As we approach the latter half of 2023, the prevailing theme in the financial landscape is undoubtedly resilience. Despite the Federal Reserve’s assertive rate hikes, occurrences of bank failures, and tightening financial conditions, the US economy has demonstrated remarkable strength, managing to avert a recession. While equity markets have shown positive performance, not all stocks have participated in the gains, except those associated with artificial intelligence. Nonetheless, there are indications that the market could be heading for a downturn as concerns about an inevitable recession surface in the latter half of the year. It is, however, crucial for investors to consider the possibility that the US may continue to avoid a recession this year, which could have significant implications for risk assets.

The US economy has displayed unexpected resilience, with Q1 GDP revisions indicating an annualized growth rate of 2%, surpassing the earlier estimate of 1.3%. Strong consumer spending and robust exports have been pivotal in supporting this growth. Furthermore, the outlook for Q2 remains positive, with the Atlanta Federal Reserve’s GDPNow estimate projecting a growth rate of 1.8%. The US economy’s ability to withstand higher interest rates highlights its capacity to endure adverse monetary conditions.

While inflation has peaked and is now slowing, it remains above the Federal Reserve’s target rate of 2%. Although the CPI declined to 4% in May from the peak of 9.1% in June 2022, the core CPI (excluding food and energy) remains elevated at 5.3%. However, there are encouraging signs, such as the slowdown in housing inflation, which may contribute to a further decline in inflation in the coming months.

The Federal Reserve remains resolute in its commitment to combat inflation, maintaining a hawkish bias and projecting two more rate hikes for 2023. This stance has resulted in an inverted yield curve, contributing to concerns about an impending recession.

A notable factor contributing to the US economy’s resilience amid higher interest rates is the strength of the labor market. The unemployment rate has consistently remained below 4% since 2022, standing at 3.7% currently. The decline in ongoing jobless claims indicates that those affected by layoffs have been able to find new employment opportunities swiftly.

While the US regional banking sector experienced some turbulence, the situation seems to have stabilized, with deposits at small banks steadying after the Silicon Valley Bank’s failure. However, banks are facing challenges related to profitability and balance sheet protection, which may affect their lending activities and subsequently impact the economy.

Looking ahead, the US economy’s outlook is subject to various factors. If inflation continues to decline, and the Federal Reserve adopts a prudent approach to monetary policy, the start date of a forecasted recession may be postponed. The recovery in the housing sector and its potential to offset weaknesses in manufacturing could contribute to avoiding a recession.

