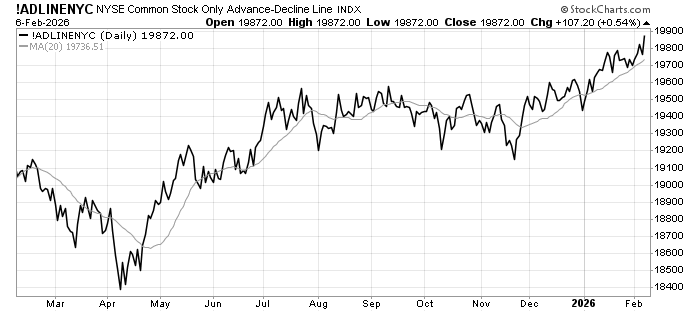

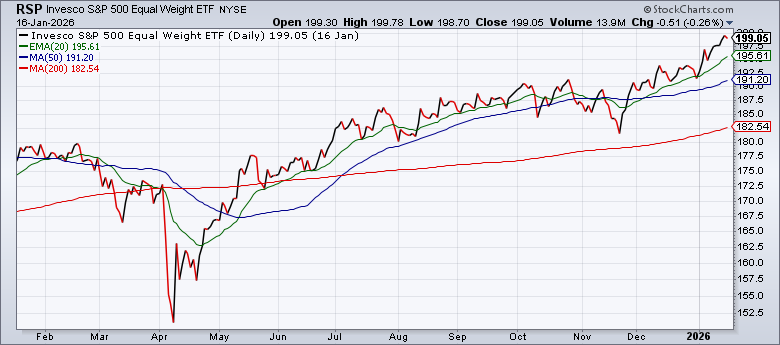

Global Stock Market Outlook 2026: Selectivity Over Momentum

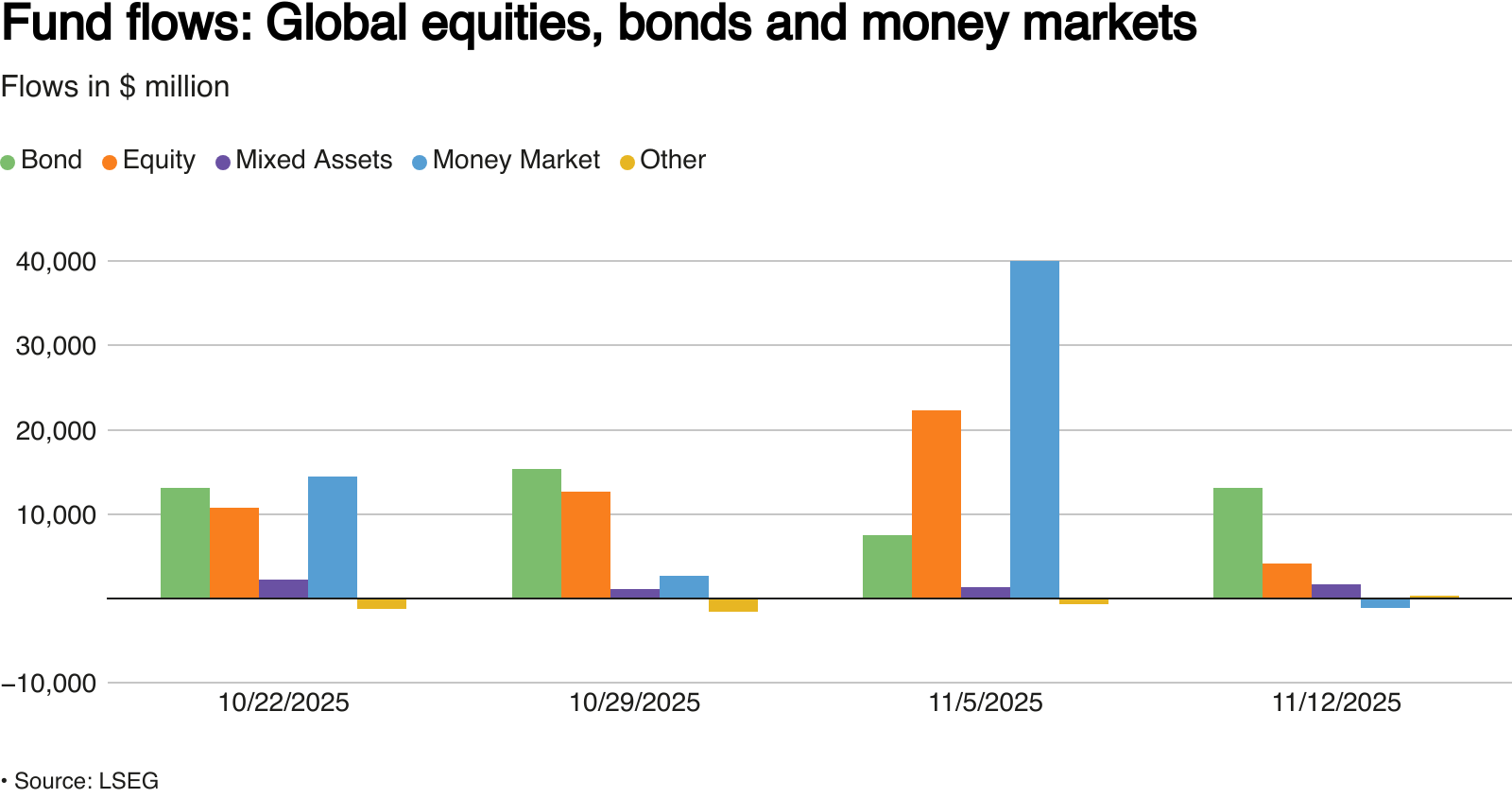

Global equities enter 2026 with restraint rather than exuberance in a more selective, fragile regime. Monetary policy settles at structurally higher neutral rates that can support equities with durable earnings and pricing power, making valuation discipline critical.