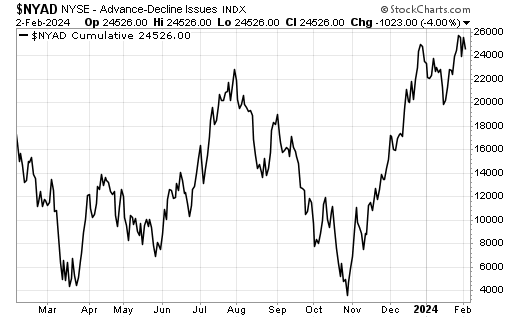

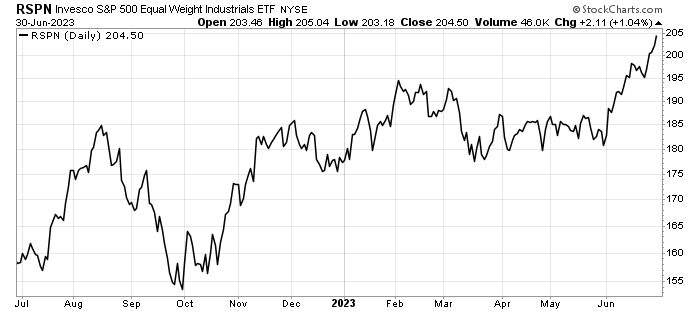

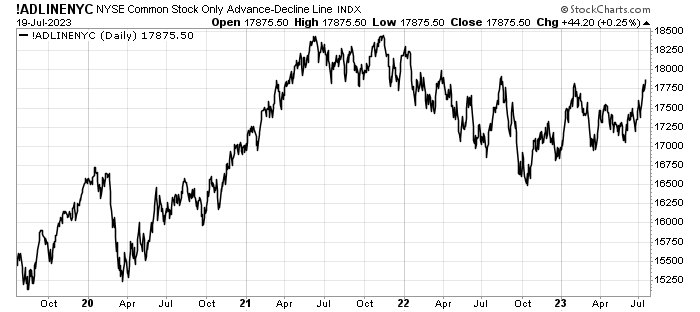

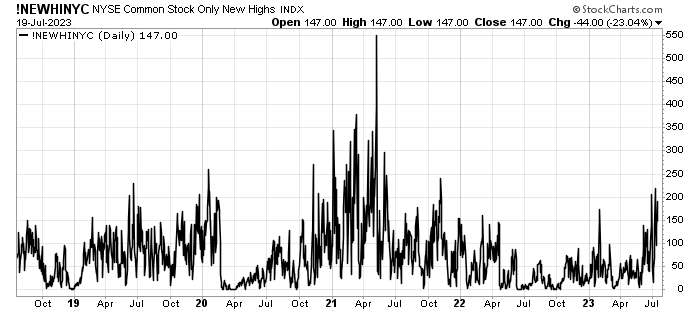

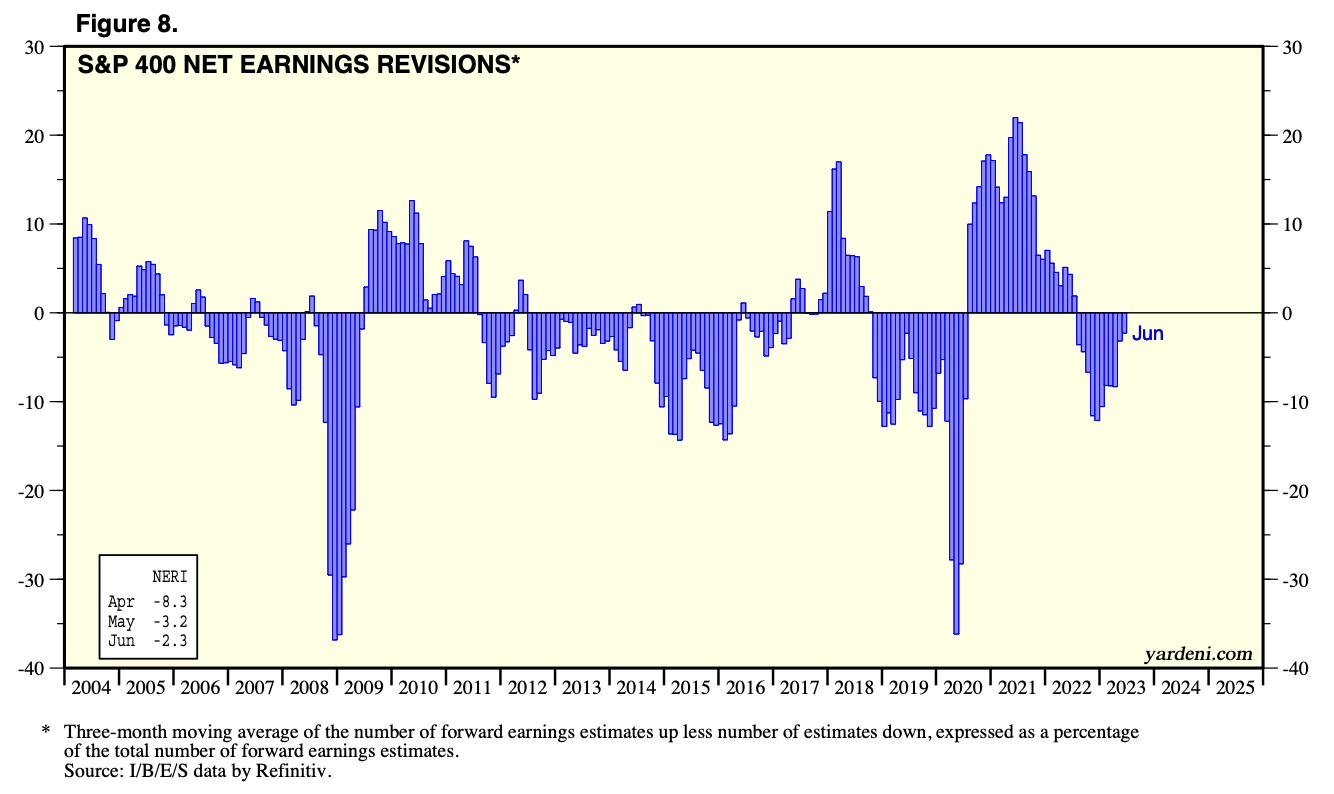

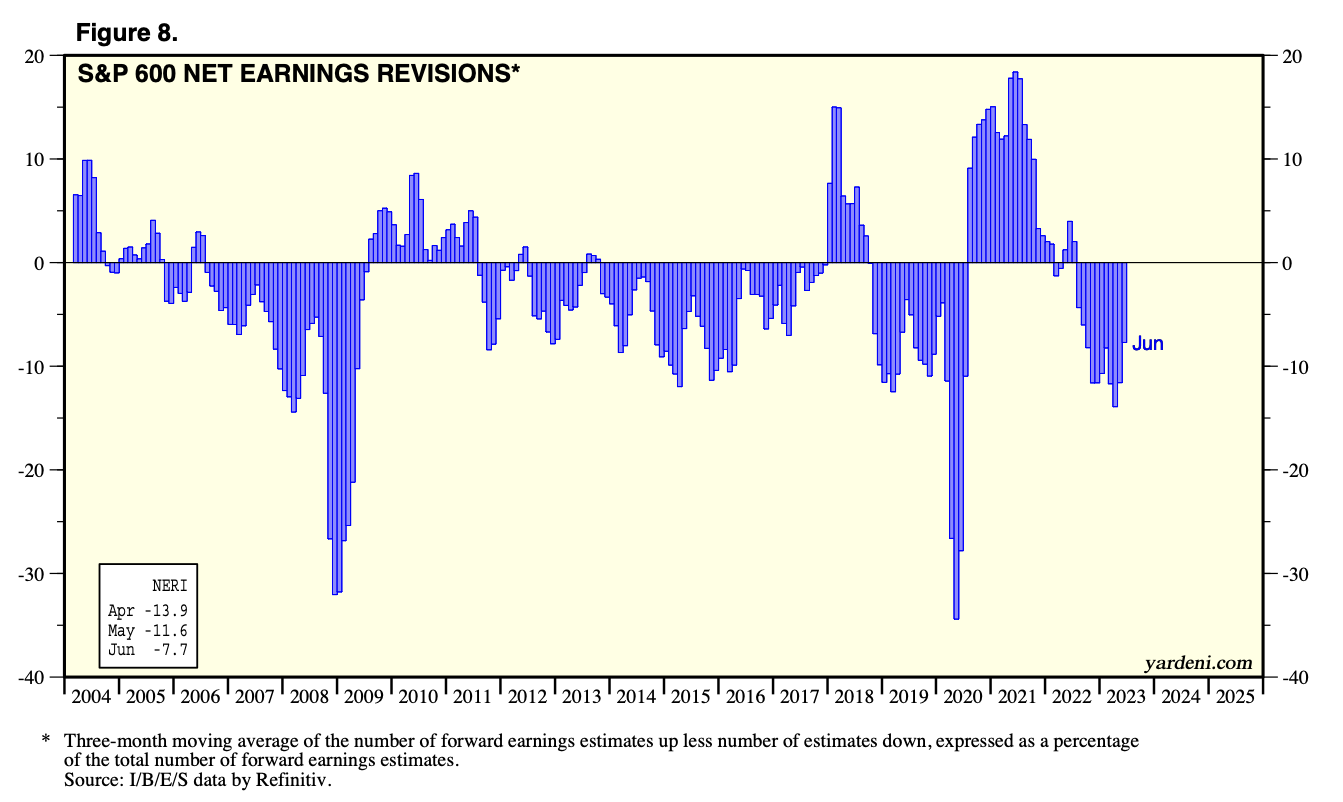

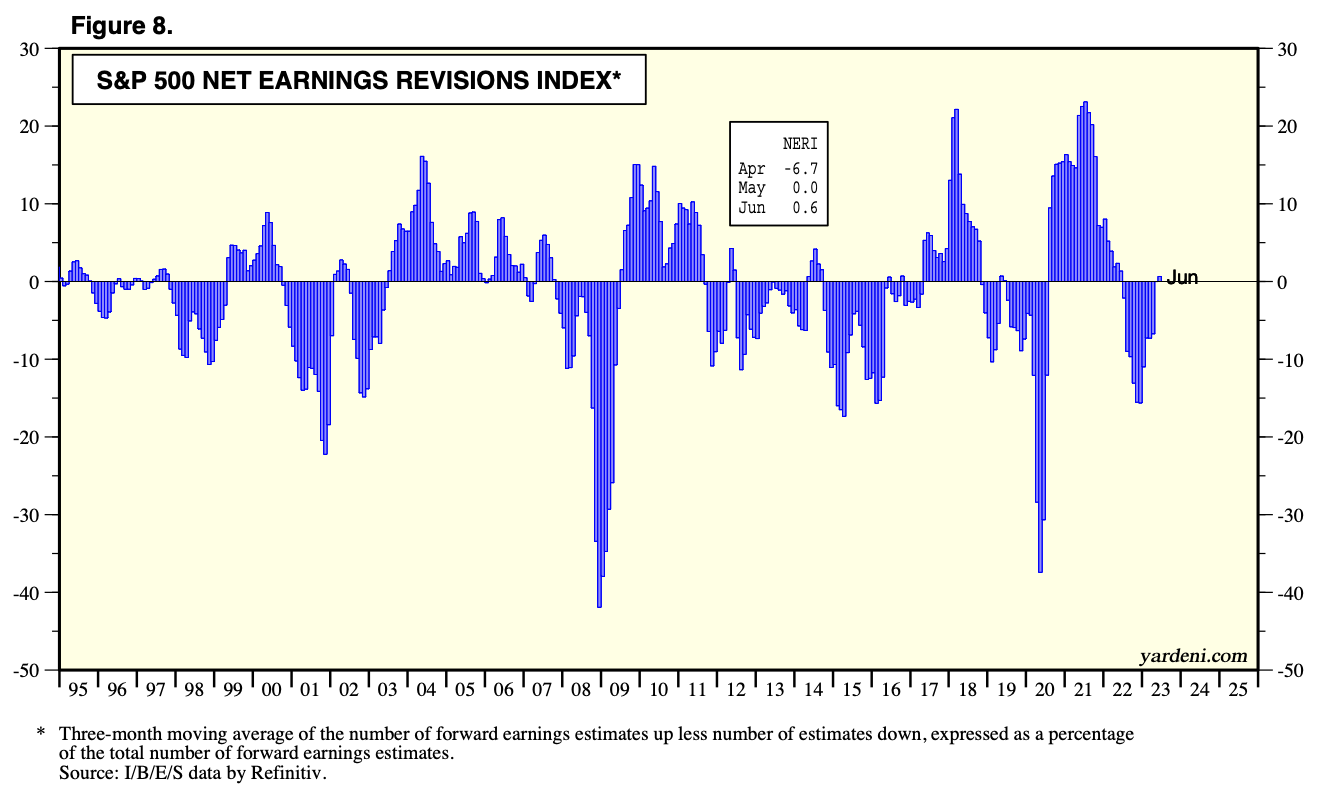

In the US stock market, while large-cap technology stocks have performed well, other sectors have lagged behind, and small caps are facing challenges due to recession concerns. The market’s sustainability largely depends on whether the rally broadens to include non-large cap technology stocks, indicating broad-based confidence in the US economic outlook.