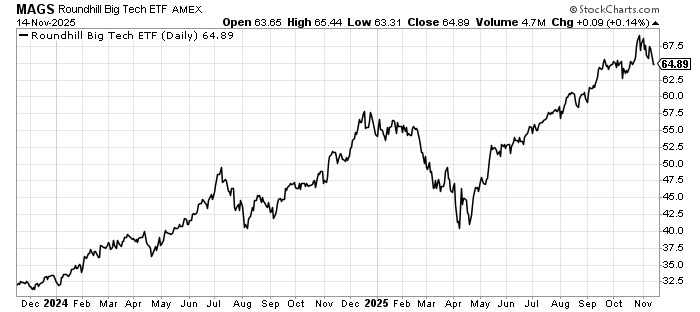

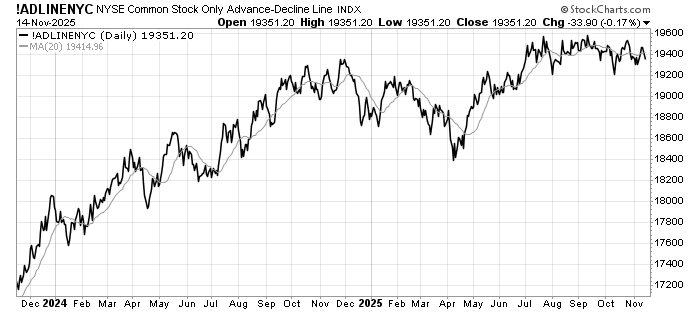

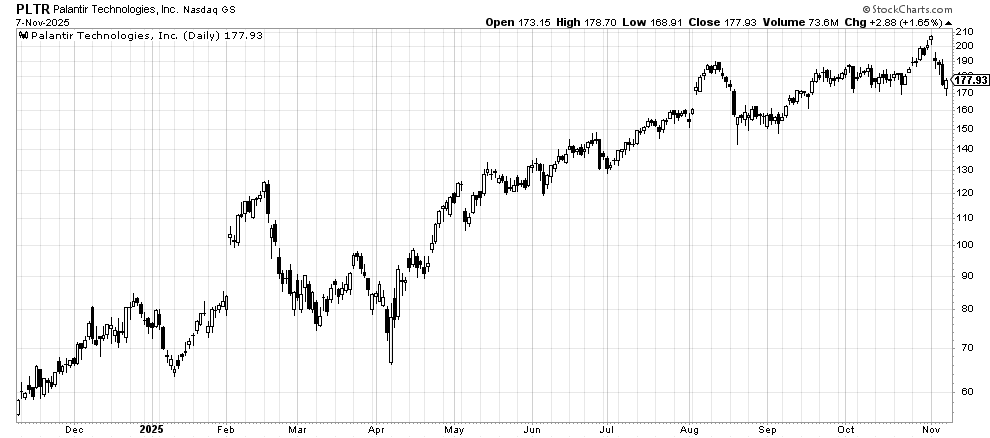

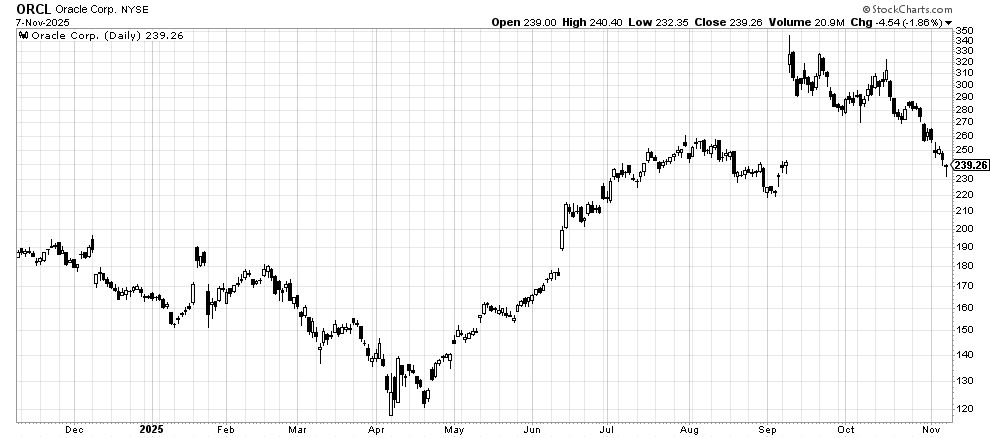

Sustainable equity performance requires profits to broaden beyond technology leaders into financials, industrials, healthcare and services. AI’s role evolves from building to effective deployment, rewarding companies translating it into tangible productivity gains and higher margins.

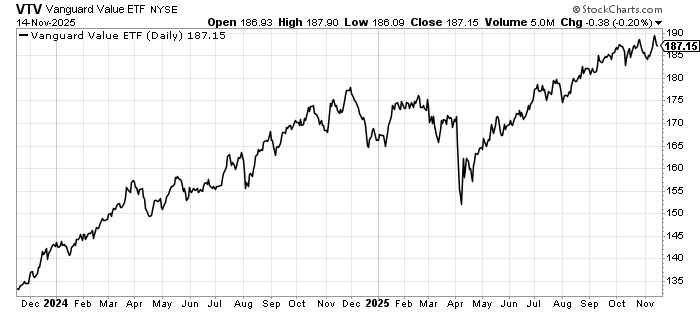

Governments direct investment towards defence, infrastructure, energy security and strategic supply chains, creating spending multipliers. Valuation discipline returns as investors become more cost-conscious, favouring earnings quality and value stocks.

Investment Risks 2026

Significant tail risks include a disorderly US fiscal event from elevated debt triggering Treasury auction failures or yield spikes. Geopolitical disruption to semiconductors or rare earth supply chains could hit margins directly and revive inflation. Financial stress in private credit, hedge funds and non-bank lenders could trigger forced selling across risk assets.

Conclusion: Investment Strategy 2026

The global economy appears resilient but increasingly uneven in 2026, with growth driven by narrower forces. Markets enter a regime where earnings quality, balance-sheet strength and valuation discipline matter again. The key risk is complacency: elevated debt, geopolitics and hidden leverage demand investors prioritise selectivity, diversification and discipline over momentum.