The European economy faced headwinds, falling into a technical recession in Q1 2023 due to various factors, including the Ukraine war, energy price surge, and slowdown in global trade. However, current consumer sentiment indicators suggest a mild recovery may be underway.

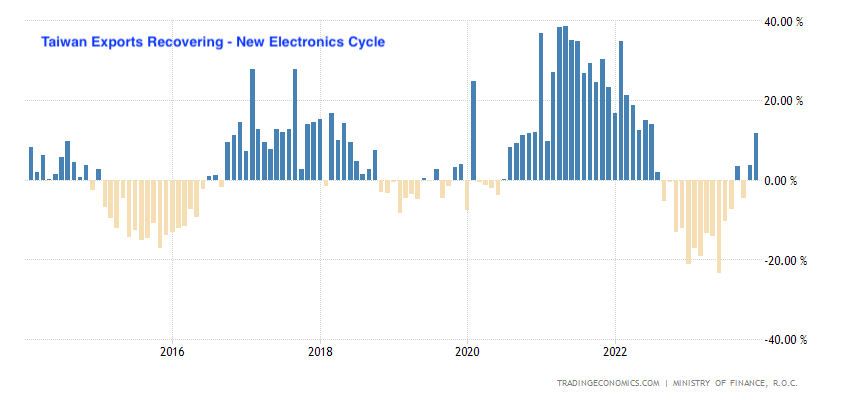

In China, growth momentum may be slowing, with some data indicating a slowdown in industrial activity. Restoring consumer confidence and stimulating the economy are critical to its recovery, especially amid global tensions and challenges.

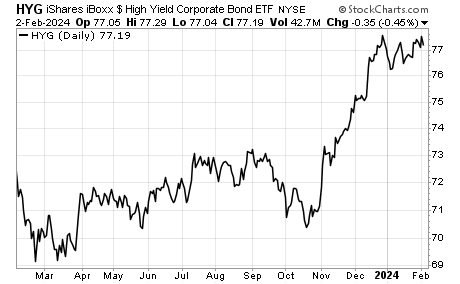

In the bond market, an inverted yield curve remains a concern for investors, with potential scenarios ranging from a recession-driven rate cut to a more cautious Fed policy. Corporate bonds are facing challenges, and defaults are expected to rise, requiring close monitoring.

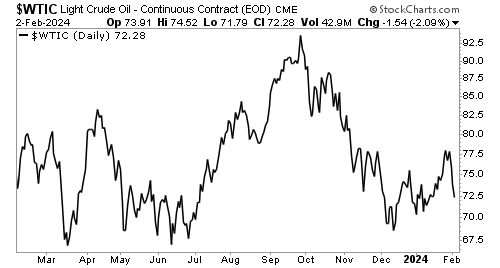

Commodities such as oil and copper reflect global economic conditions. While oil prices have been under pressure due to weak global industrial activity and higher interest rates, signs of stability in commodities could indicate an upturn in industrial activity.

The US dollar has remained range-bound amid the Fed’s hawkish monetary policy, with emerging market currencies rallying against it. The stability or appreciation of currencies like the Brazilian real may attract American investors seeking higher yields.

In conclusion, the second half of 2023 presents a mixed outlook for financial markets. While recession concerns persist, positive economic data and potential broadening of the stock market rally offer reasons for optimism. Monitoring inflation trends and the Federal Reserve’s response will be crucial in shaping market dynamics. As financial advisors, it is essential to carefully assess these factors to make well-informed decisions and navigate the evolving economic landscape for the benefit of your valued clients.